July 2021 Signal Results (+39.28%)

That’s more like it!

And it’s taken six months to finally post up a strong trading signals number. This year has not been easy and it’s been a grind, especially after that massive crypto correction. I guess that’s the whole point of keeping the emotions out of trading decisions. As soon as you feel anything, your decisions are clouded.

Every strategy returned a profit this month, the best performer was the DAX DTI. On the regular daily signals, it was FTSE that outperformed DAX. But the final numbers are all that matters.

July 2021 Signals: +39.28%

| DATE | MARKET | STRATEGY | RESULT |

| 1/7 | DAX | DTI | 4.00% |

| 1/7 | FTSE | DTI | -1.00% |

| 1/7 | FTSE | DTI | -1.00% |

| 1/7 | DAX | DAILY | -1.00% |

| 1/7 | FTSE | DAILY | -1.00% |

| 1/7 | FTSE | DAILY | -1.00% |

| 2/7 | DAX | DTI | -1.00% |

| 2/7 | DAX | DTI | -1.00% |

| 2/7 | DAX | DTI | -1.00% |

| 2/7 | FTSE | DTI | -1.00% |

| 2/7 | FTSE | DTI | -1.00% |

| 2/7 | DAX | DAILY | -1.00% |

| 2/7 | FTSE | DAILY | 0.20% |

| 5/7 | DAX | DTI | -1.00% |

| 5/7 | DAX | DTI | -0.80% |

| 5/7 | DAX | DAILY | -1.00% |

| 5/7 | DAX | DAILY | 0.05% |

| 5/7 | FTSE | DAILY | 0.60% |

| 6/7 | DAX | DTI | -1.00% |

| 6/7 | DAX | DTI | -1.00% |

| 6/7 | DAX | DTI | -1.00% |

| 6/7 | FTSE | DTI | -1.00% |

| 6/7 | FTSE | DTI | -1.00% |

| 6/7 | DAX | DAILY | 0.55% |

| 6/7 | FTSE | DAILY | 3.00% |

| 7/7 | DAX | DTI | -1.00% |

| 7/7 | DAX | DTI | 1.20% |

| 7/7 | FTSE | DTI | -1.00% |

| 7/7 | FTSE | DTI | -1.00% |

| 7/7 | DAX | DAILY | -1.00% |

| 7/7 | FTSE | DAILY | -1.00% |

| 7/7 | FTSE | DAILY | -1.00% |

| 8/7 | DAX | DTI | -1.00% |

| 8/7 | DAX | DTI | -1.00% |

| 8/7 | DAX | DTI | -1.00% |

| 8/7 | FTSE | DTI | -1.00% |

| 8/7 | FTSE | DTI | 4.00% |

| 9/7 | DAX | DTI | 4.00% |

| 9/7 | FTSE | DTI | -1.00% |

| 9/7 | FTSE | DTI | 4.00% |

| 9/7 | DAX | DAILY | 3.00% |

| 12/7 | DAX | DTI | -1.00% |

| 12/7 | FTSE | DTI | -1.00% |

| 12/7 | FTSE | DTI | -1.00% |

| 12/7 | DAX | DAILY | 1.02% |

| 12/7 | FTSE | DAILY | -1.00% |

| 12/7 | FTSE | DAILY | 0.80% |

| 13/7 | DAX | DAILY | -1.00% |

| 14/7 | DAX | DTI | 4.00% |

| 14/7 | FTSE | DTI | -1.00% |

| 14/7 | FTSE | DTI | -1.00% |

| 14/7 | DAX | DAILY | -1.00% |

| 14/7 | DAX | DAILY | -1.00% |

| 15/7 | DAX | DTI | -1.00% |

| 15/7 | DAX | DTI | 4.00% |

| 15/7 | FTSE | DTI | 4.00% |

| 15/7 | DAX | DAILY | 0.71% |

| 15/7 | FTSE | DAILY | -1.00% |

| 15/7 | FTSE | DAILY | 3.00% |

| 16/7 | DAX | DAILY | -1.00% |

| 16/7 | DAX | DAILY | 3.00% |

| 16/7 | FTSE | DAILY | -1.00% |

| 16/7 | FTSE | DAILY | 1.92% |

| 19/7 | DAX | DAILY | 3.00% |

| 19/7 | FTSE | DAILY | 3.00% |

| 21/7 | DAX | DTI | 4.00% |

| 21/7 | FTSE | DTI | 1.50% |

| 21/7 | DAX | DAILY | 2.80% |

| 21/7 | FTSE | DAILY | 0.60% |

| 27/7 | DAX | DAILY | -1.00% |

| 28/7 | DAX | DAILY | -1.00% |

| 28/7 | FTSE | DAILY | 1.57% |

| 29/7 | DAX | DTI | 4.00% |

| 29/7 | FTSE | DTI | 4.00% |

| 29/7 | FTSE | DAILY | 3.00% |

| 30/7 | DAX | DTI | 4.00% |

| 30/7 | FTSE | DTI | -1.00% |

| 30/7 | FTSE | DTI | 4.00% |

| 30/7 | DAX | DAILY | -1.00% |

| 30/7 | FTSE | DAILY | -1.00% |

| 30/7 | FTSE | DAILY | -1.00% |

June 2021 Signal Results (-9.02%)

Difficult out there. The culprit this month was FTSE DTI for me. The regular daily signals were actually pretty good performers with DAX Signals performing the strongest and the DAX DTI was profitable too.

FTSE DTI was horrendous and the returns this year are way below my expectations.

June 2021 Signal Results (-9.02%)

