[wp_ad_camp_1]

Good morning traders!

Neutral day yesterday, compressed trading range but once again reached fresh highs before closing pretty much where it started the day.

I am bullish on Dax, FTSE, CAC40 and SPX indices and am looking for dip buying opportunities.

I am looking for an opportunity to add to my long position and am especially watching for a possible release that the list of reforms that Greece submits will be rejected by the EU member states. This rejection of reforms will trigger selling in the market as investors panic about Grexit again and this selling may give an opportunity to buy again at support. I believe that any rejection of reforms at this stage would be completely normal and will view it at political posturing and game playing on both sides. Greece won’t want to lose face, Tsipras and Co. will talk a good fight, but will do what they’re told for now.

Bullish approach. Support for dip buying could be either 11050 (retest of the breakout) or 11026 (daily S2) and beyond that 10945 (median line of the pitch fork on the daily chart and also the lower part of the original wedge formation that we recently broke from).

Bearish Approach. If the candle from yesterday turns out to be the start of a corrective pattern, then the fundamental trigger would be the Greek obstacles and/or geopolitical tensions, which are possible today. Without this trigger, the Bullish sentiment will likely dominate with consolidation coming a close second.

[twitter-follow username=”DaxTrader54″ scheme=”light”]

Support & Resistance

| KEY LEVELS | Difference | |

| Daily R2 | 11204 | -88 |

| Daily R1 | 11162 | -46 |

| Value High | 11126 | 73 |

| Naked VPOC | 11121 | 145 |

| Daily Pivot | 11115 | 38 |

| 24hr VWAP | 11110 | 92 |

| Value Low | 11087 | 128 |

| Daily S1 | 11073 | 80 |

| 34 Hour EMA | 11067 | 58 |

| Daily S2 | 11026 | 164 |

| 200 Day EMA | 9808 | 13 |

Dax Daily Chart Analysis

[wp_ad_camp_1]

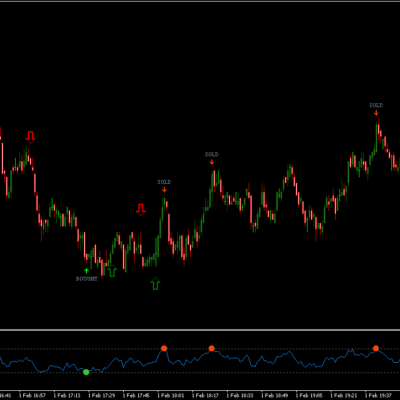

All time highs again, but we have already climbed around 10-12% this year, the momentum indicators are slightly overbought, we are in the top half of the pitchfork, still near the top of the rising channel and above the 100% fib extension from the Oct/Dec swing. There will soon likely be further consolidation or a pullback/correction. Right now though, strongly Bullish.

Dax Intra-day Chart Analysis

[wp_ad_camp_1]

After plenty of action on Friday, yesterday was a lot more tame. We made fresh highs but the formation is that of a triangle and a breakout is coming again. A break below the trend defining 11070 low opens up 11026 which is the S2. A break above the recent high takes us back into new territory. On the second chart, I would like to add to my position somewhere near the circle.

Dax Volume Profile Analysis

[wp_ad_camp_1]

Much smaller profile, normal distribution with no low volume pockets. Price was oscillating around VWAP with mixed buy/sell signals again compressing into a triangle pattern. The entire value area for yesterday was within a 39 point range.

[wp_ad_camp_1]