Good morning traders. A big couple of days for Europe coming up. In Italy, we should soon know if there’ll be a new Conte government, a Cottarelli technocratic government or whether president Mattarella will call new elections. In Spain, the no-confidence moción debate starts soon in Spanish parliament. Possibly tomorrow during the day we should know Rajoy’s fate. We have the G7 meetings happening as well as the European CPI numbers due out late morning.

Technical Tools

Check The Economic Calendar |

Read Today’s Trading Ideas |

Advanced Swing Trading Course |

31-05-2018 Dax Technical Analysis

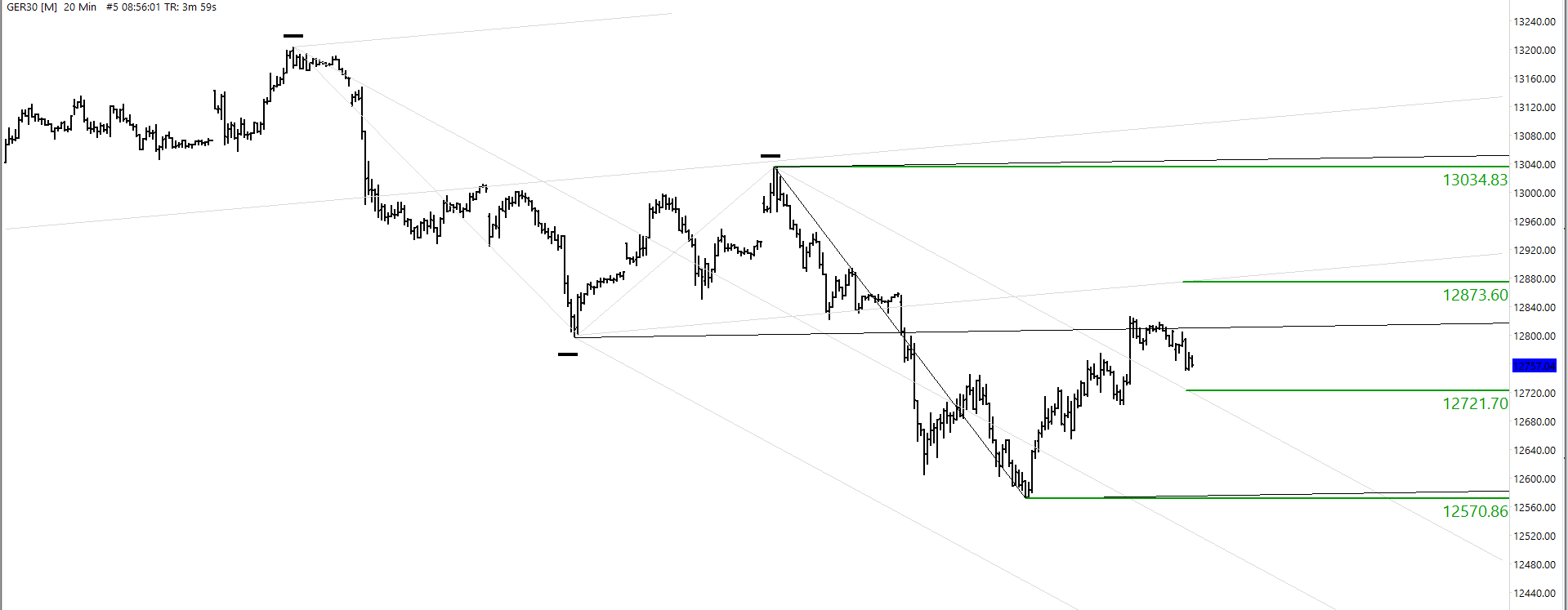

We have a new confirmed swing low of 12,570 on the DAX 20-minute chart. By drawing a regular pitchfork through the three most recent alternating pivots, we can see that price has reached the ML. The question we now have is whether or not this ML is a stop and reverse point, allowing us to short and continue the overall trend. Or whether price zooms through this and continues on its way to challenging the swing high. We would like to see price move higher. The sign for this came yesterday with the white range bar that took out the UMLH of the middle grey fork. So this opens up a trading idea.

