Markets generally exhibit two kinds of movements; impulse legs and reaction legs. When a market is trending higher, the impulse leg is the swing higher. When a market is trending higher, then reaction leg is the retracement.

We believe the DAX30 is currently forming a reaction leg. We saw the bullish impulse leg recently with the bullish swing and now it’s digesting those gains and consolidating, finding a new value area to build from.

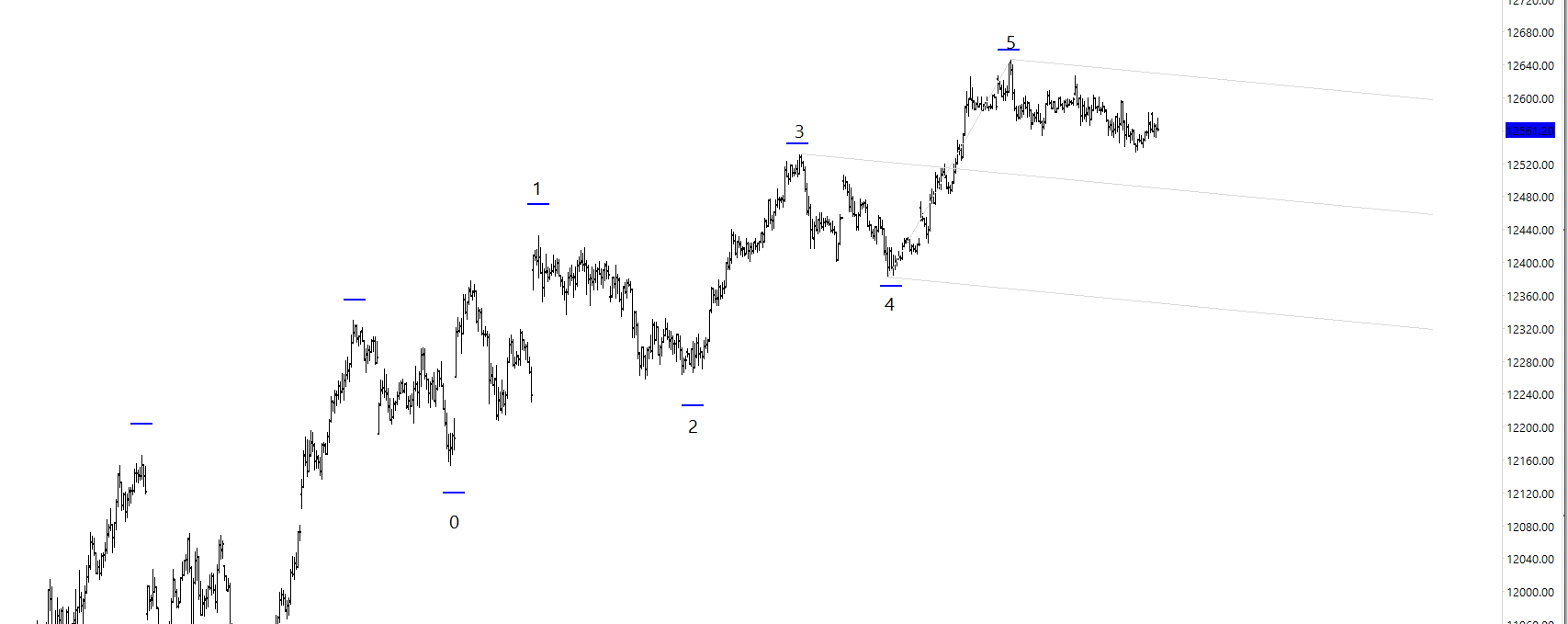

The overall trend is still bullish and the trend defining level is the low around 12380 which formed during the middle of April. See image 1 below.

However, at the moment, there is not a lot of excitement. This is often the stage that traders ‘fall asleep’ and look elsewhere and before they know it, the Dax has moved 300 points without them. So whilst we appreciate that there are other opportunities on other markets, we are keeping a close eye on this one.

