April 2021 Signal Results (-24.13%)

Similar story and it’s looking poor right now. DAX DTI is once again the poorest performer (contributing around -10% to the result) after taking around 37% of the trades.

The DAX daily signals posted a small profit for the month, but the rest of the strategies performed similarly poorly and I have to make a decision as to whether the strategy is now unable to produce a return.

April Signal Returns: -24.13%

| DATE | MARKET | STRATEGY | RESULT |

| 1/4 | DAX | DTI | -1.00% |

| 1/4 | DAX | DTI | -1.00% |

| 1/4 | DAX | DTI | 4.00% |

| 1/4 | DAX | DAILY | 0.80% |

| 1/4 | FTSE | DAILY | -1.00% |

| 1/4 | FTSE | DAILY | -1.00% |

| 6/4 | DAX | DTI | -1.00% |

| 6/4 | DAX | DTI | -1.00% |

| 6/4 | DAX | DTI | -1.00% |

| 6/4 | FTSE | DTI | -1.00% |

| 6/4 | DAX | DAILY | 0.50% |

| 6/4 | FTSE | DAILY | -1.00% |

| 6/4 | FTSE | DAILY | -1.00% |

| 7/4 | DAX | DTI | 4.00% |

| 7/4 | FTSE | DTI | -1.00% |

| 7/4 | FTSE | DAILY | 0.35% |

| 9/4 | DAX | DTI | -1.00% |

| 9/4 | DAX | DTI | 2.40% |

| 9/4 | FTSE | DTI | -1.00% |

| 9/4 | FTSE | DAILY | -1.00% |

| 12/4 | DAX | DTI | -1.00% |

| 12/4 | DAX | DTI | -1.00% |

| 12/4 | FTSE | DTI | -1.00% |

| 12/4 | FTSE | DTI | -1.00% |

| 12/4 | FTSE | DAILY | -1.00% |

| 12/4 | FTSE | DAILY | -1.00% |

| 13/4 | DAX | DTI | -1.00% |

| 13/4 | DAX | DTI | -1.00% |

| 13/4 | DAX | DTI | -1.00% |

| 13/4 | FTSE | DTI | -1.00% |

| 13/4 | FTSE | DTI | -1.00% |

| 13/4 | DAX | DAILY | -1.00% |

| 13/4 | FTSE | DAILY | -1.00% |

| 14/4 | DAX | DTI | -1.00% |

| 14/4 | DAX | DTI | -1.00% |

| 14/4 | DAX | DTI | -1.00% |

| 14/4 | FTSE | DTI | 4.00% |

| 14/4 | DAX | DAILY | -1.00% |

| 14/4 | FTSE | DAILY | 3.00% |

| 15/4 | DAX | DTI | -1.00% |

| 15/4 | DAX | DAILY | -1.00% |

| 15/4 | FTSE | DAILY | -1.00% |

| 16/4 | FTSE | DTI | -1.00% |

| 16/4 | FTSE | DTI | -1.00% |

| 16/4 | DAX | DAILY | 3.00% |

| 16/4 | FTSE | DAILY | -1.00% |

| 16/4 | FTSE | DAILY | -1.00% |

| 27/4 | DAX | DTI | -1.00% |

| 27/4 | FTSE | DTI | -1.00% |

| 27/4 | DAX | DAILY | 3.00% |

| 28/4 | DAX | DTI | -1.00% |

| 28/4 | DAX | DTI | -1.00% |

| 28/4 | DAX | DTI | -1.00% |

| 28/4 | FTSE | DTI | -1.00% |

| 28/4 | DAX | DAILY | -1.00% |

| 28/4 | FTSE | DAILY | -1.00% |

| 28/4 | FTSE | DAILY | -1.00% |

| 30/4 | DAX | DTI | -1.00% |

| 30/4 | DAX | DTI | -1.00% |

| 30/4 | DAX | DTI | -1.00% |

| 30/4 | FTSE | DTI | -1.00% |

| 30/4 | DAX | DAILY | -1.00% |

Cryptocurrency portfolios are at an all time high, distracting me from here

I hope you guys are all enjoying your crypto portfolios. The bull cycle is still running strong and there is still some headroom. You’ll remember that I was involved in crypto since 2017 and I still am. I’ve spent time over the past year working alongside the awesome team at Ivan on Tech as an instructor and analyst and have plans to continue getting even more heavily involved with various projects. That’s been keeping me busy, hence the lack of recent content on the site for the past couple of months.