If price manages to take out the median line, then we have to be aware of the LMLH from the previous older fork. Therefore 721 looks interesting the buyers and 873 looks interesting as the target.

That idea would be countertrend because the swings have been bearish since the high on the 22nd of May.

| KEY LEVELS | |

| 14 Day ATR | 152.5 |

| 200 EMA | 12599 |

| 50 EMA | 12707 |

| Daily R2 | 12945 |

| Daily R1 | 12874 |

| Daily Pivot | 12754 |

| Daily S1 | 12683 |

| Daily S2 | 12563 |

| *These are FXCM numbers, not futures numbers. Please be aware that FXCM can often be 5-10 points higher than futures prices | |

31-05-2018 FTSE Technical Analysis

The FTSE has broken its series of lower lows and lower highs. This suggests that we have completed the major bearish swing. Watch for the formation of a new trend.

Notice how price has broken out of the UMLH on the fork and used the topside of the UMLH as support. If you go back to the beginning of this fork, You can also see how price reached the ML after forming Pitsea, then came back to the LMLH and used that as support before starting this rally. When price action respects the geometry like this, it builds faith in these tools.

| KEY LEVELS | |

| 14 Day ATR | 74.95 |

| 200 EMA | 7395 |

| 50 EMA | 7512 |

| Daily R2 | 7790 |

| Daily R1 | 7754 |

| Daily Pivot | 7685 |

| Daily S1 | 7649 |

| Daily S2 | 7580 |

| *These are FXCM numbers, not futures numbers. Please be aware that FXCM can often be 5-10 points higher than futures prices | |

31-05-2018 DOW Technical Analysis

The Dow reminds bearish below 24902, but has zoomed back through the email on the fork. 24625 is now providing support. Previously it was a bearish ignition point. The market remains volatile.

| KEY LEVELS | |

| 14 Day ATR | 242.74 |

| 200 EMA | 24129 |

| 50 EMA | 24590 |

| Daily R2 | 24934 |

| Daily R1 | 24780 |

| Daily Pivot | 24549 |

| Daily S1 | 24394 |

| Daily S2 | 24164 |

| *These are FXCM numbers, not futures numbers. Please be aware that FXCM can often be 5-10 points higher than futures prices | |

If you want to develop as a trader and adopt a professional mindset then you are at the right place. If you want to get excellent analysis and indications on the high probability setups, then come and join the DaxTrader community. We have a number of active members contributing towards the DaxTrader community with setups, charts and ideas. As a premium member you will have access to:

TheDaxTrader.co.uk Reviews

See what people are saying about DaxTrader.co.uk by visiting the TrustPilot page here:

https://uk.trustpilot.com/review/www.thedaxtrader.co.uk

The Chat Rooms

Participate in the various member’s chat room for Dax, Forex, Cryptocurrency, Algorithm Trading with charts and ideas, improve your own analysis and pick the brains of other experienced traders.

The Webinars & Webinar Library

We have some excellent content to share in the webinars to help you understand the strategies and tools used by Dax traders. These strategies and tools are incredibly effective on the DAX and quite easy to start to understand. They don’t require expensive software either. The experience available in the webinars is excellent with guest webinars weekly.

Live Trading Signals

When a trade opens on our account, we share the information directly to the signals channel. We provide information including the entry, the stop loss, the target and the date/time. Premium members get access to DAX, FTSE and occasionally S&P500.

Our software sends the signals directly to your phone using Telegram messenger and thanks to our engineering, the delay between us opening a trade and you receiving it to your phone, is around 0.6 seconds.

The Charts (live)

I broadcast my charts for the majority of the day, which you can access and see what we are working on. You can view the charts from a tablet or smartphone as well as a computer