[notification message=”The Morning Briefing will start at 8:30am this morning. Join the Telegram Channel to get the room link” type=”info” _fw_coder=”aggressive” __fw_editor_shortcodes_id=”d62d55d606681a63bae3703c8319e7e7″][/notification]

The German stock market was under pressure yesterday as a result of the escalating trade dispute. After the significant losses at the start of the week, the Dax shows some signs of recovery this morning.

For the trade conflict between the US and China, there is nothing new to report. However, investors should continue to exercise caution in light of the risks to economic growth posed by the dispute. Following new threats from US President Donald Trump , China and the US are moving towards a solid trade war. Beijing announced retaliation on Tuesday and clearly will not be blackmailed. The international dangers dampen the future prospects for Germany. The commodity, technology, industrial goods and car sectors will likely suffer the most from the gradually escalating trade conflict.

20-06-2018 Dax Technical Analysis

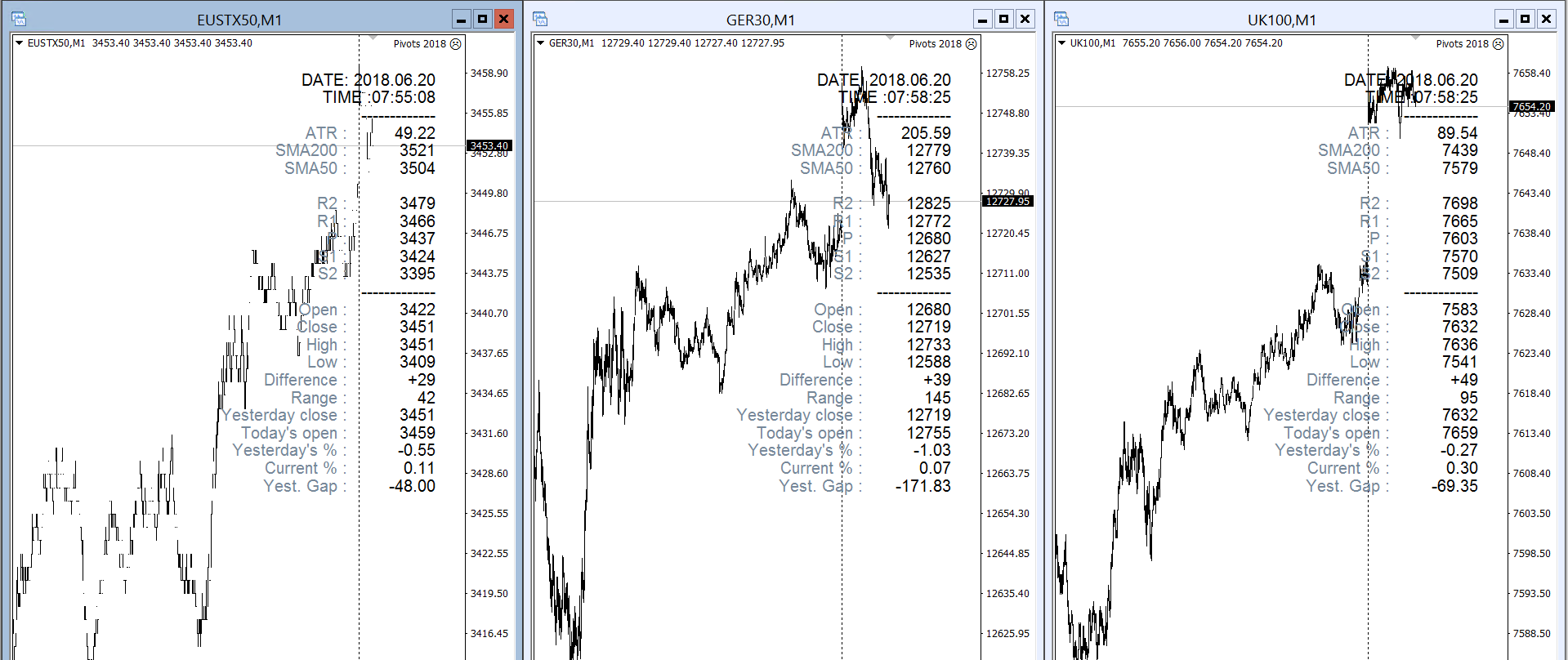

Yesterday, the German DAX took its losses to over 3% for the week mainly because of the intensified trade dispute between China and the USA. We were expecting for the market to open this morning between 12750-12760 and it actually opened at 12754.

The gap yesterday was 171 points, and we are still approximately 100 points short of closing that gap [as I write this article].

The 50 daily SMA has recently crossed below the 200 daily SMA (the death cross). But more importantly, the swing structure is also now bearish after aggressively taking out 12775 yesterday morning.

Many traders are likely waiting for a revisit of the 800-850 zone.

Looking ahead, the market should also look at the central bank meeting of the ECB in Sintra, Portugal. Thus, in the afternoon, the heads of the ECB, the US Federal Reserve, the Japanese Federal Reserve Bank and the Australian Central.

20-06-2018 Dax Morning Briefing Webinar

Come and join us for the webinar, the link will be in the Telegram Channel. Here is the link to the Telegram channel.