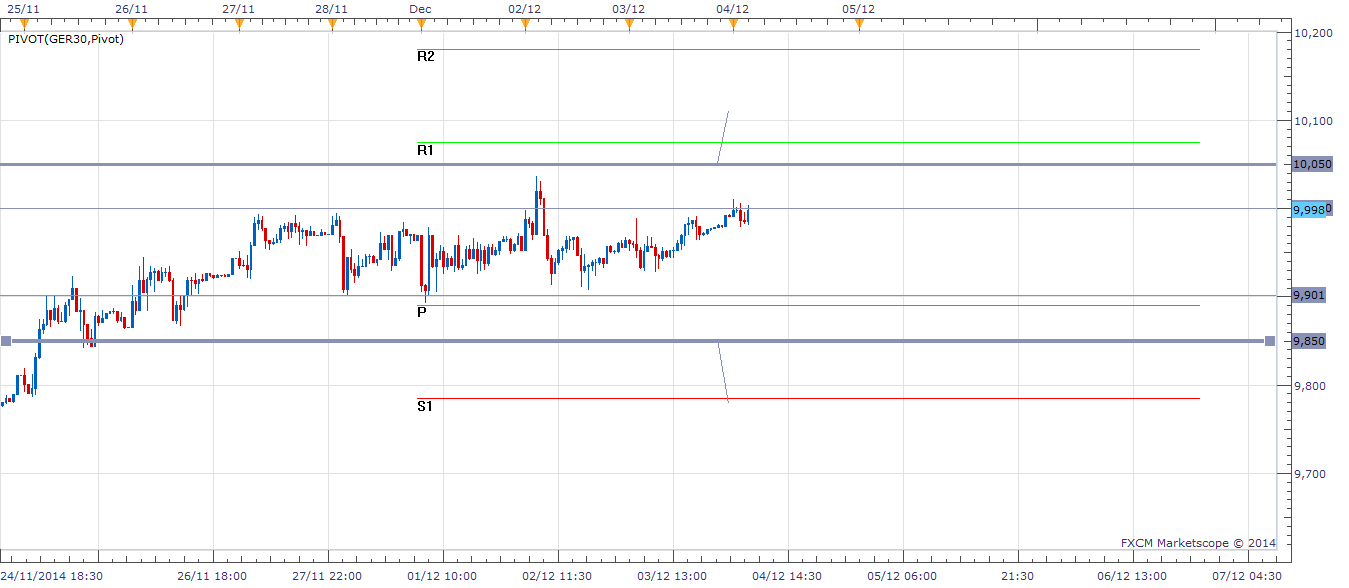

Current Bias: Neutral

Resistance: 10000 10014 10038 10050

Support: 9978 9971 9959 9948 9930 9905

[wp_ad_camp_3]

Dax Summary

The ECB press conference from Mario Draghi certainly provided some volatility today and we actually experienced a swing between the daily R3 and S3, which is unusual. The body of the daily Dax candle is still trapped within the 9900 – 10000 level so no real progress has been made. After the massive sell off, we have pulled back to around the 50% level, respected the S1, the vpoc from yesterday and the newly carved low pocket pocket today. Signs are suggesting a further sell off.

In the video I have highlighted number of interesting technical patterns from today, please have a look.

In terms of bias, I am currently neutral and a little unsure of where this is going to go. I still feel there is room to the upside and eventually will be shorting this for the mid/long term, but I would like a better price to sell. In the short term, based on the current trade I have open, I am bullish, but suspect I may have a poor trade here.

Outlook tomorrow is: either up, down or sideways….. But seriously, there is potential for further movement because it’s Friday, but NFP Friday and that combination could signal the start of a reversal. However when you consider the recent sharp rise from the S&P and the following slow down around 2045, I think the Dax is at a similar position to that. The S&P continued North from there, after a week or two of consolidation, so perhaps the Dax is a couple of weeks behind and will follow in the S&P’s footsteps.

[wp_ad_camp_3]

[wp_ad_camp_1]

Market Commentary

ECB day, today we may very well get the volatility we need to break above and stay above the 10000 level, or at least get us out of the neutral bias into a new trend. In the very short term (couple of hours) I am bearish, but today overall I am neutral/bullish.

We have been trapped in a range for a few days and there is a lot of support to break through today. A dovish press conference from Mario Draghi could break through some of that support.

I had a scalp trade from yesterday which was not closed finally get stopped out this morning for a loss of 18 points and now I am trading the range. Price has moved into my sell zone, so I took the trade but I am looking to get out of that trade by lunchtime to make sure I have no positions open for the ECB decision. The pivots on this chart are the weekly pivots, which I haven’t paid much attention to today, although if we do break out to the upside it will be interesting to see if those levels are respected.

[wp_ad_camp_1]

Good luck trading today