Good morning traders!

We had a bearish week last week after shedding over 260 points, in part caused by the renewed Brexit fears and Goldman Sachs have joined multiple multiple banks in stating their bearish bias on equities. We had some high impact news events including the ECB and NFP, with NFP providing the biggest surprise with a massive under delivery. This may have caused some surprises on the technical side, but we are much quieter this week allowing us to take advantage of more setups.

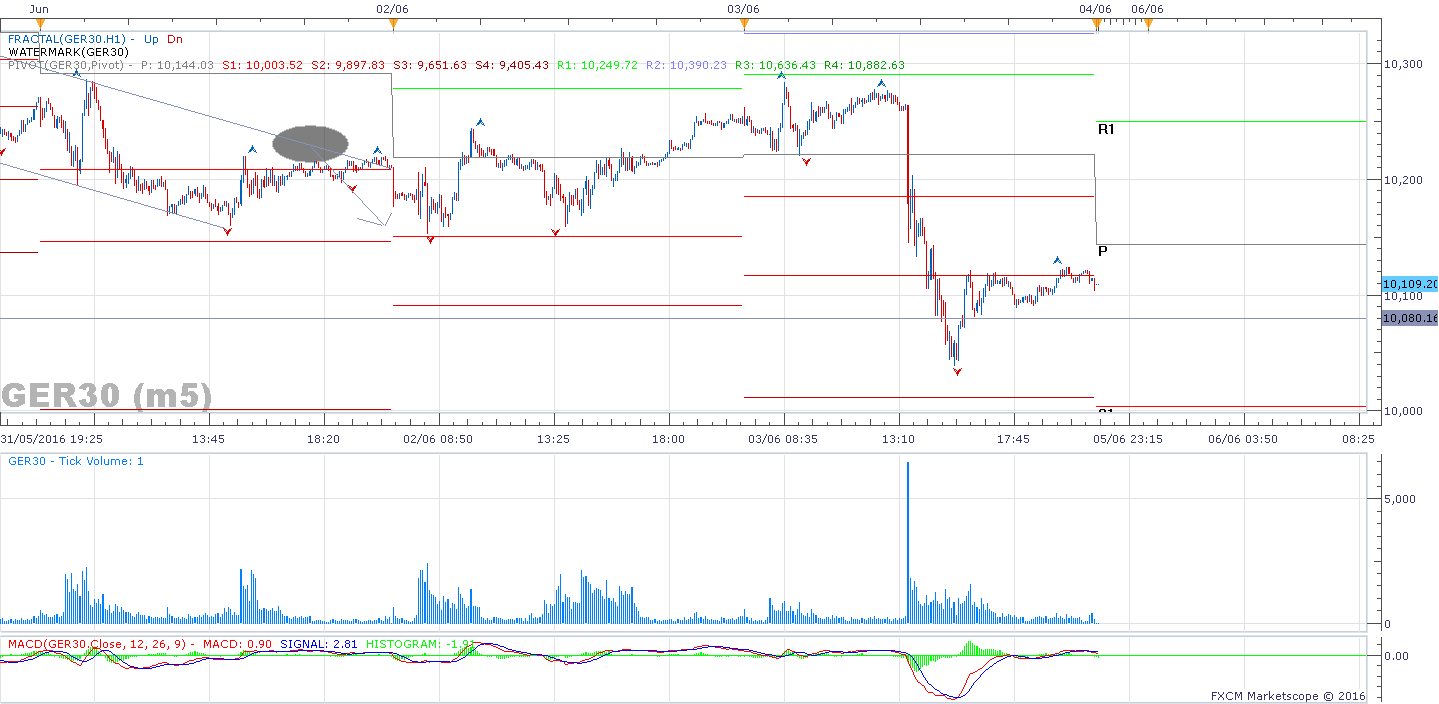

On the daily chart, we have now closed below the daily 200 EMA, just outside the bullish trend channel and momentum is about to turn negative on the MACD. But price is currently at a key level of previous resistance (10100) and recently tested the 50% retracement of the recent swing. Longer term, the trend since February, is still technically bullish above 9725, short term we are bearish below 10285.

A break below the 10000-10030 zone opens up a move down to the 9900-9950 level. A break above 10285 opens up a move to 10375 and beyond that 10475+. Right now however, we are in the retracement zone and the retracement zone is easier to see on the 30 minute chart.

Dax Support & Resistance

| KEY LEVELS | |

| Daily R2 | 10390 |

| Daily R1 | 10249 |

| Daily Pivot | 10144 |

| Daily S1 | 10003 |

| Daily S2 | 9897 |

| 200 Day EMA | 10151 |