| DATE | MARKET | STRATEGY | RESULT | 10000.00 |

| 1/6 | DAX | DTI | -1.00% | 9900.00 |

| 1/6 | FTSE | DTI | -1.00% | 9801.00 |

| 2/6 | DAX | DTI | -1.00% | 9702.99 |

| 2/6 | FTSE | DTI | -1.00% | 9605.96 |

| 2/6 | FTSE | DTI | -1.00% | 9509.90 |

| 2/6 | FTSE | DAILY | -1.00% | 9414.80 |

| 3/6 | DAX | DTI | 4.00% | 9791.39 |

| 3/6 | FTSE | DTI | -1.00% | 9693.48 |

| 3/6 | FTSE | DTI | 4.00% | 10081.22 |

| 3/6 | DAX | DAILY | -1.00% | 9980.41 |

| 3/6 | DAX | DAILY | 3.00% | 10279.82 |

| 4/6 | DAX | DTI | -1.00% | 10177.02 |

| 4/6 | DAX | DTI | -1.00% | 10075.25 |

| 4/6 | DAX | DTI | -1.00% | 9974.50 |

| 4/6 | FTSE | DTI | -1.00% | 9874.75 |

| 4/6 | DAX | DAILY | 1.45% | 10017.94 |

| 4/6 | FTSE | DAILY | 1.60% | 10178.22 |

| 7/6 | DAX | DTI | -1.00% | 10076.44 |

| 7/6 | DAX | DTI | -1.00% | 9975.68 |

| 7/6 | FTSE | DTI | -1.00% | 9875.92 |

| 7/6 | FTSE | DTI | -1.00% | 9777.16 |

| 7/6 | FTSE | DAILY | -0.55% | 9723.39 |

| 8/6 | DAX | DTI | -1.00% | 9626.15 |

| 8/6 | DAX | DTI | -1.00% | 9626.15 |

| 8/6 | FTSE | DTI | -1.00% | 9529.89 |

| 8/6 | FTSE | DTI | -1.00% | 9434.59 |

| 8/6 | DAX | DAILY | -1.00% | 9340.25 |

| 8/6 | FTSE | DAILY | -1.00% | 9246.84 |

| 8/6 | FTSE | DAILY | -1.00% | 9154.38 |

| 9/6 | DAX | DTI | 4.00% | 9520.55 |

| 9/6 | FTSE | DTI | -1.00% | 9425.35 |

| 9/6 | FTSE | DTI | 0.80% | 9500.75 |

| 9/6 | DAX | DAILY | -1.00% | 9405.74 |

| 9/6 | FTSE | DAILY | -1.00% | 9311.68 |

| 9/6 | FTSE | DAILY | -1.00% | 9218.57 |

| 10/6 | FTSE | DTI | -1.00% | 9126.38 |

| 10/6 | FTSE | DTI | -1.00% | 9035.12 |

| 10/6 | DAX | DAILY | -1.00% | 8944.77 |

| 10/6 | FTSE | DAILY | -1.00% | 8855.32 |

| 11/6 | DAX | DTI | 4.00% | 9209.53 |

| 11/6 | FTSE | DTI | -1.00% | 9117.44 |

| 11/6 | FTSE | DTI | -1.00% | 9026.26 |

| 11/6 | DAX | DAILY | 3.00% | 9297.05 |

| 11/6 | FTSE | DAILY | 0.90% | 9380.72 |

| 12/6 | FTSE | DTI | -1.00% | 9286.92 |

| 12/6 | FTSE | DTI | -1.00% | 9194.05 |

| 12/6 | DAX | DAILY | 0.70% | 9258.40 |

| 12/6 | FTSE | DAILY | 0.71% | 9324.14 |

| 15/6 | DAX | DTI | -1.00% | 9230.90 |

| 15/6 | DAX | DTI | 1.20% | 9341.67 |

| 15/6 | FTSE | DTI | -1.00% | 9248.25 |

| 15/6 | FTSE | DTI | -1.00% | 9155.77 |

| 15/6 | DAX | DAILY | -1.00% | 9064.21 |

| 15/6 | DAX | DAILY | -1.00% | 8973.57 |

| 15/6 | FTSE | DAILY | -1.00% | 8883.83 |

| 16/6 | DAX | DTI | -1.00% | 8795.00 |

| 16/6 | FTSE | DTI | -1.00% | 8707.05 |

| 16/6 | DAX | DAILY | -1.00% | 8619.97 |

| 16/6 | FTSE | DAILY | 1.05% | 8710.48 |

| 17/6 | DAX | DTI | -1.00% | 8623.38 |

| 17/6 | DAX | DTI | -1.00% | 8537.15 |

