Current Bias: Bearish, with potential bounce at previous resistance (September)

Support: 9835 9810 9790 9783 9687

Resistance: 9885 9900 9932 9981 10083

Best trading method today: breakout

I have not been available for much today so apologies for any delay, today’s article will be slightly retrospective providing a summary of today’s trading with an outlook to the rest of the evening and perhaps tomorrow.

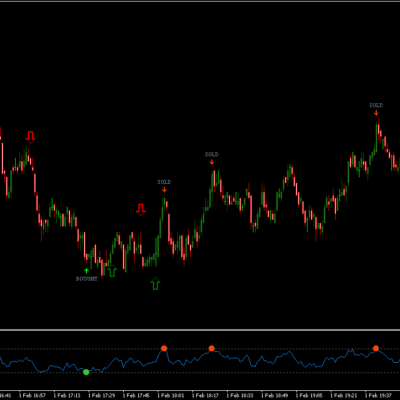

So today we have been consolidating yesterday’s losses and trapped in a range waiting for a breakout of either below 9835 or above 9885. Our vwap bands were starting to pinch in and the MACD was forming a wedge as well, suggesting that when a breakout came it would be quite significant in terms of day trading.

We had the breakout and have taken out the 9835 to the downside for 50 points or so and bounced from the daily S1, retracing around 50% of the move down from the original vwap at around 9870. We are threatening a further move to the downside from here and have not quite yet managed to retrace all the way back to vwap.

EURUSD and USDJPY are still interesting charts to watch as are SPX, FTSE and EUROSTOXX because the Dax is sharing similar moves (inverted moves with EURUSD).

At the moment the trend is bearish and the trend defining level is 9912 so under this level I am currently bearish. You could technically say that the low today is a new lower low, but I suspect we might go down and retest that shortly perhaps carving out a more significant low closer to the daily S2 for today around 9700, perhaps by tomorrow.

There is currently low volume pocket between 9826 – 9840 which currently proving resistive, but could fall quickly if we breach that area. So far we have tested the area twice and both times been rejected.

Technical Analysis Video

Develop Your Trading Business

TheDaxTrader.co.uk provides top quality DAX Analysis articles every day cover various topics of technical analysis from technical indicators to naked price action. We study market geometry and share our outlooks. If you want to learn more about how we trade, you can become a member today and get access to our DAX trading strategy. We trade the strategy every day and this is where we generate our DAX signals. So come and learn the strategy for yourself.

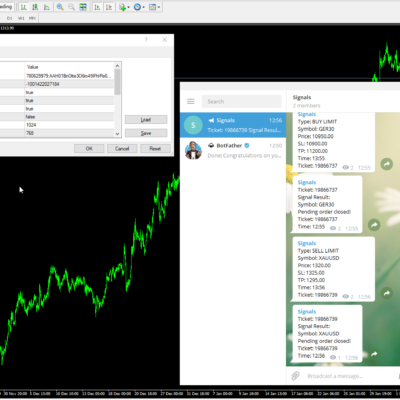

Perhaps you want to learn how to become a signal provider for yourself? If so, learn about how to send trading signals from Metatrader 4 to Telegram. We have produced an excellent piece of software will help you do exactly that. To learn more about the DAX, visit the Wikipedia page, you will find we are mentioned there.