DAX Technical Analysis

Technical Analysis, DAX Outlook, Economic Calendar, Key Levels and Current BiasDAX Analysis Intraday

Daimler TANKS

Shares of German automaker Daimler AG fell over 4% on Monday after the company cut its outlook for the rest of 2019 fiscal year, mostly due to the costs related to the dieselgate scandal. Earnings before interest and taxes (EBIT) are now expected to be flat year-over-year, according to the firm's latest projection. Over the weekend, it was announced that the maker of Mercedes will recall 60,000 vehicles that were found to be equipped with software for cheating on data related to diesel emissions. At 1:30 pm CET, Daimler's stocks were down 4.23% to go for €47.53, lowest in six days. It was the worst performing stock on the DAX, which was 0.57% in the red.

DAX So Far

Frustrating morning's trading so far, I have not been able to catch any momentum move. I have had a few attempts, but nothing has really caught the moves I would like to see. Let's see what the market does this afternoon

Iran Tensions Continue To Bubble Away

Shares on Wall Street were mostly subdued in premarket trading on Monday as traders keep watch over geopolitical developments. At the end of last week, United States President Donald Trump ordered a retaliatory attack on Iran after the downing of an unmanned American surveillance drone near the Strait of Hormuz, only to abort the proposed strike in favor of new sanctions against Tehran, set to be announced later in the day.

German IFO Numbers Drop

The business climate index for Germany, calculated by the Munich-based Institute for Economic Research (Ifo), decreased from 97.9 in May to 97.4 in June, in line with expectations, according to the latest report published on Monday. At the same time, the expectations index which reveals businesses' forecasts for the next six months stood at 94.2, somewhat below estimates, and slightly lower than in the previous month. The current assessment index came in at 100.8, above projections and marginally higher than the previous month's 100.6, the Ifo said.

