Hello traders, let’s begin the Dax Technical Analysis 24-05-2017 by carrying on from yesterday. We were looking at three main things yesterday:

-

- Developing head and shoulders pattern on the daily chart

- Trend line being tested on the hourly

- Symmetrical triangle on the 5 minute

Developing head & shoulders on the daily chart

This pattern is still developing, so long as we stay below 12705. I will check this again tomorrow. If this move plays out to a head and shoulders pattern, then I am looking for [3] to begin forming the right shoulder, with [4] forming part of the neckline. By all means, this pattern may not complete and actually break higher, because nothing is certain in trading. So risk management and reward to risk is the best way to capture the move.

The next target for me would be to take out the trend line on the hourly chart.

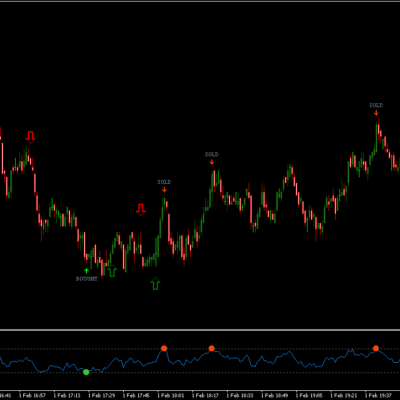

Trend line being tested on the hourly

This is the most compelling technical setup that I can see at the moment. Since forming this trend line, we have tested it three times this week. I appreciate that every other trader on the planet will be able to see this setup, it’s not disguised. But it does present a trading opportunity (see below) on a break below 12605. If we do break lower, and the move is not a fake break, I am watching 12500 for support. This could be a target. A stop loss would have to be above 12700, so the reward to risk is pretty much 1:1.

I am also going to keep an eye on the MACD here, to see if we cross the centre line.

Symmetrical triangle on the 5 minute

This triangle is not the strongest technical pattern to study because it often suggests that we are in a sideways market. In this example, there was not a lot to see. Price initially broke lower, perhaps encouraging sellers to jump on the move, but buyers took control and the move reversed quickly. So I will store this one and recall it for the next time it happens.

We briefly pierced the Bollinger Bands yesterday, before creating a double-top around lunchtime. Price did very little in the afternoon, retreating back to the daily pivot. I have noticed that the Bollinger Bands are beginning to pinch, so I will follow that up tomorrow.

Dax Trading Idea

Let’s consider the following, which I will follow up tomorrow:

SellLimit @ 12605

Take Profit @ 12505

Stop Loss @ 12705

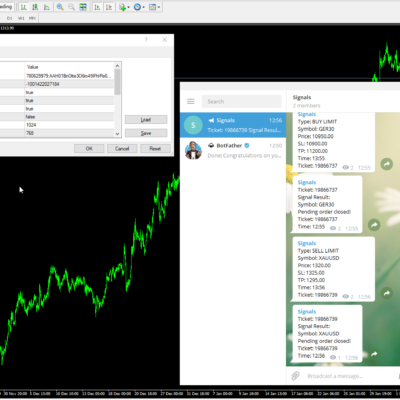

If you are looking for trading signals, then come and receive live trading signals directly to your phone and join the trading community by upgrading to Premium. If you wish to take advantage of the current promotion, whilst remaining a basic member, then three months of signals will cost £94 and can be purchased using this link: https://www.paypal.me/DaxTrader54/94 .

Don’t forget to access the free broadcast channel on Telegram messenger, (additional Dax analysis and messages to my readers and subscribers) simply download the Telegram messenger (from www.telegram.org) and then click this link: https://t.me/joinchat/AAAAAEAypsW3Xet_6ngBlw

Technical Analysis Summary

- SellLimit @ 12605 (H1)

- Bollinger Bands are beginning to pinch (m5)

- MACD about to cross center line (H1)

Dax Support & Resistance

| KEY LEVELS | |

| Open | 12596 |

| High | 12703 |

| Low | 12585 |

| Close | 12666 |

| Range | 118 |

| Change | 0.56% |

| 14 Day ATR | 121.28 |

| 200 Day EMA | 11543 |

| Daily R2 | 12769 |

| Daily R1 | 12718 |

| Daily Pivot | 12652 |

| Daily S1 | 12600 |

| Daily S2 | 12534 |

Dax Technical Analysis 24-05-2017 written by Chris Bailey