Hello Traders!

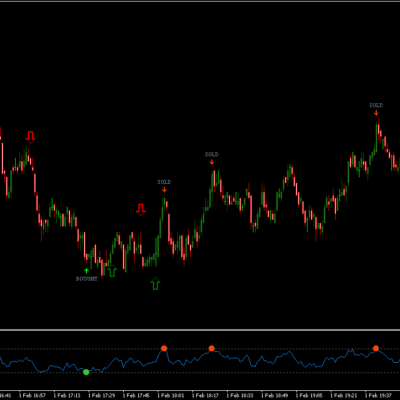

Not the most exciting day to trade yesterday, in fact we traded in between the daily S1 – R1 all day, a 97 point range and rarely deviated more than 40 points away from the Bollinger band midline, (visible on the 5-minute chart below). We lost 0.35% on the day, closing around 6 points below the 12191 support level I mentioned in my article yesterday.

There is definitely still a case for a little more weakness on the Dax and both the 5m and the H1 charts show similar levels and targets for both Bulls and Bears. The H1 chart still shows the possible retracement zone, somewhere between 12093 – 12118. But it is the m5 chart that shows the most interesting setup for me.

I am watching for a retracement down to 12110 for a potential opportunity to buy. There is a confluence of technical indicators at that price, such as the daily S2 (pivot point indicator, the recent trend line will form support there, the lower Bollinger band and the early April low as well. I am considering a limit order there.

Dax Support & Resistance

| KEY LEVELS | |

| Open | 12229 |

| High | 12272 |

| Low | 12175 |

| Close | 12186 |

| Range | 97 |

| Change | -0.35% |

| 14 Day ATR | 109.86 |

| Daily R2 | 12306 |

| Daily R1 | 12245 |

| Daily Pivot | 12209 |

| Daily S1 | 12148 |

| Daily S2 | 12112 |

| 200 Day EMA | 11230 |