Today we are going to learn about the Average Directional Index on the German DAX or DAX ADX for short. This is a technical indicator which helps traders determine the strength of a trend. Finally it is useful for learning whether the market may be switching from a trend to a range or vice-versa.

The DAX ADX Indicator Basics

The DAX ADX indicator is made up of three lines. You have the ADX line (black) a +DI (green) line and a +DI line (blue). The two DI lines are known as the positive directional index or positive di line and the negative directional index or the negaative di line. These two lines actually help create the ADX line. The calculation of these lines is pretty complex, so rather than explain the exact formulas for each lines, I will summarise what they do.

The +DI line looks at how strong or weak the buyers in the market are. The -DI line looks at how strong or weak the seelers in the market are. The DAX ADX line does not care about which direction a market is moving. It simply shows the strength of the overall trend.

How to Use The DAX ADX

The DAX ADX indicator paints a really nice picture of both the buying and the selling pressure. It presents the buying and selling pressure as two different lines and then gives you a third line for the overall strength of the underlying trend.

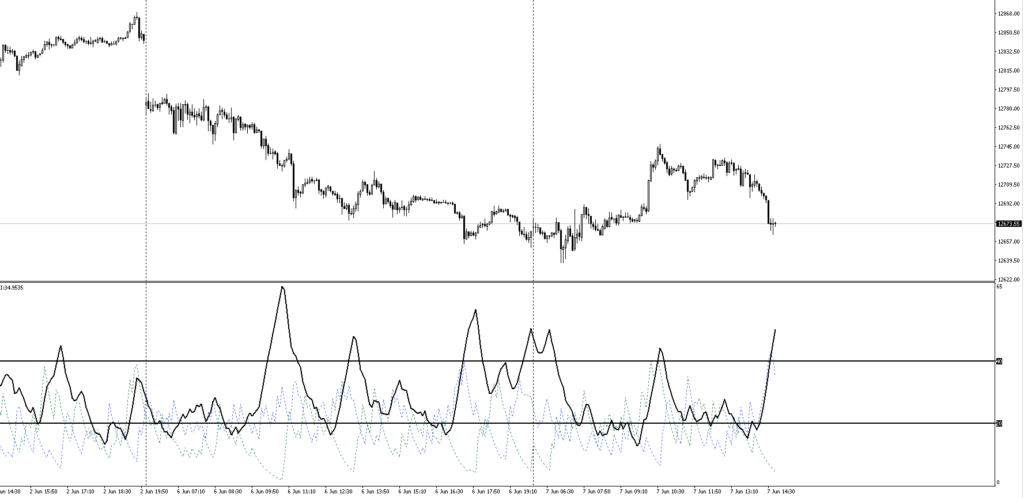

When the DAX ADX line is above 40 and rising, this is indicative of a strong trend. When the ADX line is below 20 and falling, this is indicative of a ranging market. You can see above here that we are currently above 40 and rising and the market is in a downtrend. Sometimes, traders will put that 40 number at 30 for more signals. Some traders say you can start looking to trade trends above 25 instead of 20. There’s a lot of debate as to what’s the best number to use.

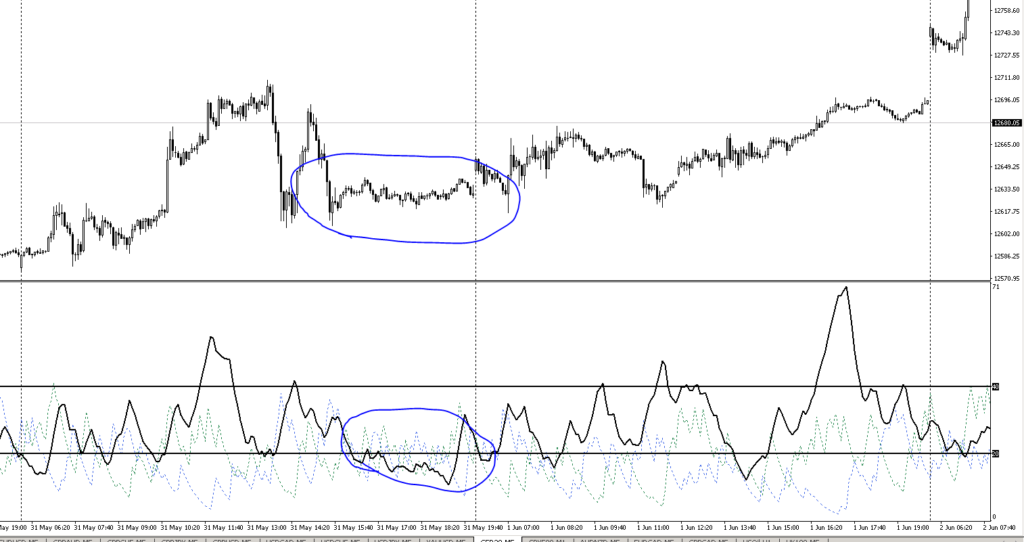

We can start using the ADX indicator as a confirmation of whether or not the DAX is trending. It will help you to avoid ‘choppy periods’. Range traders can not make money in ranging markets. The developer of the indicator recommends not trading any trend based strategy if the DAX ADX line is below both the DI lines. (Even if the ADX line is above 20). Here you see a situation you want to avoid trend strategies. In fact, maybe avoid the market altogether because the DAX ADX line is below both +DI and -DI lines. You can also see that there’s not much action in the market at all.

Identifying New and Old Trends

Another way we can use the ADX indicator is to identify the potential start of a new trend. We watch the DAX ADX line for a move from below the 20 line to above the 20 line. This would be a signal that the market may be beginning a new trend. The longer the market has been in a range, the stronger the signal when it moves above the 20 line. So again, above, you can see the period of slow price action and ADX indicator below 20. Then we have a break above 20 and the price begins to follow.

How can you spot a dying trend? Firstly, the ADX is trading above both the +DI and -DI lines. But then it then turns lower. This is often a signal that the current trend in the market is reversing and traders will position themselves accordingly.

DI Line Crossover

The +DI will rise when there is an uptrend as represents the strength of the buyers. The -DI line will rise when there is a downtrend as it represents the strength of the sellers. When the +DI line crosses above the -DI line, this is an indication that buyers are taking control in the market. So traders will look to go long when that happens. On the other hand, when the +DI line crosses below -DI line, this is an indication that sellers are taking control in the market. So traders will look to go short when that happens. As a rule of thumb, you probably want to have other confirmations.

So there are a lot of different ways to trade the ADX on the German DAX. There’s a lot of other good information out there to further your understanding. I also use the DAX ADX indicator in many automated systems as a filter. So it has a use in our trading. See if you can find some interesting strategies using it.