After yesterday’s significant gap higher to all-time highs, the DAX is simmering in comparison. Despite the encouraging, very bullish, start, the DAX traded in an 85 point range between 13517 – 13601 according to FXCM. The price action is currently trading around the daily pivot 13564 (at the time of writing).

The gap closed from yesterday and price closed higher suggesting that the bullish momentum can continue. I am going to assume that a bullish continuation is to be the case. So what levels look interesting and what can we expect?

My bias remains bullish, I am looking for dips to buy.

I entered a trade yesterday and sent out a couple of trade ideas to the premium group. My most recent DAX trades can be seen on this page. Just be aware that I have not traded as much as normal this month.

24-01-2018 DAX Technical Analysis Charts

Please be patient for the GIFs below to load, I hope they are useful.

Dax Daily Chart Explained (GIF)

Click the GIF below to see it full size. Share this article if you like the content

- Mark out the pivots (major swings)

- Draw your fork

- Fibonacci expansion tool – assuming that this bullish move continues

- Balance point from the recent low with the 50% line through yesterday’s gap

- Price to move to the confluence zone: Median line, Balance point extension, Fibonacci expansion target etc

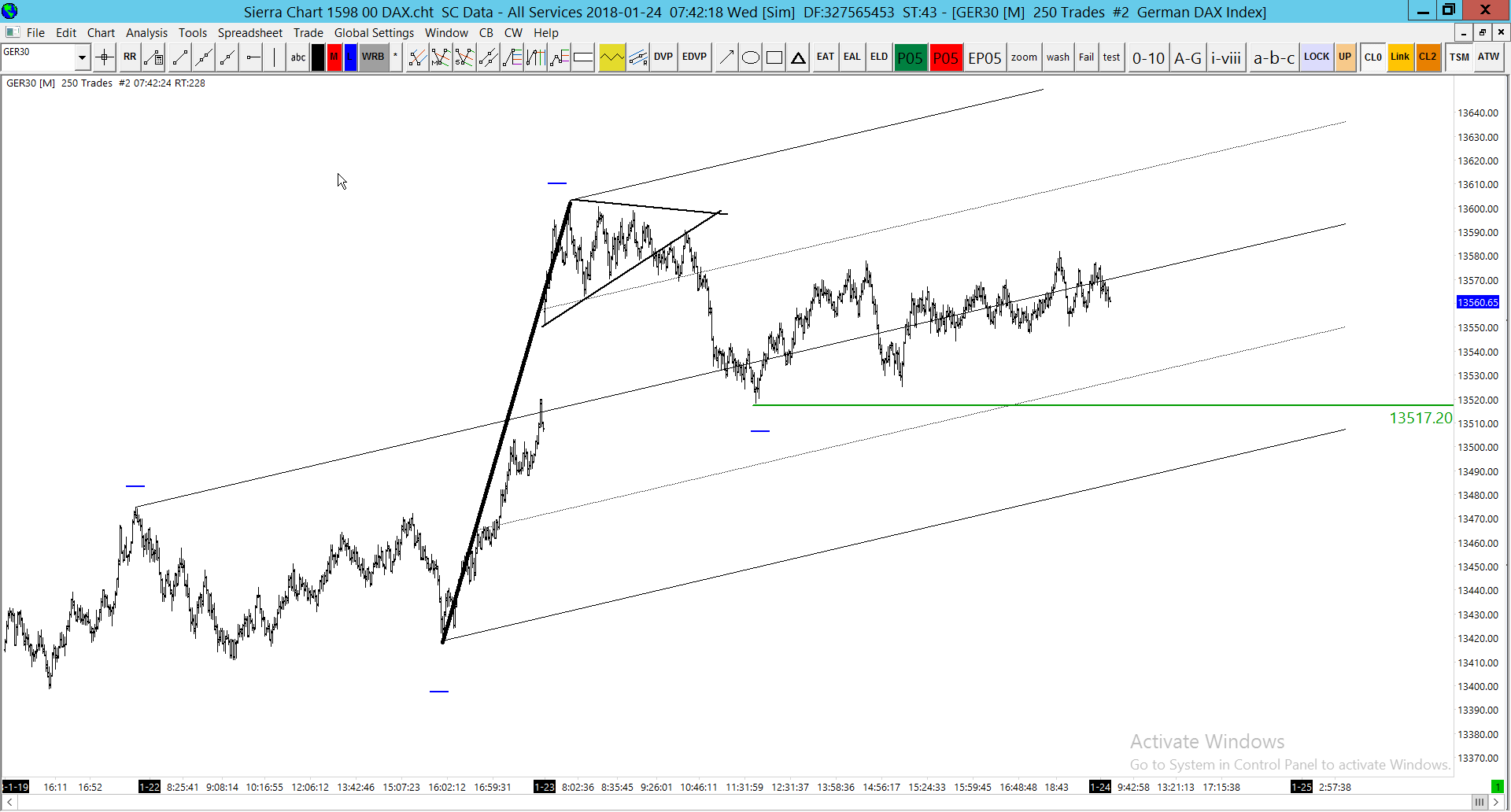

DAX 250 Trade Chart Explained (GIF)

Click the GIF below to see it full size. Share this article if you like the content

- Draw the spike from just before the gap yesterday

- Draw the pivots (minor swings)

- Draw the fork from three of the alternating pivots

- Draw the wedge containing price after the spike – see the kiss goodbye?

- Gap close found support at the median line

- 13517 is the line to hold for now

Dax Key Levels

| KEY LEVELS | |

| POC * | 13559 |

| Value Area High * | 13583 |

| Value Area Low * | 13550 |

| 14 Day ATR | 124.33 |

| 200 EMA | 12654 |

| Daily R2 | 13648 |

| Daily R1 | 13611 |

| Daily Pivot | 13564 |

| Daily S1 | 13527 |

| Daily S2 | 13481 |

| *These are FXCM numbers, not futures numbers. Please be aware that FXCM can often be 5-10 points higher than futures prices | |