Sentiment from Germany

“The equity markets are fundamentally cyclical. In this cyclicality we have the known year-end rally” says Friedemann Wagner, Managing Director of PEH wealth management. At the same time, the asset manager states: “As with all well-known stock market phenomena, nothing is certain it occurs only with high probability. ”

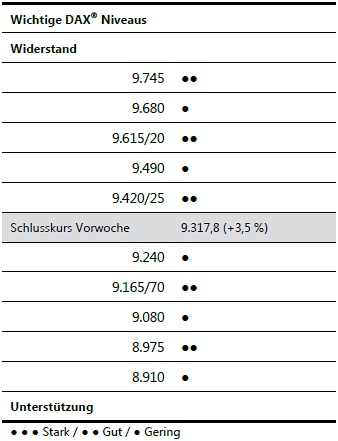

Michael Dutz of the Adlatus asset management is optimistic for this year: “Yes, we expect a Dax final score of 9,800 points in 2014”. And he gives investors a clear guide to action: “Who wants to experience the year-end rally, must act immediately and buy Dax from 9,200 points”.

Trading So Far

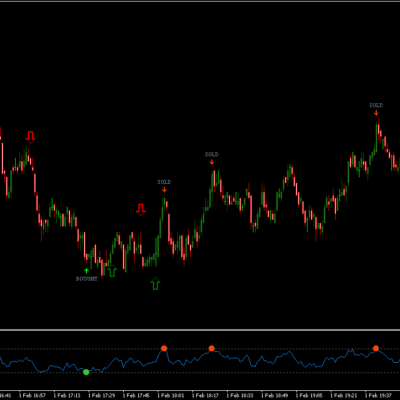

In a word: choppy

Directional bias: currently intra-day bearish as we pullback from Friday’s high.

Commentary: we have breached Friday’s value area low and have started the descent again towards the deviation low after piercing it earlier today. There is currently disparity between SPX and DAX perhaps because ECB are currently caught in between two major monetary policy decisions Fed vs BoJ who are on two opposite ends of the spectrum and some report that ECB are unlikely to improve TLTRO terms currently. But looking back over the years, the last two trading months of the year tend to be fairly lucrative for investors as companies look to squeeze out maximum value from the share prices for reporting purposes.

I still have a feeling that Thursday the ECB may spring a surprise similar to Japan.

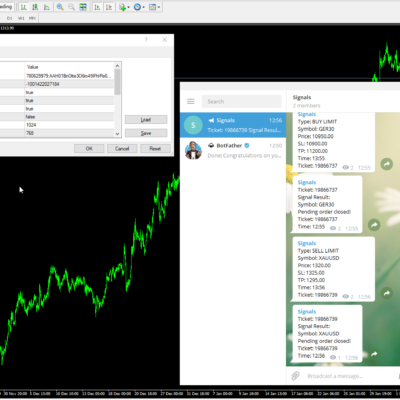

I have placed a trade: Trade0041 | BUY DAX @ 9205 | SL: 9052 | TP: 9577 | 03/11 @ 11:43GMT | #forex #signal #DAX http://www.daxtrader.co.uk/my-trades