In this unit, we will look at continuations patterns, specifically the formations of DAX flags and DAX pennants. These patterns are generally seen after a big move in one direction. They represent brief consolidations or pauses in the market before a resumption of the trend. They can be very profitable to trade but are not very common. In the previous unit, we looked at strategies for trading the rising and falling wedge chart patterns.

A DAX flag is represented by a consolidation which can be encompassed by a rectangular formation. However, a flag can also slant downwards as well. A DAX pennant is represented by a consolidation which needs to be encompassed by a triangle formation. The flag and the pennant patterns both contain a flagpole. This flagpole is represented by the sharp move upwards or downwards which sets up the consolidation period.

When either of the Flag & Pennant patterns occurs in an uptrend and a break of the top resistance line can be seen, then It is often looked at as a resumption of the uptrend. Conversely, when a flag or pennant occurs in a downtrend and a break of the bottom support line can be seen, it’s often a resumption of the downtrend.

Bullish DAX Flag

On this chart we see an uptrend, there are three examples of flags here. Price action moves higher, has a brief period of consolidation and a flag occurs. We can encompass the flag portion of the pattern with two parallel lines. The flag pole is represented by the up move in the market. In this chart, you can see three flagpoles and also three flags. These examples are referred to as Bull Flags. When price broke these Bull Flags, you can see it continued to make a decent run.

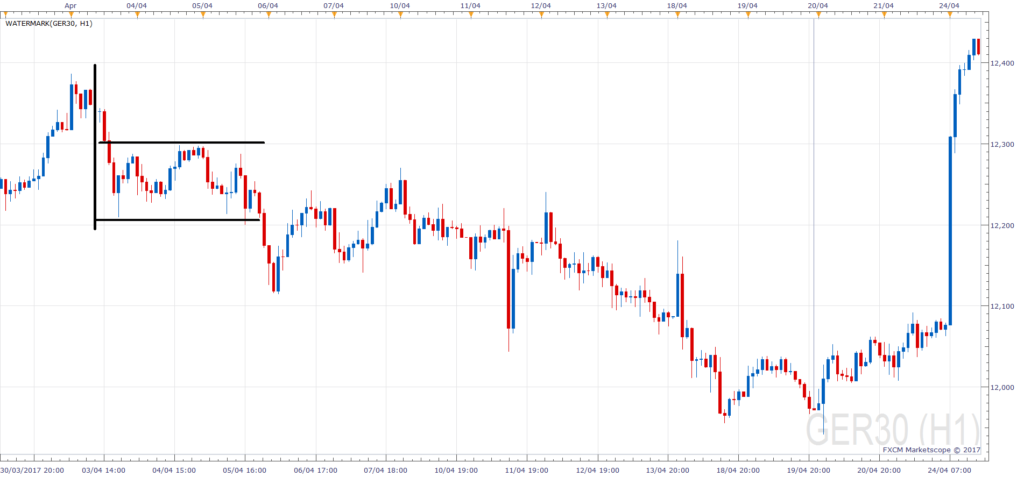

Bearish DAX Flag

A Bear Flag the opposite to a Bull Flag, so it’s basically the same pattern, but flipped upside down. This is because we’re in a downtrend. The charts below show a move downward, then a brief consolidation in the market before the resumption of the downtrend. You can see the flag portion of the pattern and the flagpole of the patterns.

DAX Pennants

A Pennant is also formed during the consolidation after the big move up or down. A Pennant narrows as it matures creating a triangle shape instead of a rectangular shape, but it still has a flagpole.

Often when a Pennant forms, we see a breakout above the top portion of the pennant. A pennant can also point directly to the side or slightly downward and both would be considered valid moves. The next part of this unit will look at how to trade the Flag & Pennant patterns.

DAX Flag Trading Strategy

When you spot a flag pattern in an uptrend this is a bullish sign. So when traders spot flags in up trends, they’re going to commonly look to enter a long position. The entry is it going to be the break point of the upper resistance line of the flag. The target for the trade is calculated by measuring the flagpole (the distance between the high point of the run-up and the low point of the run-up that forms the flag) and then projecting that distance upward from the break of the top resistance line. The stop is then placed just below the bottom support line of the flag.

In this example, we have our bull flag with the flagpole and the parallels. We see the break here of the upper resistance line. That’s the entry. The flagpole measures x so that’s the target for the trade. The stop loss is just below the support line. A bear flag would be the reverse.

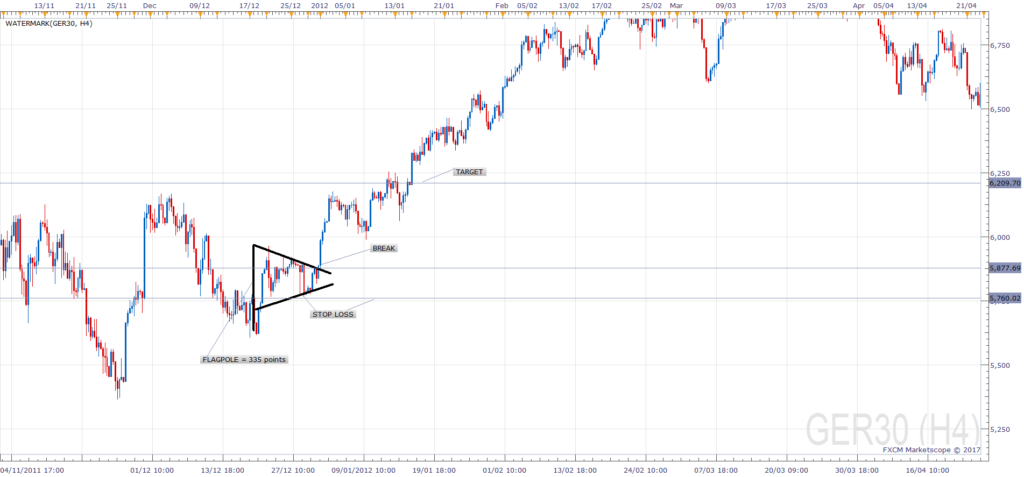

DAX Pennant Trading Strategy

A bull pennant is exactly the same as trading the bull flag except the stop loss is the lowest trough, or the highest peak (for a bear pennant). Have a look at the chart below. We have a flagpole and a pennant. We have a break above resistance. You can see the entry, target and stop loss levels.

In previous units, I said that traders often use volume for confirmation of a move, for example, and an increase in volume, in the case of the Flag & Pennant patterns, it’s the same. Traders like to see volume diminish as the flag and pennant mature and then like to see volume increase on the break of the support or resistance line.

Go and find some examples of Flag & Pennant patterns on the German DAX and post them here in the comments.