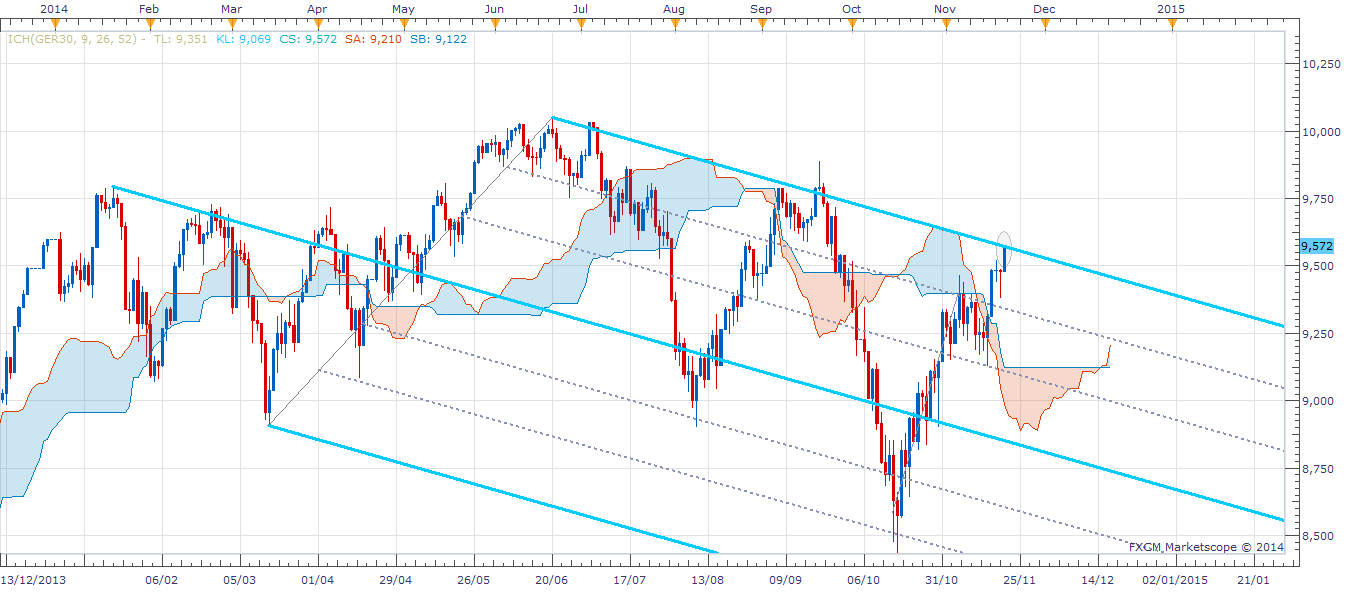

Current Bias: Bullish

Resistance: 9558, 9666

Support: 9450, 9410, 9365, 9342

Summary Video

Dax Summary

So we are in new territory and have carved out new highs, broken out of the pitch fork from May, taken out the daily R3, nearly reached the 9750 goal, overall a bullish trader would be very happy with today.

The relentless surge could be attributed to PBoC decisions and Draghi’s comments earlier today and certainly futures traders are positioning themselves to account for the rising of stock prices.

On the volume profile there is nothing obvious to watch out, today’s trading has been steady, but steady in one direction. We may be peaking as we see the beginnings of a star formation / doji on the H4 chart. I have taken the trade to go short.

Next week will be interesting, as Monday will decide either a correction or a continuation of the move.

Dax Outlook Video

Dax Outlook Commentary

Huge surge this morning, racing towards the 9600 and we are approaching the top of the pitch fork formation. We are already at the daily R2 and we’ve been open two hours. Draghi can move the markets. Perhaps further speculation of easing is pleasing the futures traders.

I am interested to watch the reaction to the top of the fork and see how resistive the pattern is.

On the volume profile, we have opened up a gap around 9490-9506. At current levels it look unlikely that we close that anytime soon. I entered into an early scalp trade, expecting to be in and out within 20 minutes, but it has turned out to be more lucrative that I imagined, so I have moved my stop and I will sit on it and squeeze.

There are a lot of technicals pointing to this market being oversold and I imagine lots of people are short on either a longer term bearish view or a shorter term fade move, but it is not conforming. In fact I’ll quote jonatsgonats from StockTwits: “does not make sense at all… but oh well got to trade what we see which is up”