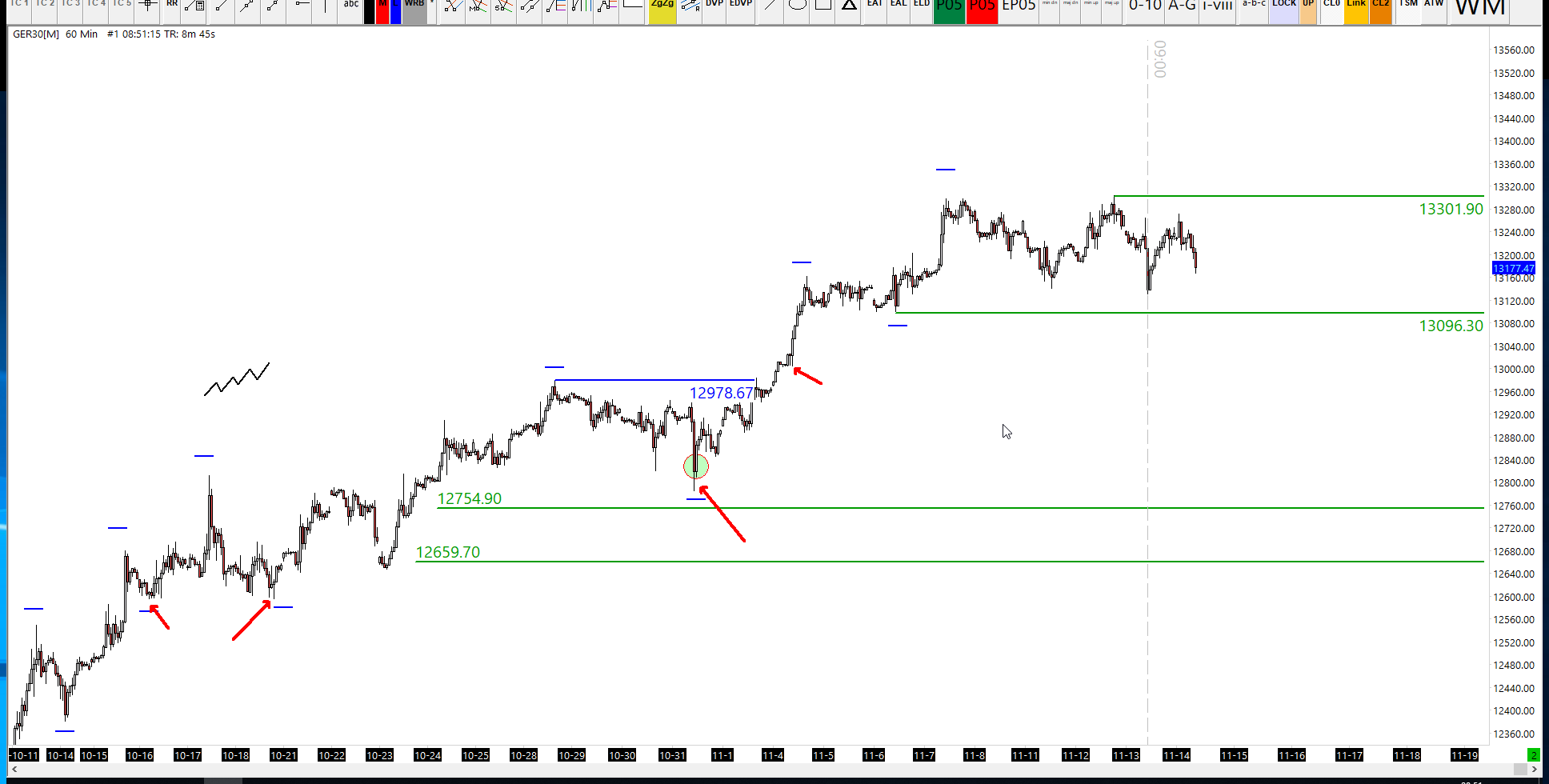

DAX Targets 13,900 after reaching downside measured moved

Thursday Feb 04, 2021

NEW ALL TIME HIGH FOR THE DAX?

The German DAX closed at a record high on the Cash market, but the futures and derivates are still lagging behind a little. So is that the next move? It seems so based on the short-term moment we’ve had since the [3] pivot. Take a look at the update below of the thumbnail from the top. That shaded area I drew around 13,900 has pretty much acted as a swap zone. We’ve broken above the upsloper and kissed it goodbye and now currently trading above 14k (at the time of writing).

Euphoria continues to pump the markets through resistance and we have probably now get a brand new all-time high on the DAX.