However, I will be looking to produce some more content for the site soon, to help people understand how to install and use the Dax trading strategy on TradingView and how to use the Dax trading signals and FTSE trading signals that I provide to members in the premium channels.

I’m trading the DAX every day, i’m using the strategy everyday, so that is business as usual. I hope you are all doing well.

March 2021 Signal Results (-10.71%)

This was a very poor month and there were very few positives to take. I noticed that my DAX DTI was the most common strategy that I used, and it was the strategy that lost a significant amount of trades. If I had taken only these trades, I would have lost -21% which is horrendous.

The FTSE DTI was the highest performing strategy, gaining +9.3%

March 2021 Signals Earned -10.71%

| DATE | MARKET | STRATEGY | RESULT |

| 1/3 | FTSE | DTI | -1.00% |

| 1/3 | FTSE | DTI | -1.00% |

| 1/3 | FTSE | DAILY | -1.00% |

| 2/3 | FTSE | DTI | 4.00% |

| 2/3 | DAX | DAILY | -0.15% |

| 3/3 | DAX | DTI | -1.00% |

| 3/3 | DAX | DTI | -1.00% |

| 3/3 | DAX | DTI | -1.00% |

| 3/3 | FTSE | DTI | 4.00% |

| 3/3 | DAX | DAILY | -1.00% |

| 3/3 | DAX | DAILY | 3.00% |

| 3/3 | FTSE | DAILY | -1.00% |

| 4/3 | DAX | DTI | -1.00% |

| 4/3 | DAX | DTI | -1.00% |

| 4/3 | DAX | DTI | -1.00% |

| 4/3 | DAX | DAILY | -1.00% |

| 4/3 | DAX | DAILY | -1.00% |

| 4/3 | FTSE | DAILY | 3.00% |

| 5/3 | DAX | DTI | -1.00% |

| 5/3 | DAX | DTI | -1.00% |

| 5/3 | FTSE | DTI | 4.00% |

| 5/3 | FTSE | DAILY | 2.30% |

| 8/3 | DAX | DTI | -1.00% |

| 8/3 | FTSE | DTI | -1.00% |

| 8/3 | DAX | DAILY | -1.00% |

| 8/3 | FTSE | DAILY | -1.00% |

| 8/3 | FTSE | DAILY | -0.72% |

| 9/3 | FTSE | DTI | -1.00% |

| 9/3 | FTSE | DTI | -1.00% |

| 9/3 | DAX | DAILY | 2.30% |

| 10/3 | DAX | DTI | 4.00% |

| 10/3 | FTSE | DTI | -1.00% |

| 10/3 | FTSE | DTI | -1.00% |

