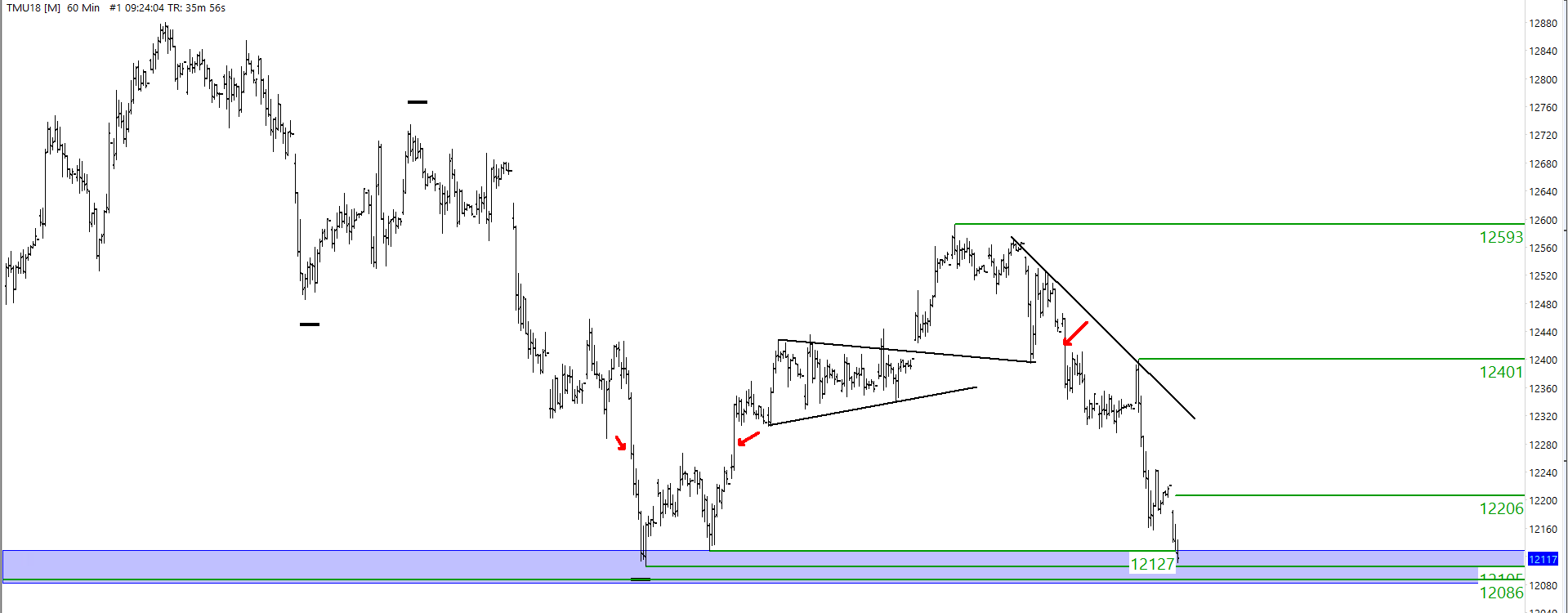

The German DAX lost 109 points on Tuesday, closing at 12220. At one point, the market had dropped over 200 points and we managed to grab quite a few of those points before 10am. Our BBRSI strategy offered three signals to sell yesterday morning and these could have provided up to 200 points profit. I personally only managed 72, but that’s more than enough for me.

On to the news. Traders remain cautious ahead of the next round of negotiations in the US-Canada trade dispute. Canadian Prime Minister Justin Trudeau rejects concessions on key issues in the talks on the new edition of the North American Free Trade Agreement Nafta. US President Donald Trump threatened to break the negotiations this weekend (sigh). Above all else, US domestic policy is hovering, with midterm elections scheduled for November in Congress. The Republicans Trumps could suffer a slump. Against this background, some investors headed for the “safe haven” US dollar. Regardless, stock exchanges expect that US President Donald Trump will impose new punitive tariffs on Chinese imports worth $ 200 billion in the coming days. The fear of a possible new round in the trade dispute USA / China on Tuesday shunned the investors on the European stock exchanges.

Many discussions about Deutsche Bank and E.ON took place on the German stock exchange. According to Reuters documents, the shares of the two Dax groups are out of the European benchmark index EuroStoxx50. The changes in EuroStoxx50 will take effect on 24th September. There are also changes in the Dax: It is expected that Commerzbank will have to leave the Dax and the payment processor Wirecard will come in.

DAXTRADER FEEDBACK FORM

What do you want to see on the site? What comments can you offer to improve the service? Please take a moment to send a message

[contact-form][contact-field label=”Name” type=”name” required=”1″][contact-field label=”Message” type=”textarea” required=”1″][/contact-form]

05-09-2018 Dax Video

05-09-2018 Dax Key Levels (Yesterday)

05-09-2018 Dax Key Levels (Today)