The morning’s DAX & FTSE trading signals were all taken; both shorts filled (DAX and FTSE) and they were both stopped out for -1% each and then both longs were filled, but the trades ran until 8pm so I closed them out. DAX gained +1.15% and FTSE gained +1.01%, so I pretty much broke even on those.

As for the trading strategy, there was nothing to report, I literally took zero trades from it today. There are lots of functions and criterion in the indicator/strategy to filters out signals in specific trading conditions. Trading inside an intraday consolidation range is one of those filters, so the DAX yielded no signals until the afternoon. By the time that signal came, the market had already broken out and the candles were yellow.. No bueno. FTSE’s price action was very different. All trades were ignored for being yellow without a vwap retracement.

DAX Trading Signals Update Feb 04 2021

DAX Trading Strategy Update Feb 04 2021

Wednesday Feb 03, 2021

I am growing concerned with the stock markets at the moment, especially when I try to forecast another 6-12 months down the line. I currently see euphoric levels of speculation on the stonks, into industries that are performing TERRIBLY too – thanks to the pandemic restrictions. But their stock prices are going to the moon. This can only be speculative price action based on stimulus expectations, there is huge expectation that stimulus will cascade into failing industries. I won’t go into too much detail.

So we have a huge case of buy the rumour sell the news bubbling under the surface.

I’m a very strong believer that stimulus is actually paving the way for the complete ruin of the fiat monetary system, but it’s currently masking the real issue by presenting strength to the average Joe Bloggs of the general public: ‘everything is fine, there’s no problem here’ – when in actual fact there is an incredible wealth transfer happening behind the scenes and those not involved will foot the bill of the fallout.

As a tip, study the velocity of money and how this is a key driver for inflation. Once that starts picking up, it’s time to simplify down to an end game scenario.

Anyway… stepping down off my soapbox… here’s what I did yesterday

DAX Trading Signals Update Feb 03 2021

DAX Trading Strategy Update Feb 03 2021

Tuesday Feb 02, 2021

The DAX has rallied over 5% since the end of Jan; over 700 points, challenging 14k once more – a level we’ve only reach once before. If you scroll out and take a look at the price from the beginning of January to now, can you see how price action is forming a descending broadening wedge? The lower lows are expanding further than the highs, this could be bullish for the DAX.

Four stops yesterday. Two came from the 9am trading daily signals of which one was the DAX and one for FTSE. Whereas on the DTI trading strategy I did not have too many opportunities to trade. Most of the DAX signals were ignored with the afternoon trade running until 8pm, which I closed early at +1.9%. I hit two stops on FTSE and that’s my limit there.

So a poor day, but not a disaster.

DAX Trading Signals Update Feb 02 2021

DAX Trading Strategy Update Feb 02 2021

Monday Feb 01, 2021

So the DAX Targets 13,900 after reaching downside measured moved. I’ve taken a line from the [1] [2] swing and connected a parallel of that line to the downside break of the upsloping trend line to demonstrate the measured move.

I hit a nice target for a +4% gain from the FTSE trading strategy. But I had four stop losses across the day to leave me pretty much even. Sadge.

DAX Trading Signals Update Feb 01 2021

DAX Trading Strategy Update Feb 01 2021

January 2021 Signal Results (+6.71%)

The January 2021 DaxTrader trading signal results are in and the total is +6.71%:

| Date | Market | Strategy | Result |

| 4 Jan | DAX | DTI | -1.00% |

| 4 Jan | DAX | DTI | -1.00% |

| 4 Jan | DAX | DTI | -1.00% |

| 4 Jan | FTSE | DTI | 4.00% |

| 4 Jan | DAX | DAILY | -1.00% |

| 4 Jan | DAX | DAILY | 0.75% |

| 4 Jan | FTSE | DAILY | -1.00% |

| 5 Jan | DAX | DTI | -1.00% |

| 5 Jan | FTSE | DTI | -1.00% |

| 5 Jan | FTSE | DAILY | -1.00% |

| 5 Jan | DAX | DAILY | 0.00% |

| 6 Jan | NOTHING | -1.00% | |

| 8 Jan | DAX | DTI | -1.00% |

| 8 Jan | DAX | DTI | -1.00% |

| 8 Jan | DAX | DTI | -1.00% |

| 8 Jan | FTSE | DAILY | -1.00% |

| 11 Jan | DAX | DTI | -1.00% |

| 11 Jan | DAX | DTI | 4.00% |

| 11 Jan | FTSE | DTI | 4.00% |

| 11 Jan | FTSE | DAILY | -1.00% |

| 12 Jan | DAX | DTI | -1.00% |

| 12 Jan | DAX | DAILY | -1.00% |

| 12 Jan | FTSE | DAILY | 3.00% |

| 13 Jan | DAX | DTI | -1.00% |

| 13 Jan | FTSE | DTI | -1.00% |

| 13 Jan | DAX | DAILY | -1.00% |

| 13 Jan | DAX | DAILY | -1.00% |

| 13 Jan | FTSE | DAILY | -1.00% |

| 13 Jan | FTSE | DAILY | -1.00% |

| 14 Jan | DAX | DTI | -1.00% |

| 14 Jan | DAX | DTI | -1.00% |

| 14 Jan | FTSE | DTI | 2.80% |

| 14 Jan | DAX | DAILY | -1.00% |

| 14 Jan | DAX | DAILY | -1.00% |

| 15 Jan | DAX | DTI | 4.00% |

| 15 Jan | FTSE | DTI | 4.00% |

| 15 Jan | DAX | DAILY | -1.00% |

| 15 Jan | FTSE | DAILY | -1.00% |

| 15 Jan | FTSE | DAILY | -1.00% |

| 18 Jan | FTSE | DTI | -1.00% |

| 18 Jan | FTSE | DAILY | -1.00% |

| 18 Jan | FTSE | DAILY | -1.00% |

| 19 Jan | DAX | DTI | -1.00% |

| 19 Jan | DAX | DTI | 4.00% |

| 19 Jan | DAX | DAILY | -1.00% |

| 20 Jan | FTSE | DTI | -1.00% |

| 20 Jan | DAX | DAILY | 0.05% |

| 20 Jan | FTSE | DAILY | 0.46% |

| 21 Jan | DAX | DTI | -1.00% |

| 21 Jan | DAX | DTI | -1.00% |

| 21 Jan | DAX | DTI | 4.00% |

| 21 Jan | FTSE | DTI | -1.00% |

| 21 Jan | FTSE | DTI | -1.00% |

| 21 Jan | DAX | DAILY | 0.72% |

| 21 Jan | FTSE | DAILY | 0.50% |

| 22 Jan | DAX | DTI | -1.00% |

| 22 Jan | DAX | DTI | 0.36% |

| 22 Jan | FTSE | DTI | -1.00% |

| 22 Jan | DAX | DAILY | -1.00% |

| 22 Jan | FTSE | DAILY | -1.00% |

| 22 Jan | DAX | DAILY | 0.30% |

| 25 Jan | DAX | DTI | 4.00% |

| 25 Jan | FTSE | DTI | -1.00% |

| 25 Jan | FTSE | DTI | 4.00% |

| 25 Jan | DAX | DAILY | 3.00% |

| 25 Jan | FTSE | DAILY | 0.50% |

| 26 Jan | DAX | DAILY | 1.30% |

| 26 Jan | FTSE | DAILY | -1.00% |

| 27 Jan | DAX | DTI | -1.00% |

| 27 Jan | DAX | DTI | 4.00% |

| 27 Jan | FTSE | DTI | -1.00% |

| 27 Jan | DAX | DAILY | -1.00% |

| 27 Jan | DAX | DAILY | 3.00% |

| 27 Jan | FTSE | DAILY | 3.00% |

| 28 Jan | DAX | DTI | 4.00% |

| 28 Jan | FTSE | DTI | -1.00% |

| 28 Jan | FTSE | DTI | -1.00% |

| 28 Jan | DAX | DAILY | -1.00% |

| 28 Jan | DAX | DAILY | 1.81% |

| 28 Jan | FTSE | DAILY | -1.00% |

| 28 Jan | FTSE | DAILY | 0.34% |

| 29 Jan | DAX | DTI | -1.00% |

| 29 Jan | DAX | DTI | -1.00% |

| 29 Jan | DAX | DTI | -1.00% |

| 29 Jan | FTSE | DTI | -1.00% |

| 29 Jan | FTSE | DTI | -1.00% |

DAX Trend-Defining Level Under Pressure

Friday Jan 29 2021

Pretty terrible day, cut incredibly short by my DTI trading strategy hitting 5 stop losses within the first two hours of trading, so I took that as an opportunity to close out the daily signals at breakeven and walk away and take some time away from the market.

Sometimes it’s good to walk away when conditions are not great. Otherwise there is a risk that the trading and the analysis will become frustrating and lead to bigger mistakes.

Your trading plan should allow for these ‘walk away’ conditions.

DAX Trading Signals Update Jan 29 2021

DAX Trading Strategy Update Jan 29 2021

Thursday Jan 28 2021

It’s all about cryptocurrency at the moment, I’m really enjoying my trades over there! I’ve got a nice bag of various ones now which i’ve been accumulating since 2017 and it’s great watching the new technologies start to emerge.

