[wp_ad_camp_1]

Good morning traders

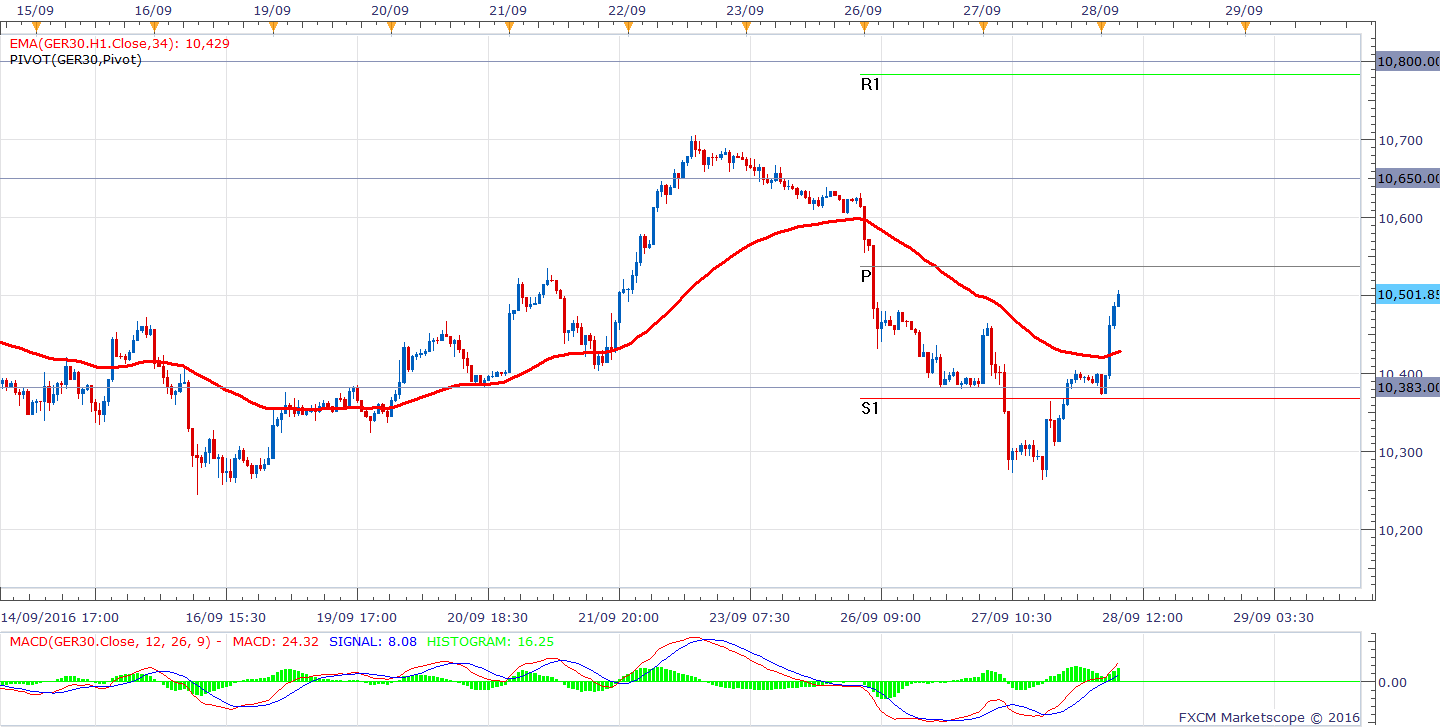

I received a signal last night to go long at look to target 10525, but I didn’t personally open the trade and here we are now looking at a brilliant surge up towards the daily R1 (pivot point indicator). It’s always very tempting to jump into moves with momentum, but it’s often considered a Fear Of Missing Out (FOMO) trade and they don’t always work out too well.

Yesterday, there was another case of bullish divergence leading to a decent opportunity which would have earned a keen eyed trader over 100 points over the afternoon session, a nice trade. You can see the divergence on the 5 minute chart below.

Today we have used the daily pivot as a springboard and are resting (at the time of writing) just underneath the daily R1 there is also price action resistance from yesterday’s pivot as well. So I am looking at an entry from slightly lower, nearer to 10400 anticipating a pullback.

There was an engulfing candle on the H4 chart for the Dax at a area of support, this has woken up the bulls and sprung them into action. If you pull a fib on the H4 chart you see a pullback zone between 10485-10537, so many traders may look at this for a target. If bears step back in here then 10525 could be interesting as this was a previous level of support that was broken, and we all know that previous support often becomes resistance.

Daily chart candle for yesterday looks interesting too!

Dax Support & Resistance

| KEY LEVELS | |

| Daily R2 | 10580 |

| Daily R1 | 10490 |

| Daily Pivot | 10377 |

| Daily S1 | 10287 |

| Daily S2 | 10174 |

| 200 Day EMA | 10230 |