| 10/3 | DAX | DAILY | 1.90% |

| 10/3 | FTSE | DAILY | 0.60% |

| 11/3 | DAX | DTI | -1.00% |

| 11/3 | DAX | DTI | -1.00% |

| 11/3 | DAX | DTI | -1.00% |

| 11/3 | FTSE | DTI | 4.00% |

| 11/3 | DAX | DAILY | -1.00% |

| 11/3 | DAX | DAILY | -1.00% |

| 12/3 | DAX | DTI | -1.00% |

| 12/3 | FTSE | DTI | -1.00% |

| 12/3 | DAX | DAILY | -1.00% |

| 12/3 | FTSE | DAILY | 2.60% |

| 15/3 | DAX | DTI | -1.00% |

| 15/3 | DAX | DTI | 4.00% |

| 15/3 | FTSE | DTI | -1.00% |

| 15/3 | FTSE | DAILY | 3.00% |

| 16/3 | DAX | DTI | -1.00% |

| 16/3 | DAX | DTI | -1.00% |

| 16/3 | DAX | DTI | 4.00% |

| 16/3 | FTSE | DTI | -1.00% |

| 16/3 | FTSE | DTI | -1.00% |

| 16/3 | FTSE | DAILY | -1.00% |

| 17/3 | DAX | DTI | -1.00% |

| 17/3 | DAX | DTI | -1.00% |

| 17/3 | DAX | DTI | -1.00% |

| 17/3 | DAX | DAILY | -1.00% |

| 17/3 | DAX | DAILY | -1.00% |

| 17/3 | FTSE | DAILY | -1.00% |

| 18/3 | DAX | DTI | -1.00% |

| 18/3 | DAX | DTI | 4.00% |

| 18/3 | FTSE | DTI | 4.00% |

| 18/3 | DAX | DAILY | -1.00% |

| 18/3 | FTSE | DAILY | -1.00% |

| 19/3 | DAX | DTI | -1.00% |

| 19/3 | DAX | DTI | -1.00% |

| 19/3 | DAX | DTI | -1.00% |

| 19/3 | FTSE | DTI | 4.00% |

| 19/3 | DAX | DAILY | -1.00% |

| 19/3 | DAX | DAILY | 3.00% |

| 19/3 | FTSE | DAILY | -1.00% |

| 19/3 | FTSE | DAILY | -1.00% |

| 22/3 | DAX | DTI | -1.00% |

| 22/3 | DAX | DTI | -1.00% |

| 22/3 | FTSE | DTI | -1.00% |

| 22/3 | DAX | DAILY | 0.30% |

| 22/3 | FTSE | DAILY | 0.70% |

| 23/3 | DAX | DTI | -1.00% |

| 23/3 | FTSE | DTI | -1.00% |

| 23/3 | FTSE | DTI | -1.00% |

| 23/3 | DAX | DAILY | -1.00% |

| 23/3 | FTSE | DAILY | -1.00% |

| 24/3 | DAX | DTI | -1.00% |

| 24/3 | DAX | DTI | -1.00% |

| 24/3 | DAX | DTI | -1.00% |

| 24/3 | FTSE | DTI | -1.00% |

| 24/3 | FTSE | DTI | -1.00% |

| 24/3 | DAX | DAILY | -1.00% |

| 24/3 | FTSE | DAILY | -0.45% |

| 25/3 | DAX | DTI | -1.00% |

| 25/3 | DAX | DTI | -1.00% |