20-04-2018 Dax Charts

This chart is a 20m chart (CFD).

The chart is clearly marking out the major swings and it’s following the textbook higher highs and higher lows that we associate with a bullish trend. It’s very difficult to argue against the this being a bullish trend.

If you were familiar with the work of Roger Babson or Alan Andrews or the tools we use in the premium channels, then you would be able to plot a pitchfork on these pivots and potentially forecast the next zone to buy, if you wanted to continue following the trend. If you wanted to short, then the same tool could provide you with some guidance on your target area.

How familiar are you with those tools?

This next chart is a 250 tick chart (CFD).

I am demonstrating a modified schiff pitchfork.

These tools requires three points to draw from. I have used the a b c pivots which are a known in this case as a ‘valley’ formation. If you study the median line (the centre line of the fork), notice how it is cutting through the price action and calling the various internal support and resistance levels? The overall fork is also containing price action quite nicely, so we will continue to watch this.

Perhaps one strategy would be to trade the extremes of this fork.

20-04-2018 Dax Key Levels

| KEY LEVELS | |

| POC * | 12562 |

| Value Area High * | 12585 |

| Value Area Low * | 12546 |

| 14 Day ATR | 177.15 |

| 200 EMA | 12525 |

| 50 EMA | 12399 |

| Daily R2 | 12666 |

| Daily R1 | 12614 |

| Daily Pivot | 12573 |

| Daily S1 | 12520 |

| Daily S2 | 12480 |

| *These are FXCM numbers, not futures numbers. Please be aware that FXCM can often be 5-10 points higher than futures prices | |

20-04-2018 News Roundup and Economic Calendar

- Pres. Trump: Will do everything to make meeting with North Korea a worldwide success

- Trump: I would much prefer a bilateral deal with Japan

- Protectionism is the main risk to Europe’s robust economic growth this year

- Le Maire Says ECB Interest Rates are ‘Clouds’ Ahead

- German economic growth forecasts being raised, but trade restrictions are limiting upside

- Russian army chief to discuss Syria with NATO (Russian media report)

- US Disarmament envoy says US remains committed to North Korea denuke

- IMF finance chief says investors should prepare for more volatile times ahead

- Deutsche Bank briefly lost 28 billion euros in transaction error

Economic Calendar

Be sure to regularly check the economic calendar as part of your daily routine.

If you want to develop as a trader and adopt a professional mindset then you are at the right place. If you want to get excellent analysis and indications on the high probability setups, then come and join the DaxTrader community. We have a number of active members contributing towards the DaxTrader community with setups, charts and ideas. As a premium member you will have access to:

DaxTrader.co.uk Reviews

See what people are saying about DaxTrader.co.uk by visiting the TrustPilot page here:

https://uk.trustpilot.com/review/www.daxtrader.co.uk

The Chat Rooms

Participate in the various member’s chat room for Dax, Forex, Cryptocurrency, Algorithm Trading with charts and ideas, improve your own analysis and pick the brains of other experienced traders.

The Webinars & Webinar Library

We have some excellent content to share in the webinars to help you understand the strategies and tools used by Dax traders. These strategies and tools are incredibly effective on the DAX and quite easy to start to understand. They don’t require expensive software either. The experience available in the webinars is excellent with guest webinars weekly.

Live Trading Signals

When a trade opens on our account, we share the information directly to the signals channel. We provide information including the entry, the stop loss, the target and the date/time. Premium members get access to DAX, FTSE and occasionally S&P500.

Our software sends the signals directly to your phone using Telegram messenger and thanks to our engineering, the delay between us opening a trade and you receiving it to your phone, is around 0.6 seconds.

The Charts (live)

I broadcast my charts for the majority of the day, which you can access and see what we are working on. You can view the charts from a tablet or smartphone as well as a computer