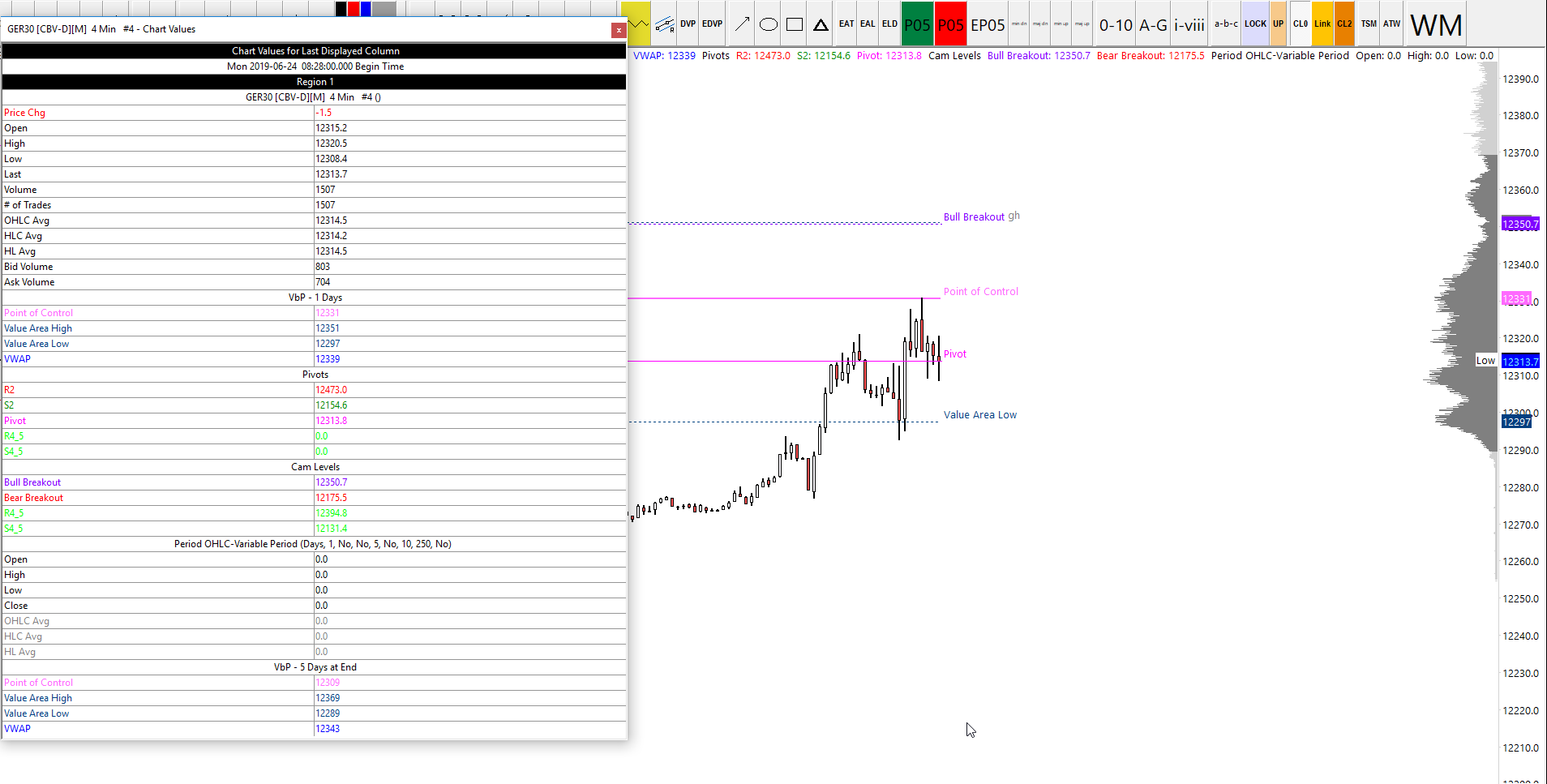

DAX Trading Signals

We have sent out plenty of DAX and FTSE signals already this morning, so it's been a pretty busy start. The trading signals have mainly come from our DAX trading strategy, which is a momentum-based, trend following strategy.

The Morning Briefing

Keep checking back to stay updatedDAX Key Levels

European Markets Begin Slowly

European markets continued their sluggish start to the week in premarket trading as tensions between the United States and Iran over the downing of an American surveillance drone persisted, with US President Donald Trump set to unveil "major" additional sanctions against Tehran later in the day. In other news, economic data for Germany is set to be released after the opening bell including the IFO current assessment, IFO expectations and IFO business climate. That happens around 9am UK time. The only high impact event on the economic calendar today is the RBA's Govenor Lowe Speech which may impact on some of the Australian forex signals this week.

Italy Budget Procedure Delayed

The European Commission will postpone the official launch of a procedure against Italy over the country's fiscal policies, the Financial Times reported. These disciplinary proceedings were previously due to start after the European Union's central body meeting on Tuesday.

According to two sources familiar with the matter, this decision may give Rome the time to align its spending plans with Brussels' recommendations.

Previously, the European Commission warned that Italy was in need of a "substantial" deficit correction for this year and 2020.

I absolutely love Italy, it's my favourite country outside of England. The food, the history, the climate, the fashion, the language, I love it. Shame they're in so much trouble financially.

Deutsche Bank faces increased scrutiny

The Federal Reserve will question Deutsche Bank over its proposals to shrink or close down large parts of its trading business outside Europe, the Financial Times reported today citing sources familiar with the matter. The media outlet previously reported that the German lender was preparing to set up a so-called "bad bank" that would have up to €50 billion in assets. However, its sources said that officials at the Federal Reserve had in recent days spoken with key figures at the bank to request further information on its plans. They were reportedly concerned about the strategy due to the uncertainty that it would cast over the bank's entire United States portfolio. The sources added that the Federal Reserve needed to know how the change would affect the German bank's operations. The reports come as Deutsche Bank faces increasing scrutiny over its activities in the US. Recent reports indicated that US federal and state authorities were investigating it for money laundering and other potential misconducts while a group of Democratic senators previously demanded that its transactions with President Donald Trump likewise be looked into. In addition, the bank's Chief Operating Officer for the Americas resigned at the beginning of the month.

Gold and Oil both up due to US v Iran tensions

United States President Donald Trump ordered a retaliatory attack on Iran after the downing of an American surveillance drone near the Strait of Hormuz. However, he said he backed down from the proposed strike in favor of new sanctions against Tehran, set to be announced later in the day. US Secretary of State Mike Pompeo said on Sunday he wants to build a global coalition against Iran as he left for the Middle East. "We’ll be talking with them about how to make sure that we are all strategically aligned, and how we can build out a global coalition, a coalition not only throughout the Gulf states, but in Asia and in Europe, that understands this challenge as it is prepared to push back against the world’s largest state sponsor of terror," he stated. Precious metals traded in the green today amid dovish signals from the Federal Reserve and heightened tensions between the United States and Iran. Traders remain confident that the Federal Reserve will cut rates next month after Fed Chairman Jerome Powell signaled a more dovish approach in the future. "Many participants now see the case for somewhat more accommodative policy has strengthened," he said at a press conference following the central bank's policy statement, adding that officials are concerned about trade developments and global growth. "Risks seem to have grown," he underlined.