| 25/3 | DAX | DAILY | 1.74% |

| 26/3 | DAX | DTI | -1.00% |

| 26/3 | DAX | DTI | -1.00% |

| 26/3 | DAX | DTI | 4.00% |

| 26/3 | DAX | DAILY | -1.00% |

| 26/3 | FTSE | DAILY | -1.00% |

| 26/3 | FTSE | DAILY | -1.00% |

| 29/3 | DAX | DTI | -1.00% |

| 29/3 | DAX | DTI | -1.00% |

| 29/3 | DAX | DAILY | -1.00% |

| 29/3 | DAX | DAILY | 0.97% |

| 29/3 | FTSE | DAILY | 0.36% |

| 30/3 | DAX | DTI | -1.00% |

| 30/3 | DAX | DTI | -1.00% |

| 30/3 | DAX | DTI | -1.00% |

| 30/3 | FTSE | DTI | 4.00% |

| 30/3 | DAX | DAILY | 3.00% |

| 30/3 | FTSE | DAILY | 3.00% |

| 31/3 | DAX | DTI | -1.00% |

| 31/3 | DAX | DTI | -1.00% |

| 31/3 | DAX | DTI | -1.00% |

| 31/3 | FTSE | DTI | -1.00% |

| 31/3 | FTSE | DTI | -1.00% |

| 31/3 | DAX | DAILY | -1.00% |

| 31/3 | DAX | DAILY | -1.00% |

| 31/3 | FTSE | DAILY | -1.00% |

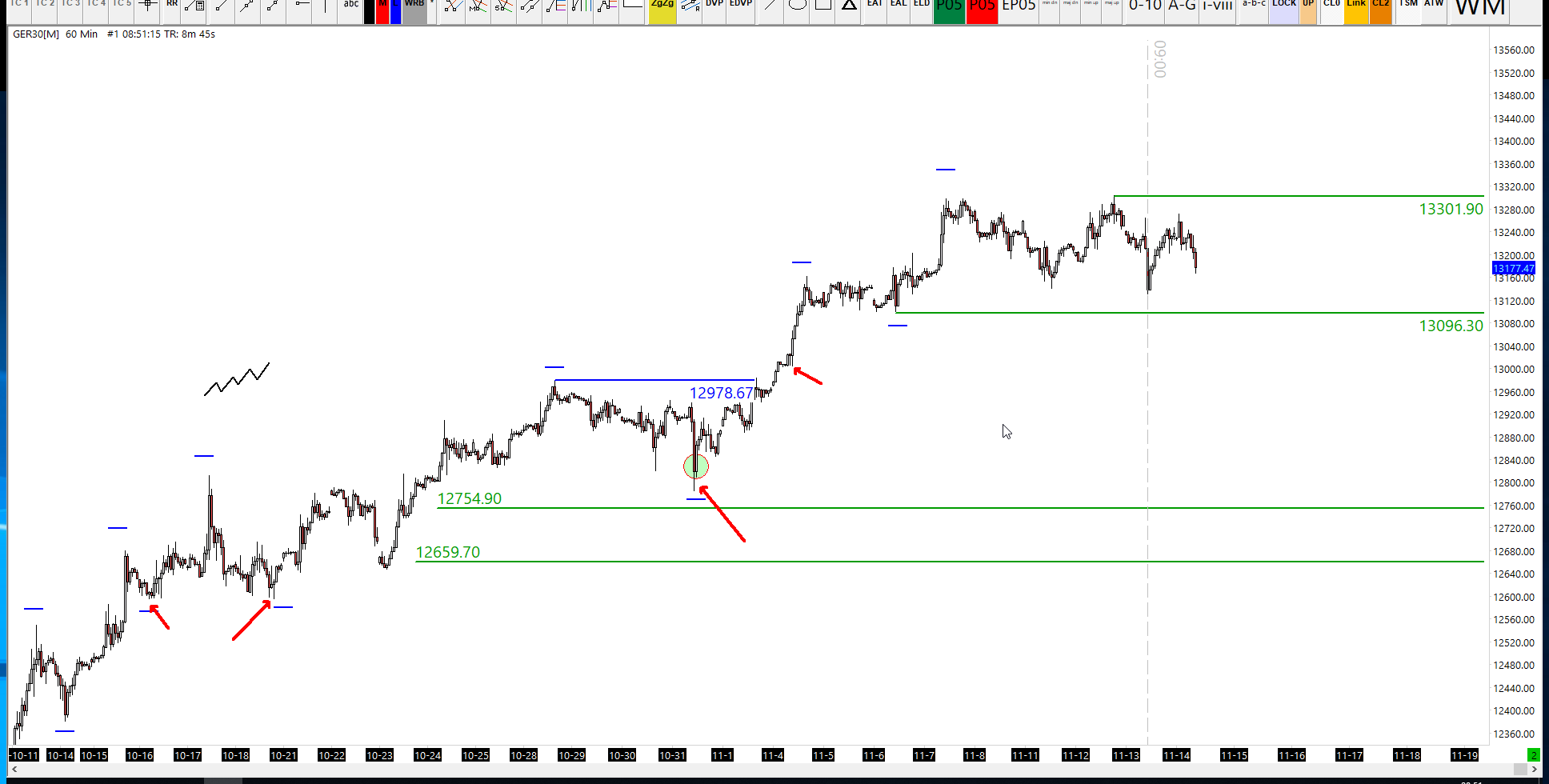

DAX Technical Analysis Articles

These are daily DAX analysis articles. I have been watching the German DAX index every day since February 2014, when I quit my job to become a full-time trader. During my quest to become a professional market analyst and trader, I learnt as much about technical analysis as I could. The DAX is my favourite equity index to trade because it responds well to technical analysis tools such as market profile, swing analysis, volume profile, RSI divergence and various other technical indicators.

Effective DAX Technical Analysis Techniques

The most effective technique to improve your own DAX analysis is to always keep the DAX index price action at the front of your analysis. Always understand how the market moves, and what the most recent trend-defining level is.

I know this analysis sounds simple, but it’s the most overlooked technique by traders and market analysts. There is a common mistake to try to be too advanced sometimes, and this causes us to miss the obvious.