Hello traders and welcome to the new domain.

Hopefully, you did not even realise that you were redirected.

25-04-2018 Dax Morning Briefing

25-04-2018 Dax Charts & Analysis

The chart below shows the 20 minute Dax chart (CFD). I am using this chart to demonstrate the major swings. The major swings are marked with black swing markers. The swings are currently bullish, however, we have failed to create a new high and yesterday we took out the recent low. This sounds an alarm to buyers. The price action is suggesting that we have a change in behaviour as the trend is no longer following the expected path.

I have drawn a fork on the chart from the three most recent pivots and I observed how the price action has taken out the median line with ease, retraced back to the median line and then continued further lower to reach the lower median line parallel. On the way to past the median line, we also broke the black multi-pivot line (trend line), which is another sign of a change in behaviour.

So the warning signs are there for the bulls.

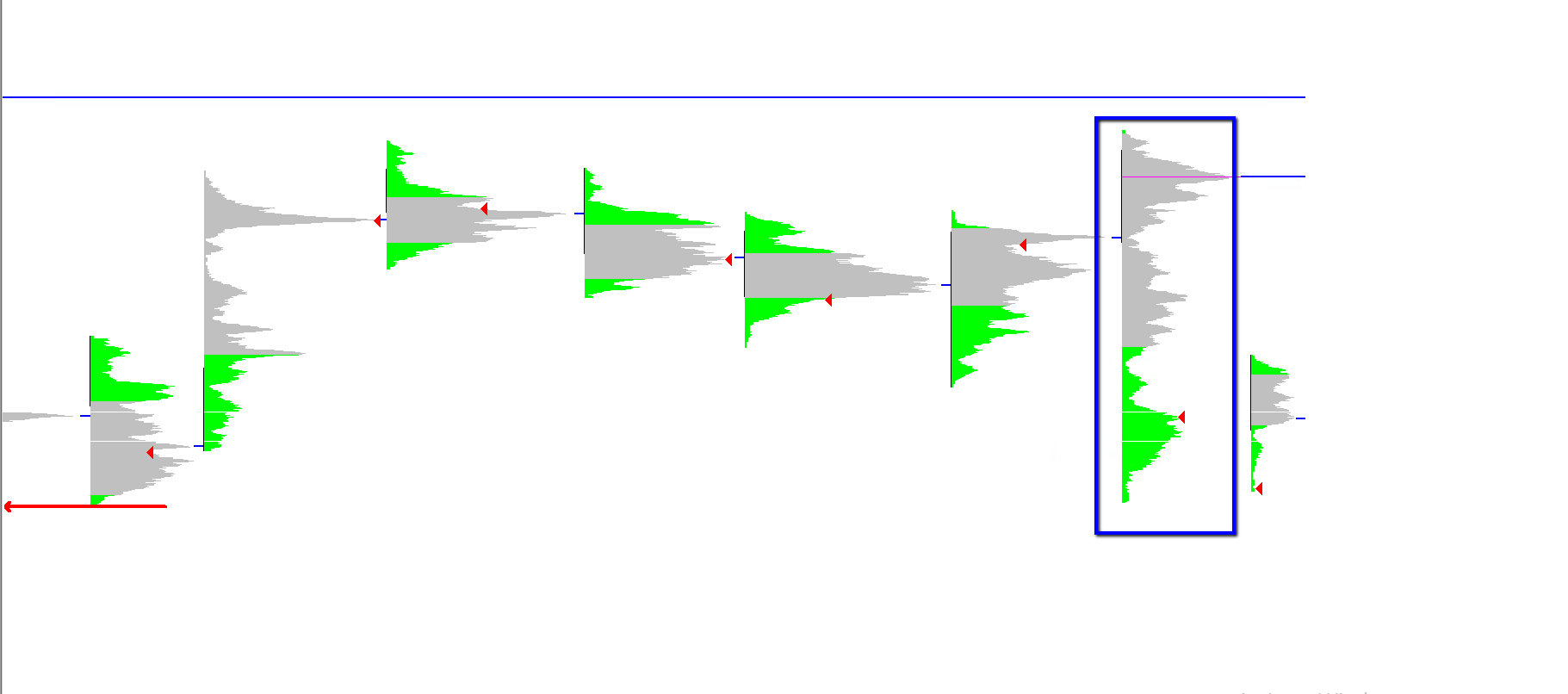

This chart below is a 250 tick Dax30 chart (CFD) and I am using this chart to display the minor swings. This chart is very clearly bearish as the trend has been creating lower lows and lower highs for some time.

I have marked out two zones with a green horizontal highlight. These zones are potential swap zones. If the price stays in between those two swap zones, then we have a battle area and price can move sideways.

Notice the three parallel lines on the right of the chart? That is an ACR line set. The centre line of this ACR line set is using the lows of price action to show a multi-pivot line. I like using multi-pivot lines as centre lines. It allows us to forecast target zones for trades when we break through the MPL or centre line.

In this case, if we break below the reaction line (the lowest of the three parallels) then we are likely heading lower and as a result. And if we take out 12380, then I will be sidelined and waiting for more clues.

EDIT: Since writing this article, the previous sentence has happened. So I am sidelined.

25-04-2018 Dax Key Levels

| KEY LEVELS | |

| POC * | 12621 |

| Value Area High * | 12650 |

| Value Area Low * | 12497 |

| 14 Day ATR | 160.06 |

| 200 EMA | 12524 |

| 50 EMA | 12412 |

| Daily R2 | 12764 |

| Daily R1 | 12604 |

| Daily Pivot | 12494 |

| Daily S1 | 12335 |

| Daily S2 | 12224 |

| *These are FXCM numbers, not futures numbers. Please be aware that FXCM can often be 5-10 points higher than futures prices | |