| 17/6 | DAX | DTI | 4.00% | 8878.63 |

| 17/6 | FTSE | DTI | -1.00% | 8789.85 |

| 17/6 | DAX | DAILY | -1.00% | 8701.95 |

| 17/6 | FTSE | DAILY | -1.00% | 8614.93 |

| 18/6 | DAX | DAILY | 3.00% | 8873.38 |

| 18/6 | FTSE | DAILY | 3.00% | 9139.58 |

| 21/6 | FTSE | DTI | -1.00% | 9048.18 |

| 21/6 | FTSE | DTI | -1.00% | 8957.70 |

| 21/6 | DAX | DAILY | 2.00% | 9136.85 |

| 21/6 | FTSE | DAILY | 1.10% | 9237.36 |

| 22/6 | DAX | DTI | -1.00% | 9144.98 |

| 22/6 | DAX | DTI | 2.39% | 9363.55 |

| 22/6 | FTSE | DTI | -1.00% | 9269.91 |

| 22/6 | FTSE | DTI | -1.00% | 9177.22 |

| 22/6 | DAX | DAILY | -1.00% | 9085.44 |

| 22/6 | DAX | DAILY | 1.08% | 9183.57 |

| 22/6 | FTSE | DAILY | -1.00% | 9091.73 |

| 23/6 | DAX | DTI | -1.00% | 9000.81 |

| 23/6 | DAX | DTI | -1.00% | 8910.80 |

| 23/6 | DAX | DTI | 4.00% | 9267.24 |

| 23/6 | FTSE | DTI | -1.00% | 9174.56 |

| 23/6 | FTSE | DTI | -1.00% | 9082.82 |

| 23/6 | DAX | DAILY | 1.16% | 9188.18 |

| 23/6 | FTSE | DAILY | -1.00% | 9096.30 |

| 23/6 | FTSE | DAILY | -1.00% | 9005.33 |

| 24/6 | DAX | DTI | 4.00% | 9365.55 |

| 24/6 | FTSE | DTI | -1.00% | 9271.89 |

| 24/6 | FTSE | DTI | 1.60% | 9420.24 |

| 24/6 | DAX | DAILY | 1.38% | 9550.24 |

| 24/6 | FTSE | DAILY | -1.00% | 9454.74 |

| 25/6 | DAX | DTI | -1.00% | 9360.19 |

| 25/6 | DAX | DTI | -1.00% | 9266.59 |

| 25/6 | DAX | DTI | -1.00% | 9173.92 |

| 25/6 | FTSE | DTI | -1.00% | 9082.19 |

| 25/6 | FTSE | DTI | -1.00% | 8991.36 |

| 25/6 | DAX | DAILY | -1.00% | 8901.45 |

| 25/6 | DAX | DAILY | 0.25% | 8923.70 |

| 25/6 | FTSE | DAILY | -1.00% | 8834.47 |

| 28/6 | DAX | DTI | -1.00% | 8746.12 |

| 28/6 | DAX | DTI | -1.00% | 8658.66 |

| 28/6 | FTSE | DTI | -1.00% | 8572.07 |

| 28/6 | FTSE | DTI | -1.00% | 8486.35 |

| 28/6 | DAX | DAILY | -1.00% | 8401.49 |

| 29/6 | FTSE | DTI | -1.00% | 8317.48 |

| 29/6 | FTSE | DTI | -1.00% | 8234.30 |

| 29/6 | DAX | DAILY | 0.30% | 8259.00 |

| 29/6 | FTSE | DAILY | -1.00% | 8176.41 |

| 30/6 | DAX | DTI | 0.85% | 8245.91 |

| 30/6 | FTSE | DTI | 4.00% | 8575.75 |

| 30/6 | DAX | DAILY | 3.00% | 8833.02 |

| 30/6 | FTSE | DAILY | 3.00% | 9098.01 |

May 2021 Signal Results (+15.77%)

After the terrible performance from the past couple of months, I wanted to see an improvements from the DAX DTI strategy, to avoid the difficult decisions of strategy modification (or even strategy termination) and I got that this month.

The DAX DTI contributed +13.6% and the DAX regular signals contributed just over 10%, so DAX turned it around this month. Let’s see how it progresses from here

May 2021 Results (+15.77%)