As for the equities, it’s just business as usual.

On the daily signals, I took a couple of stops in the first session with both shorts losing out, but the longs in the afternoon session did well. They ran to 8pm, so I closed them both for a gain. As for the DTI trading strategy, I had a couple of stops on FTSE and a nice target on the DAX. The morning setups were ignored because of yellow candles and a failure to retrace back to vwap.

Yet another solid day!

DAX Trading Signals Update Jan 28 2021

DAX Trading Strategy Update Jan 28 2021

Wednesday Jan 27 2021

Let’s update the chart, what is DAX telling us? “Just when I thought I was out…. they pull me back in!”

The movie quotes were out yesterday and today we have another, name the film? Too easy? Well, this quote describes the German DAX’s recent failure to hold above the ascending channel resistance. It failed spectacularly. But we don’t really care for directional bias, because we trade long or short – so this failure provided some excellent trading opportunities and congratulations to the rest of you that capitalised. As far as trend analysis goes, the DAX is no longer in a bull market after breaking below its trend-defining level.

The morning signals yielded TWO targets (one on DAX and one on FTSE) after the initial DAX stop loss. Superb. But wait. There’s more! 🙂 The trading strategy also gave a nice +4% too.

So today, we grabbed THREE nice targets to compensate me for three-stop losses. Very happy with the result.

DAX Trading Signals Update Jan 27 2021

DAX Trading Strategy Update Jan 27 2021

Tuesday Jan 26, 2021

The DAX roars back into life, smashing through the descending channel resistance, slamming a daily engulfing candle down on the table, forcing a direct glare into the eyes of every doubter, and Gladiator shouts “are you not entertained?!” What a great result for the German DAX today. So now, us greedy traders are all quoting Andy Dufresne from the Shawshank Redemption “And if you‘ve come this far, maybe you‘re willing to come a little further” and expecting another rally, to break to yet another all-time high. We’ll see if that’s likely by watching the price action reaction over the rest of this week.

Onto the trading results. How did we do? Well, the best result came from the DAX trading signal this morning in the signal channel. The trade ran for the whole day so I closed it this evening around 8pm for +1.3%. That gain covered the stop loss I had from the FTSE signal.

And the DTI trading strategy was pretty quiet today. In fact I didn’t have any DAX trades at all, because before the 9am start, I noticed price had tagged the deviation high and failed to retrace back to VWAP. Those conditions make it less probable for my setups to work out, so I choose to ignore them. You’re obviously welcome to create your own trading rules to take those trading signals. As for FTSE, I did take a trade, long, but it was closed at breakeven after reaching 2R profit.

Overall, quiet day on the trading front, there’s always tomorrow.

DAX Trading Signals Update Jan 26 2021

DAX Trading Strategy Update Jan 26 2021

Monday Jan 25, 2021

Since the high on 8th January, the German DAX has posted consecutive short-term lower lows and lower highs and is now challenging the major low posted on the 5th January. However, the ascending channel that we’ve discussed over the past couple of weeks is still holding and is expected to hold at least once more. In order for the bull market to continue, we need to break the ascending channel resistance and break above the short-term lower highs.

The trading session was excellent on Monday. The DAX daily signal smashed target easily for +3%, but the FTSE didn’t quite get there, so I closed it at 8pm for +0.5% gain. And the trading strategy provided some fantastic setups too. I had a stop loss from the DTI trading strategy with FTSE early in the season, but everything else worked perfectly. DAX and FTSE hit their targets for +4% each (although I was very fortunate with the DAX, as the retracement to vwap was borderline). A superb day to start the week!

DAX Trading Signals Update Jan 25 2021

DAX Trading Strategy Update Jan 25 2021

DAX Technical Analysis Articles

These are daily DAX analysis articles. I have been watching the German DAX index every day since February 2014, when I quit my job to become a full-time trader. During my quest to become a professional market analyst and trader, I learnt as much about technical analysis as I could. The DAX is my favourite equity index to trade because it responds well to technical analysis tools such as market profile, swing analysis, volume profile, RSI divergence and various other technical indicators.

Effective DAX Technical Analysis Techniques

The most effective technique to improve your own DAX analysis is to always keep the DAX index price action at the front of your analysis. Always understand how the market moves, and what the most recent trend-defining level is.

I know this analysis sounds simple, but it’s the most overlooked technique by traders and market analysts. There is a common mistake to try to be too advanced sometimes, and this causes us to miss the obvious.