Current Bias: Bullish

Talking Point: Bullish engulfing candle from Friday

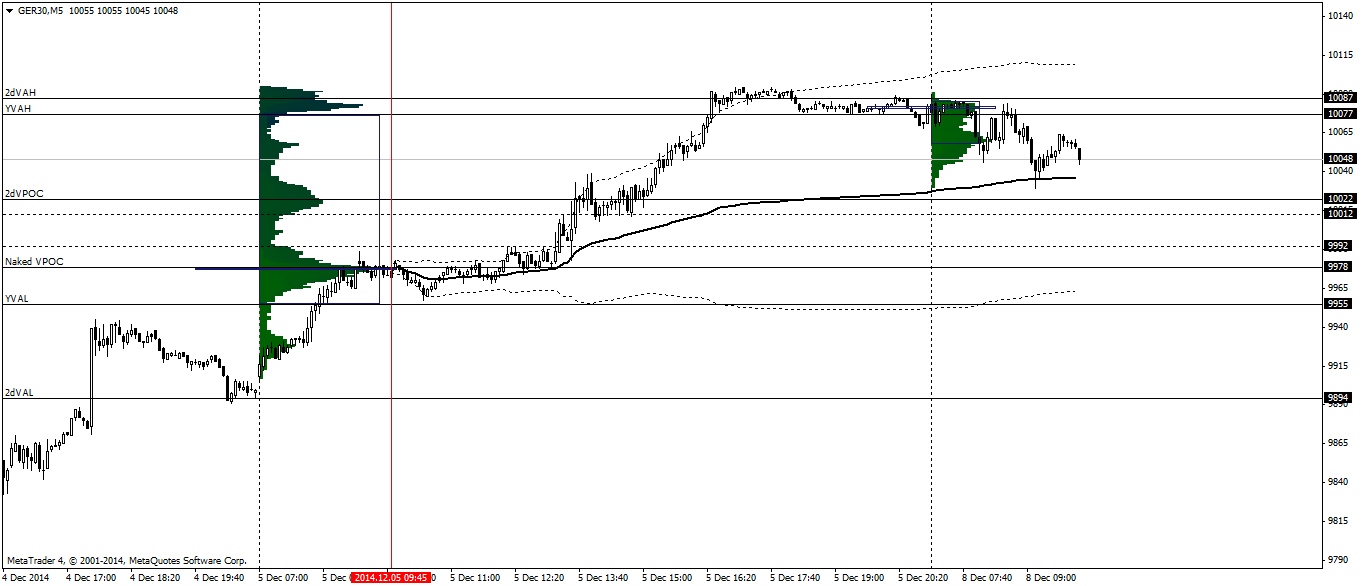

Resistance: 10077, 10094, 10100, 10151

Support: 10035, 10026, 10012, 10000, 9978, 9956

[wp_ad_camp_3]

Evening Summary

We started a pullback today, not unusual after a decent NFP print which caused quite a bit of movement across the markets. The overall trend has to be considered to be bullish with the trend defining level around 9820. I feel as long as we stay above 9820, we will continue the uptrend and can buy anywhere between 9850-9575.

Lots of technical patterns today with price rolling the deviation low, holding at low volume pockets, bouncing off vwaps and respecting the various support and resistance levels. I was unable to trade some of the patterns today so missed a few decent opportunities, but there are always opportunities in trading.

I am sitting on longs which I will hold if necessary and my bias is still bullish.

[wp_ad_camp_1]

[wp_ad_camp_3]

Morning Dax Technical Analysis

Big day on Friday with the US printing some big numbers and easing concerns that the economy is still in trouble, after recently finishing its QE.

NFP day always has the potential to create a decent amount of volatility and action, and this time round we saw exactly that. We saw one of the largest volume days of the quarter and the daily chart shows a bullish engulfing candle which is one of the more significant patterns.

I would generally like to see some follow through after such a formation and suspect there will be further upside, after the initial pullback is complete.

There are two options today in my opinion, either we pullback a little and continue heading north (my preferred buy zone is from around 9985) or we have a corrective day today to eat in to some of Friday’s gains.

In the short term today we are making lower highs and lower lows so I would like to enter a trade once that trend fails.

There is a low volume pocket just under the vwap today which sits above the naked vpoc. I would like to see a fall down towards the naked vpoc, but hold above the value area high from Friday (YVAH). From here I would like to go long.

[wp_ad_camp_1]