| DATE | MARKET | STRATEGY | RESULT |

| 4/5 | DAX | DTI | -1.00% |

| 4/5 | FTSE | DTI | -1.00% |

| 4/5 | DAX | DAILY | 4.00% |

| 4/5 | FTSE | DAILY | 0.80% |

| 4/5 | FTSE | DAILY | -1.00% |

| 5/5 | DAX | DAILY | 1.89% |

| 5/5 | FTSE | DAILY | 2.00% |

| 6/5 | FTSE | DTI | -1.00% |

| 6/5 | FTSE | DTI | -1.00% |

| 6/5 | DAX | DAILY | -1.00% |

| 6/5 | FTSE | DAILY | 0.50% |

| 6/5 | FTSE | DAILY | 0.85% |

| 7/5 | DAX | DTI | -1.00% |

| 7/5 | DAX | DTI | 4.00% |

| 7/5 | FTSE | DTI | -1.00% |

| 7/5 | FTSE | DTI | 2.40% |

| 7/5 | DAX | DAILY | -1.00% |

| 7/5 | FTSE | DAILY | -1.00% |

| 10/5 | DAX | DTI | -1.00% |

| 10/5 | DAX | DTI | -1.00% |

| 10/5 | DAX | DTI | -1.00% |

| 10/5 | FTSE | DTI | -1.00% |

| 10/6 | FTSE | DTI | 4.00% |

| 10/5 | DAX | DAILY | -1.00% |

| 11/5 | DAX | DTI | -1.00% |

| 11/5 | FTSE | DTI | -1.00% |

| 12/5 | DAX | DTI | -1.00% |

| 12/5 | DAX | DTI | -1.00% |

| 12/5 | DAX | DTI | -1.00% |

| 12/5 | FTSE | DTI | -1.00% |

| 12/5 | FTSE | DTI | -1.00% |

| 12/5 | DAX | DAILY | -1.00% |

| 12/5 | DAX | DAILY | -1.00% |

| 12/5 | FTSE | DAILY | -1.00% |

| 12/5 | FTSE | DAILY | -1.00% |

| 13/5 | DAX | DTI | 4.00% |

| 13/5 | FTSE | DTI | -1.00% |

| 13/5 | DAX | DAILY | -1.00% |

| 13/5 | DAX | DAILY | 3.00% |

| 13/5 | FTSE | DAILY | -1.00% |

| 13/5 | FTSE | DAILY | 1.77% |

| 14/5 | DAX | DTI | -1.00% |

| 14/5 | DAX | DTI | -1.00% |

| 14/5 | DAX | DTI | -1.00% |

