Good morning traders!

A direct article today, straight into the charts. Remember to come and join the broadcast channel on Telegram by clicking this link (Telegram is free to register): https://t.me/joinchat/AAAAAEAypsW3Xet_6ngBlw

Daily Dax Chart

A decent bullish close yesterday and we find ourselves back above 12,000 and just 50 points below the 2017 highs (that was before the open this morning). We reached 12180 after we gapped higher to take out the 2017 highs, finding some support around 12130. And the technical bull trend is still intact. I would expect the price to settle closer to 12075 after a few days, assuming that it does not turn ultra bullish and continue to rally sharply. I say 12075 because the was previous resistance.

We are bullish above 11910. My strategy is to wait for a pullback to enter or add to new positions.

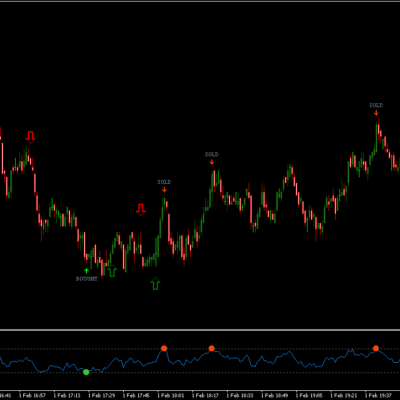

Dax Hourly Chart

This chart was from last night, you can see the 12075 level roughly marked out here, price closed just below it and has now broken it. Just out of sight in this chart is the longer term resistance of 12191 which is likely to be the next level to slow down price and beyond that, it’s the 12395-12400 level.

I am watching for a slow down at 12191, a move down to 12075 and then a move up to take out 12191 on the way up to 12397. It’s a little ‘predictive’, but that’s the kind of zig-zag move I would like to see.

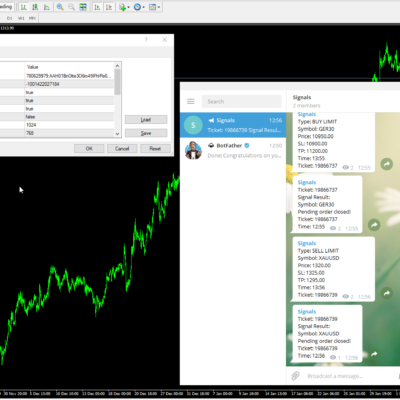

Dax Intraday Chart

Here’s a good example of when this new indicator is not always right. On the chart below (from last night, before the market opened today), the price has broken outside of the Bollinger band, then posted RSI divergence, suggesting it is time for a turnaround. However this morning we gapped even higher and now price is even further outside the band, but perhaps that just makes the signal even more compelling. Has it made me short the market? No. The algo is still bullish.

We are currently around 12135 and outside the upper band having posted the second (steeper) bearish RSI divergence, so I would expect the price will fall back in line and come back under control again, before finding higher levels.

Dax Support & Resistance

| KEY LEVELS | |

| Daily R2 | 12118 |

| Daily R1 | 12088 |

| Daily Pivot | 12033 |

| Daily S1 | 12002 |

| Daily S2 | 11947 |

| 200 Day EMA | 11049 |