22:42

Guess who didn’t manage to come back and close their 2nd 1/3 before the market closed last night?

Yeah, me. I’m that guy.

20:19

The question now, is whether or not to keep the trade open overnight and face the dreaded gap. I am thinking that I will close one more 1/3 and leave the last on. Because althought the delta is still negative, we are still above the value area high. I was expecting more of a retracement back towards VWAP, certainly back inside the value area. But at the moment, we still keep testing resistance. Perhaps as buyers fail, sellers will turn the price over.

I have been thinking about it for a little while. But that’s my decision. Close another 1/3 just before market shuts to leave minimum risk on overnight.

16:37

Took 1/3 off for around 13 points profit. Mainly because I did not really have much of an exit strategy, which was foolish and I spotted a mini jump in the cumulative delta. Plus we had broken below the VAH and were about to tag VWAP whilst heading towards the POC. I’m happy with a partial there.

16:20 – NEW TRADE

I decided to take a trade here, as we seem to have found some bullish momentum in terms of price action, but we are running directly into resistance and the delta is continuing to diverge. My Algo was also giving me a 12475 sell zone, so I took the trade. My thinking was also that we are in a ranging day and are currently above the value area. The expectation would be a retracement back to value.

I have risked only 0.5% on this one, because I am not in love with it and the reward to risk is not ideal:

DAYTRADE SELL #GER30 @ 12469.85 | SL:12500.00 | TP:12415.00 | 2017.07.05 16:18 (BST) | ID 13691289

Potential issue with the trade: that this is a bullish breakout and the retracement (which allowed my entry) falls short at the value area high, or POC.

15:29

Here is a little chart of my thinking. I am thinking that we are clearly in the war zone, it’s ranging an no real progress is being made in any direction, however delta is dropping. It’s possible that the Delta will find parity and range around zero, which confirms that price action has reached a stalemate. However if it continues to trend to the downside, with price continuing to test resistance, then I am going to look for a short.

14:56

The more I read these charts, the more I am starting to want to find spots to sell. I can’t see a great reward at current levels 12435, but selling the rips is possibly going to provide a decent trade soon. This range is preventing me getting the 475 I was looking for earlier.

The algo is actually showing a buy zone of 427 and a sell zone of 467. But that’s because we have been ranging for the last few hours and the levels are compressing.

12:45

Eerily quiet here at the moment, we are trading inside the value area from yesterday. Another hour or two to see what happens with price on the US open. As for zones, I am watching 404 as a potential buy zone or 475 as a potential sell zone.

11:38

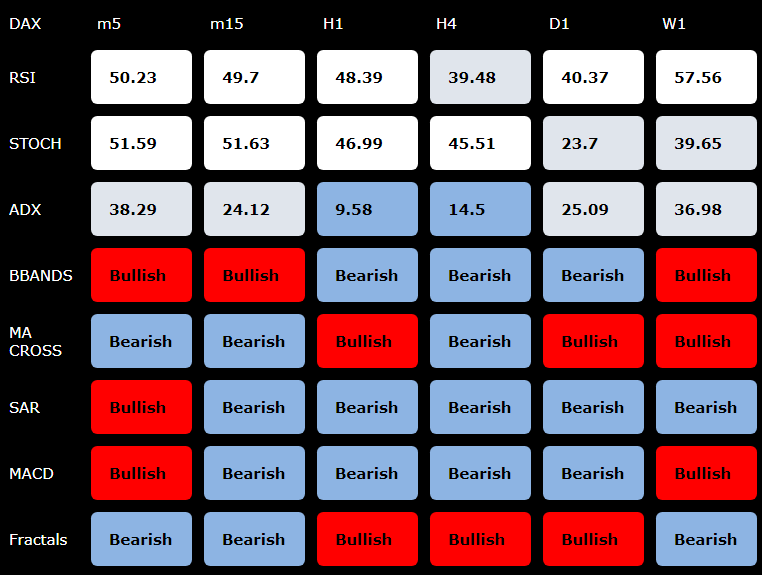

During the quieter periods, like now, it’s easy to point to the sun being out. Perhaps that is part of it. I am keeping myself busy upgrading the Journal page and turning it into a dashboard, so at a quick glance, we can see the important indicators that we need for the DAX, FTSE and SPX. Here’s a little snapshot. It’s a combination of MQL4, MySQL and PHP, using data sent from my VPN. Lots of letter there:

10:43

And we’re range bound again. After all that. Support held at 12400 and delta is beginning to build positive momentum, suggesting buyers are beginning to take control and perhaps we are building up for another move. However, with failed attempts to break higher and lower, it’s a choppy market.

9:45

Webinar completed and video recorded, it seems the majority of the movement wanted to happen during the webinar. We saw a 70 point rally, followed by a 70 point decline. I think I commented that something looked a bit fishy. But alas, we remain inside the value area from yesterday.

The potential trade below would not have worked. I am pleased the reward:risk was not there.

8:12 – Potential Trade

Attempted to break to the downside, took out a bunch of stops and bounced. Let’s see if that is only temporary. There is a possibly trade on right now, a short. Eye balling that move on this chart, the 100% extension from this move is targeting 391, which is also a naked VPOC, so that looks interesting to me. But I can’t see the reward to risk to take it. It’s more of a risky scalp.

7:59

Levels I am watching today:

12450 – VPOC from yesterday

12392 – VPOC fro Monday

12599 – VPOC from Thursday

We can possibly reach these levels on a break through the value area from yesterday. VAH – 12457 and VAL – 12420.

7:30

Delta is beginning to increase, but we had a gap lower this morning. Perhaps on the political tensions from NK with their ICBM. So today, I think caution would be wise. I will mark out some zones to watch, but when US open up, that’s when we will have a better idea of where to go. The second half of the session today is key.

Develop Your Trading Business

TheDaxTrader.co.uk provides top quality DAX Analysis articles every day cover various topics of technical analysis from technical indicators to naked price action. We study market geometry and share our outlooks. If you want to learn more about how we trade, you can become a member today and get access to our DAX trading strategy. We trade the strategy every day and this is where we generate our DAX signals. So come and learn the strategy for yourself.

Perhaps you want to learn how to become a signal provider for yourself? If so, learn about how to send signals from Metatrader 4 to Telegram. We have produced an excellent piece of software will help you do exactly that. To learn more about the DAX, visit the Wikipedia page, you will find we are mentioned there.