[wp_ad_camp_1]

Good morning traders!

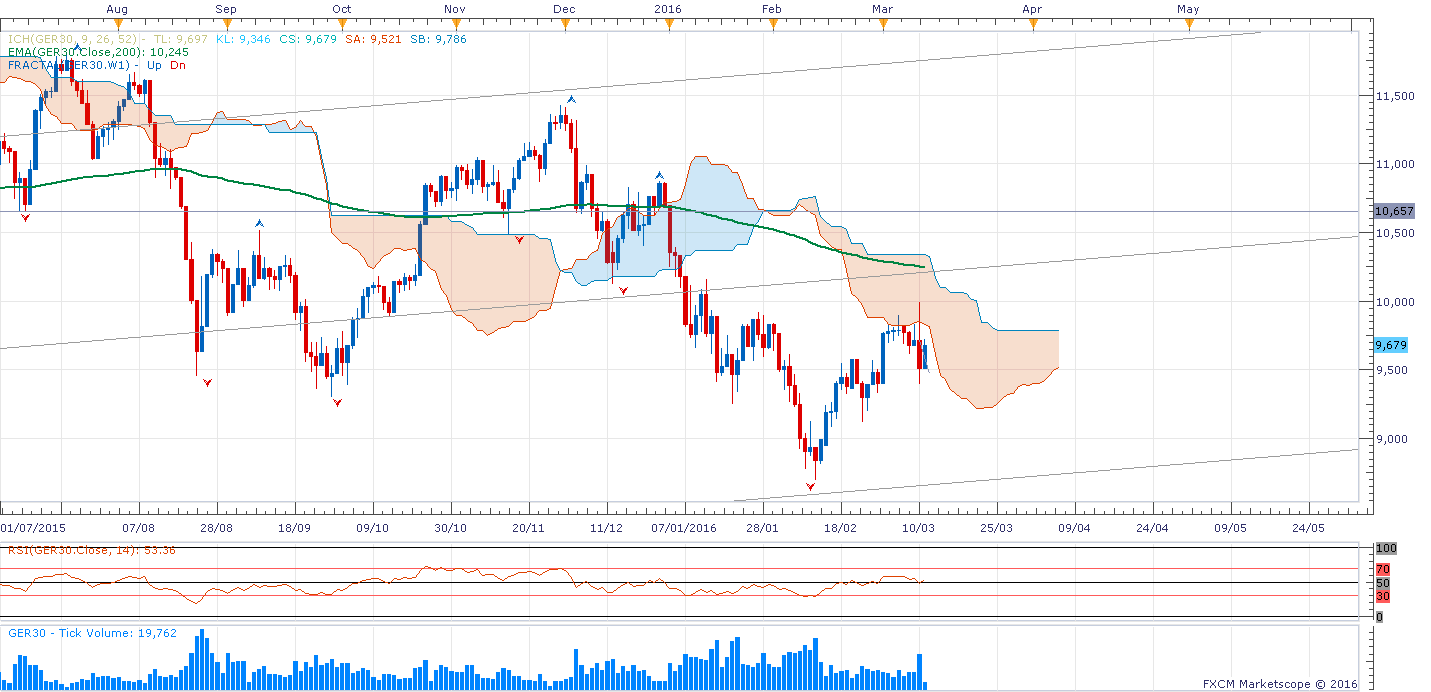

So who else was surprised by yesterday? I try to avoid trading ECB and FOMC because of days like that, reactions like that, but it’s a little more difficult when Draghi throws the sink at the market and hopes for the best. The initial announcement was a big surprise; we have €20 billion more a month, a -10bp deposit rate cut, an expansion of the eligible assets for the QE programe and a new series of four TLTRO II, and I expected a heavily bullish reaction on the Dax, which we got.

But as the day progressed bond yields were higher, EURUSD surged and stocks fell through the floor, to effectively make the Dax technically a bearish market again. We thank the Draghi Q&A session for the results. We now understand the reason for the massive sell off being that Draghi has signalled no further rate cuts.

I suspect many traders had their trades wiped out in some way yesterday because the daily candle had a 600 point range and eventually closing over 200 points down. The sharp rejection at 10,000 makes the level of resistance a little stronger now, but we are making progress today to pare some of those losses, hovering once again around 9700.

[wp_ad_camp_1]

I suggested that traders may be looking to trade an OCO either side of the recent trading range(the lines can be seen on the 4-hour chart), well price actually swung through both levels and is now almost perfectly in the middle of that range again… Nothing unusual about that all, right. But that just suggests we have retraced and are now looking for the next direction.

On a 30 minute chart, we have been in a bullish uptrend, but the break below 9650 yesterday ended that series of higher highs and higher lows and now we trade around the weekly pivot again. Price also trades at the fibonacci retracement zon from the swing of yesterday. So the question is which direction to trade? My answer is simple. None. Leave this one alone, let the dust settle, let the market digest all of this, then look for a move.

DaxTrade RSI EA Back Testing

I have been doing some back testing on my DaxTrader RSI EA recently, on the German Dax, using various RSI settings and the idea is to build a little cheat sheet of settings for various time frames and markets that tend to perform well. Here is my first offering.

Firstly, let me explain that my testing has been using an FXCM account, of £1,000 account, trading around £0.22/point, swing trading at a risk to reward ratio of 1:1 for 175 points (approximately 4% risk per trade). That means for every winning trade we take £39 and for every losing trade we take £39. A risk reward ratio of 1:1 is not ideal, so it means I need a 51% win rate or high to make a profit.

#1 DaxTradeRSI EA Settings – 5 minute chart

The Expert Advisor inputs:

- 78 overbought

- 22 oversold

- 18 period RSI

- 5 minute chart

- 175 point profit and 175 point stop loss

- no trailing stop

- £0.22/point (2k or 3k lot depending on broker)

The results

60.63% win rate over 127 trades, since 29th may 2015, earning a profit of £1,041, that’s over 100% return within a year, for doing nothing except loading up an account with the software.

Open a real account with FXCM using the link below (it’s a referral link) and I will give you the software for free, otherwise you can purchase the software using the link on the right. I just ask you to drop me a line once you have created the account, so I can send you the software. Best of luck trading.

(Disclaimer: trading financial markets is risky involving the risk of losing all of your invested money. Historical data does not guarantee future success. Trading with automated software can increase the risk. No financial advice is offered on this site. Please use the software at your own risk)

Dax Support & Resistance

| KEY LEVELS | |

| Daily R2 | 10235 |

| Daily R1 | 9873 |

| Daily Pivot | 9635 |

| Daily S1 | 9272 |

| Daily S2 | 9034 |

| 200 Day EMA | 10246 |

[wp_ad_camp_1]

Dax Charts