Psychology and mental aspects are essential. Unfortunately, they are often not strengths for most DAX traders. So it is worth spending some time to understand why most DAX traders lose money.

When we are new to trading, we constantly see the statistic that 90% of retail traders will lose their money. Nearly all of those new DAX traders believe they have what it takes to be part of the 10%. Call it a competitive instinct, call it intelligence, call it naivety or stupidity, it doesn’t matter. The statistics don’t lie. Let’s look at why most DAX traders lose money.

Why Money Management is Essential for DAX Traders

I have worked in financial services since 2004 and I’ve watched so many traders trade. One of the things that have always surprised me is how many successful people come to trading. But what is more staggering is how many of those people go on to lose large sums of money.

These people accumulate large amounts of wealth through their career but can not make it as a DAX trader. These DAX traders are making mistakes that you would think every trader would avoid. It is very likely that those DAX traders will skip over this article thinking that it’s too boring for them. Perhaps they think that they are too smart to make the same mistakes. So they will want to move on to what they consider the real need for trading. For example how to pick entry and exits.

The main thing that separates winning from losing traders is not one’s ability to pick good entry points. It is a trader’s ability to anticipate what they’re going to do once they’re in a trade. A winning trader will have a plan for the trade. They will factor that plan into the trade entry and then use their ability to follow that plan, once they’re in the trade.

Psychology of Money Management

Understanding that money management is a huge factor in one’s trading success is only the beginning. Many of you don’t understand the huge role that psychology plays when managing your trades. You may consider yourself above having to work on channelling your emotions when in a trade. You simply may not realise how basic emotional responses affect trading success. So in this series of lessons we’re going to start with a look at the psychology of money management. You will understand how traders lose money because of this.

There are specific strategies that you can use to manage trades and deal with some of the psychological responses. It’s important because emotional responses will occur every time you trade. I appreciate that this is perhaps not the most exciting part of trading. But I can assure you that if you don’t understand the concepts presented in these lessons you will be at a disadvantage.

My Preaching Bit

As DAX traders, it is important to work hard to expand our knowledge of these concepts. We did not become successful in our previous careers by ignoring the fundamental requirements of the job. We can only achieve mastery through understanding. So unless you have a solid psychological understanding of your emotional triggers, you need to spend time learning this. Ignoring it would be complacent.

You need to work hard learning how to channel your own psychological and emotional responses to trading. Otherwise, you’re pretty much doomed to failure. The German DAX will take no responsibility for stealing your money! We all react differently to others when placed under stress. We react differently to others when we have lost a trade or a trade is going bad. Having this basic understanding will ensure you are going to be well on your way to trading success.

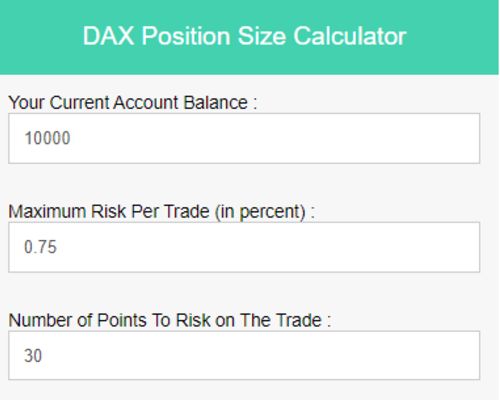

The main reason traders lose money is that they fail at this emotional and psychological control. The best way to keep your bankroll intact is to calculate the correct lot size.