Hello traders!

The Dax has started positively in the trade and wants only in one direction: upwards. But today may not be worth trading, just while the market digests the FOMC.

Janet Yellens’ decision to raise the benchmark interest rate was eagerly awaited and shows the first effects on the stock exchange today. BoE have all unanimously agreed to keep rates unchanged, no surprises there. So given the interest rate change in the US, I suspect we are going to have some unusual behaviour while the market digests the information. Dollar bulls would be delighted to hear that they’ll likely be at least two more hikes in 2017.

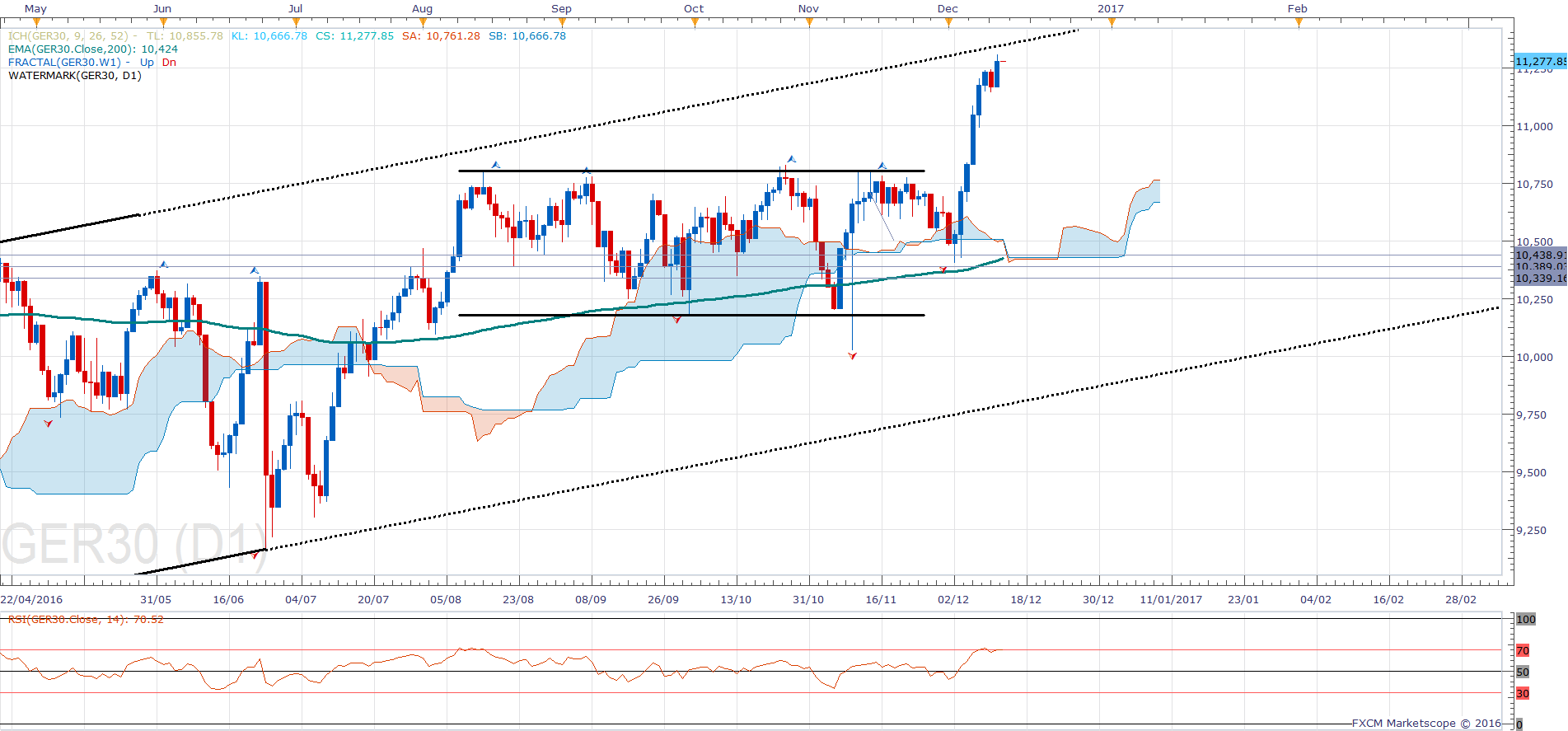

As for the Dax we are in a similar position to yesterday in that the market is still Bullish, and in contrast to the negative divergences that the MACD and RSI that we can see on the hour chart, the calculated price target of around 11,400 points is more and more on the cards. Beyond this level, the high of August 2015 is the next barrier at 11,670. Look out for the Dow Jones®, which nears 20,000 points for the first time.

If we look to the downside, a break below 11.162 points, which connects the highs of April and August. A fall below this trend would lead to significant breakthroughs in the current year-end rally. This is why trading-oriented investors should move to the same level for existing long positions. We are approaching the top of that trend channel with strong momentum, so I am interested to see the reaction to that, especially as it will have some confluence with the 11430 resistance as well.

I am still struggling to deal with the fact that we are so overbought right now, it’s difficult to find spots to get in that provide a reward to risk ratio that I want, so yes I may not have traded as much as I like, but patience is important. I am reluctant to take a long position with those resistance levels above us.

At the time of writing, we have settled back to the daily R1 (pivot point indicator) and threatening to break lower. 11280 is interesting for me at the moment, as it’s a 50% retracement from the recent swing.

No charts or levels today, back tomorrow as normal.