| 14/5 | FTSE | DTI | -1.00% |

| 14/5 | FTSE | DTI | -1.00% |

| 14/5 | DAX | DAILY | 2.70% |

| 14/5 | FTSE | DAILY | 3.00% |

| 17/5 | DAX | DTI | -1.00% |

| 17/5 | DAX | DTI | 4.00% |

| 17/5 | FTSE | DTI | -1.00% |

| 17/5 | FTSE | DTI | 4.00% |

| 17/5 | DAX | DAILY | -1.00% |

| 17/5 | FTSE | DAILY | -1.00% |

| 18/5 | DAX | DAILY | 2.07% |

| 18/5 | FTSE | DAILY | 2.30% |

| 19/5 | DAX | DTI | -1.00% |

| 19/5 | DAX | DTI | 4.00% |

| 19/5 | FTSE | DTI | 4.00% |

| 19/5 | DAX | DAILY | -1.00% |

| 19/5 | FTSE | DAILY | -1.00% |

| 19/5 | FTSE | DAILY | -1.00% |

| 20/5 | DAX | DTI | 4.00% |

| 20/5 | FTSE | DTI | 4.00% |

| 20/5 | DAX | DAILY | 3.00% |

| 20/5 | FTSE | DAILY | 3.00% |

| 21/5 | DAX | DTI | -1.00% |

| 21/5 | DAX | DTI | -1.00% |

| 21/5 | DAX | DTI | -1.00% |

| 21/5 | FTSE | DTI | -1.00% |

| 21/5 | FTSE | DTI | -1.00% |

| 21/5 | DAX | DAILY | -1.00% |

| 21/5 | DAX | DAILY | 0.35% |

| 21/5 | FTSE | DAILY | -1.00% |

| 24/5 | DAX | DTI | -1.00% |

| 24/5 | DAX | DTI | 4.00% |

| 24/5 | FTSE | DTI | -1.00% |

| 24/5 | FTSE | DTI | -1.00% |

| 24/5 | DAX | DAILY | -1.00% |

| 24/5 | DAX | DAILY | 1.75% |

| 24/5 | FTSE | DAILY | -1.00% |

| 24/5 | FTSE | DAILY | -1.00% |

| 25/5 | FTSE | DTI | -1.00% |

| 25/5 | FTSE | DTI | -1.00% |

| 25/5 | DAX | DAILY | -1.00% |

| 25/5 | DAX | DAILY | 3.00% |

| 25/5 | FTSE | DAILY | -1.00% |

| 26/5 | FTSE | DTI | -1.00% |

