Good morning traders!

The ECB has been printing lots of cheap money and since the financial crisis, the German Dax has risen by 45%. Once interest rates change a loss of profits is inevitable.The reason for this would be that companies are currently paying significantly less to service their debts. Since 2008 the average interest rate for corporate bonds with a conventional five-year maturity has decreased from 5.5% to just 2%. Some longer term analysts are very worried about this.

After a small breather on Tuesday, we had another rally yesterday and investors are noticeably waiting for the signals from the US central bank. Results will be soon.

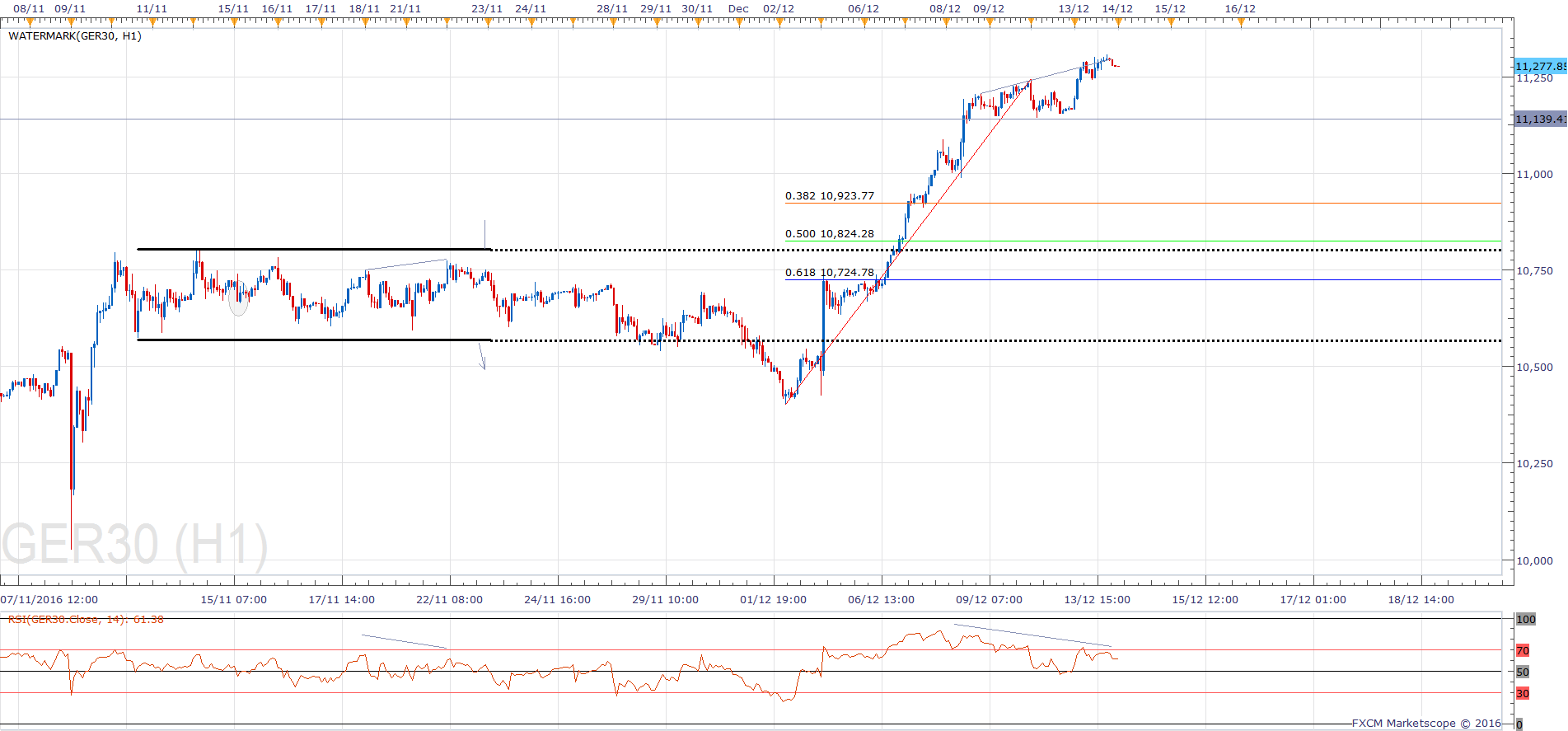

Dax Technical Analysis

Many traders are holding out for this rally to reach 11 430 and it is definitely possible that this will happen. Traders who are already long will be looking for that as the target. It may be too late for traders to get in now, however buying tips may still be profitable.

On the daily chart, we had an in golfing candle yesterday we are nearing the top of the trend channel since the beginning of 2016 and are around 70 on the daily RSI. Bears will take encouragement from these signals.

On the four hour chart, we have moved away from the upper Bollinger band and the trajectory of the rally has softened. We are still in the top half of the Bollinger channel and above the median line, and the oscillator is still overboard and has been for over a week.

On the one hour chart, the slowdown is more obvious and we can see clear bearish divergence. So from current levels, there is an opportunity to go short with a stop above the recent high. I am just aware that the move may not be over yet and I may find a better price nearer to 11 430.

On the five minute chart, I can see that we are above the daily pivots and the RSI is below 30 which suggests a dip and an opportunity to go along in the short term.

I have missed the majority of this move up and have been taunted about this fact by one of my subscribers (thanks for that) because I missed the beginning of the move. The main reason is because after I realised it was time to get in I struggled to find a cheap enough entry and it just ran away from me. I was hoping to find a more significant dip to buy, but it never came. Hindsight is a wonderful thing and all traders seem to have fantastic hindsight, but given the ECB decision it would’ve made sense to jump in earlier, regardless of the price as it was a clear bullish break-out with a fundamental catalyst. We live to fight another day and learn, I am a patient trader, which is why I have not gone bust. So I have been trading Forex as well.

Overall we are bullish above 11 140.

Dax Support & Resistance

| KEY LEVELS | |

| Daily R2 | 11393 |

| Daily R1 | 11335 |

| Daily Pivot | 11250 |

| Daily S1 | 11193 |

| Daily S2 | 11108 |

| 200 Day EMA | 10424 |