Hello traders!

Yesterday I mentioned that a break below 9500 could be interesting and if that happens, then price could reach 9400 fairly soon and test 9200 over the next week or so. I wasn’t wrong. We are currently sitting around 9370 and threatening to move further down.

The difficulty I am finding at the moment, is that I am focused on finding good reward:risk opportunities and this is causing me to miss some of the moves. Today was another example. I was talking to my subscribers about a sell opportunity around 9358, with a stop loss around 9388, but I couldn’t find a target price so didn’t commit to a trade myself. It worked out nicely, taking 40 points and it’s still moving lower.

Find out more about subscribing to DaxTrader Signals

When markets are oversold, I used to make the mistake of buying to early, because I felt the market had to turn around, but the opposite is often true and markets can stay oversold for days, sometimes weeks before moving back. When the fundamental case is bearish and the technical case is bearish, it takes something significant to reverse the trend. At the moment, I can’t see much hope for bulls.

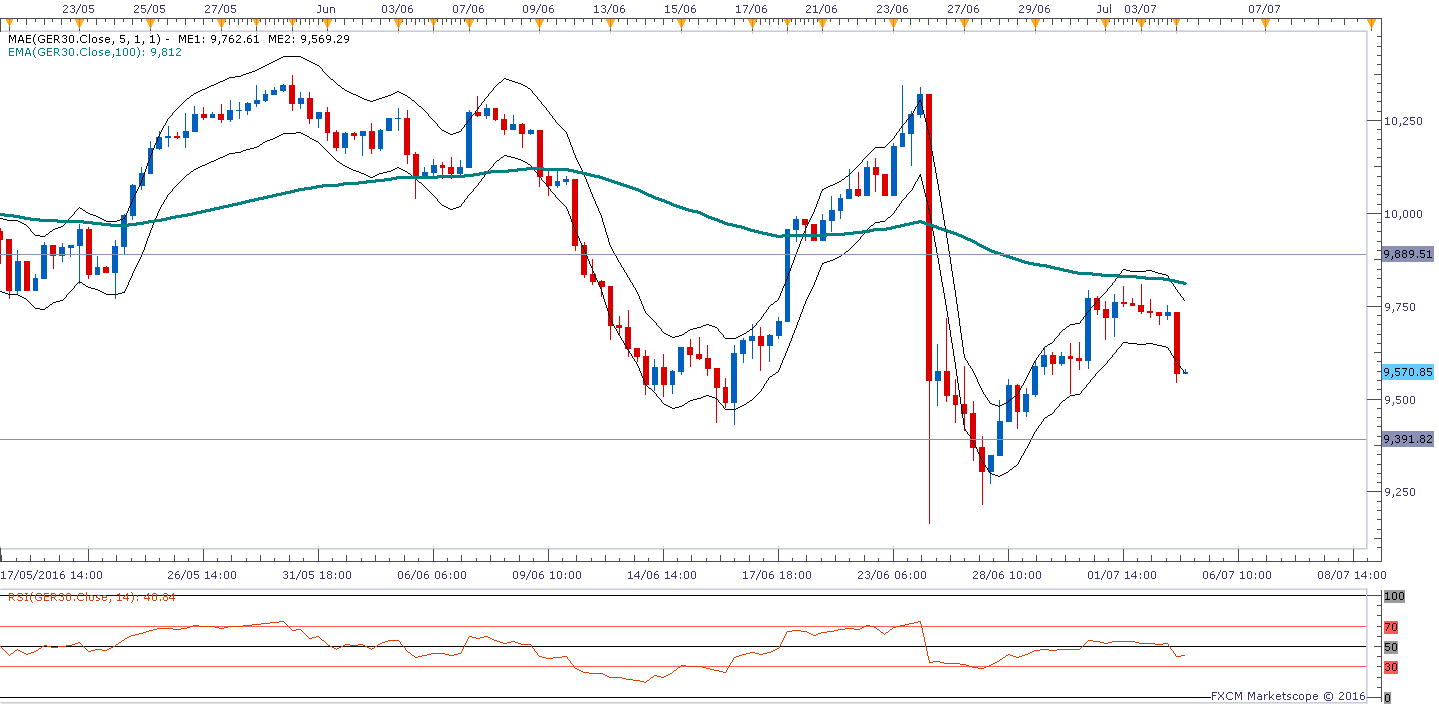

Dax Technical Analysis

There is some pretty key support around 9250 so I am watching this as an area to bounce from, which is restricting my reward:risk setups right now. If it happens, and we do get the bounce, then potential levels to bounce to could be around 9500, perhaps 9523. This would be just below the weekly pivot (pivot point indicator) and test the 34 hour EMA (my preferred fibonacci number).

We are longer term bearish below 9800 and short term bearish below 9523.

A break below 9250, assuming it’s not a fake break, opens up the door to 9160.

A fibonacci extension tool taken from pre brexit high, to post brexit low to July high gives us two potential downside targets of 9078 and 8624 in the longer term. So assuming that we have topped out at 9800, these targets remain open on a break below 9250.

[wp_ad_camp_1]

Dax Support & Resistance

| KEY LEVELS | |

| Daily R2 | 9831 |

| Daily R1 | 9660 |

| Daily Pivot | 9562 |

| Daily S1 | 9391 |

| Daily S2 | 9293 |

| 200 Day EMA | 10073 |

Dax Charts