| 26/5 | FTSE | DAILY | -1.00% |

| 27/5 | DAX | DTI | -1.00% |

| 27/5 | DAX | DTI | 4.00% |

| 27/5 | FTSE | DTI | -1.00% |

| 27/5 | FTSE | DAILY | -1.00% |

| 27/5 | FTSE | DAILY | -1.00% |

| 28/5 | DAX | DTI | 4.00% |

| 28/5 | FTSE | DTI | -1.00% |

| 28/5 | FTSE | DTI | -1.00% |

| 28/5 | DAX | DAILY | 3.00% |

| 28/5 | FTSE | DAILY | -1.00% |

| 28/5 | FTSE | DAILY | -1.00% |

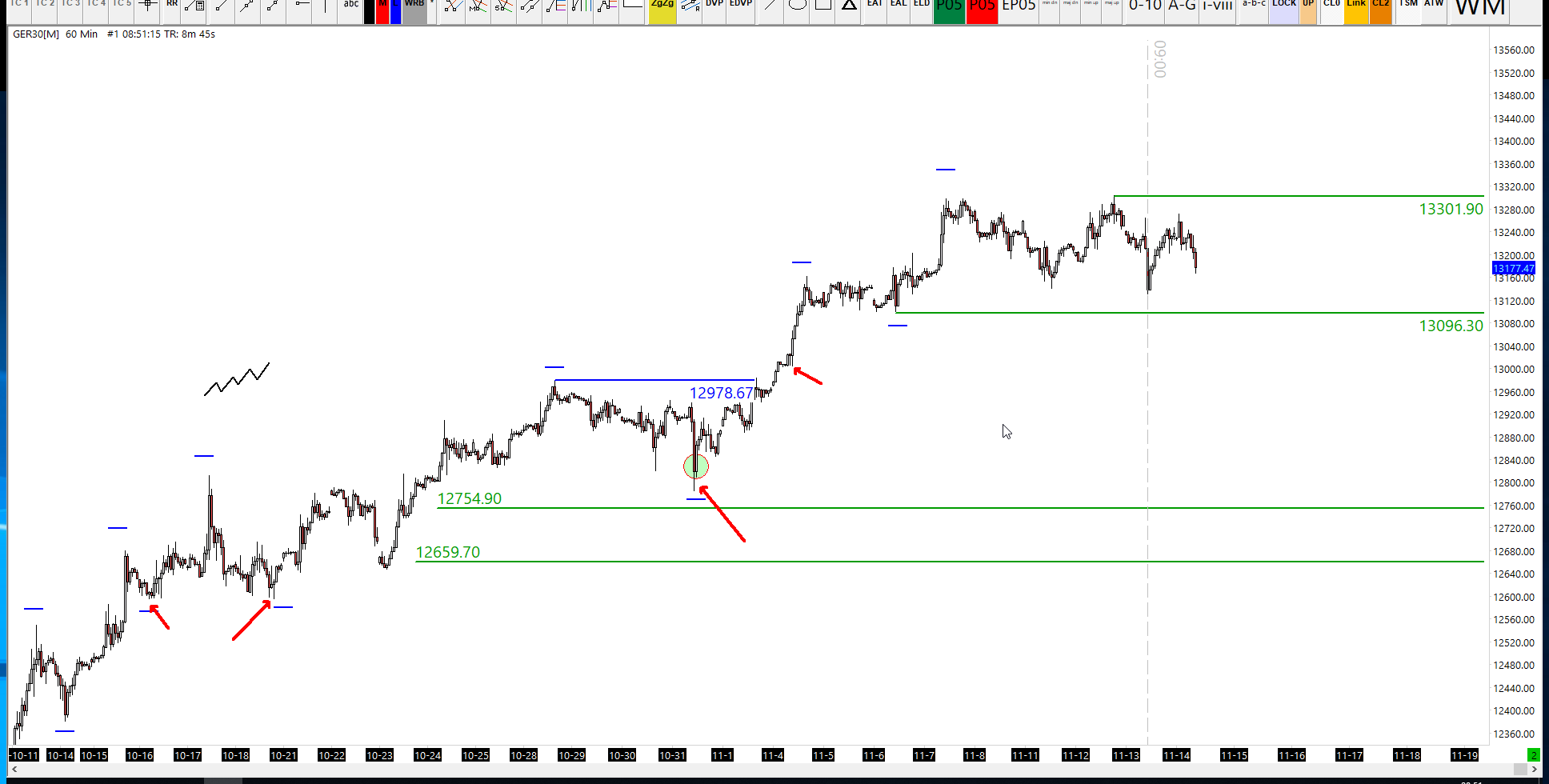

DAX Technical Analysis Articles

These are daily DAX analysis articles. I have been watching the German DAX index every day since February 2014, when I quit my job to become a full-time trader. During my quest to become a professional market analyst and trader, I learnt as much about technical analysis as I could. The DAX is my favourite equity index to trade because it responds well to technical analysis tools such as market profile, swing analysis, volume profile, RSI divergence and various other technical indicators.

Effective DAX Technical Analysis Techniques

The most effective technique to improve your own DAX analysis is to always keep the DAX index price action at the front of your analysis. Always understand how the market moves, and what the most recent trend-defining level is.

I know this analysis sounds simple, but it’s the most overlooked technique by traders and market analysts. There is a common mistake to try to be too advanced sometimes, and this causes us to miss the obvious.