Dax Outlook

It seems the political uncertainty of a certain US president, first name Donald and his half-wit team were a significant contributor to the market activity yesterday, along with the horrific news from Barcelona. So there is definitely an opportunity for buyers to get filled at lower prices today.

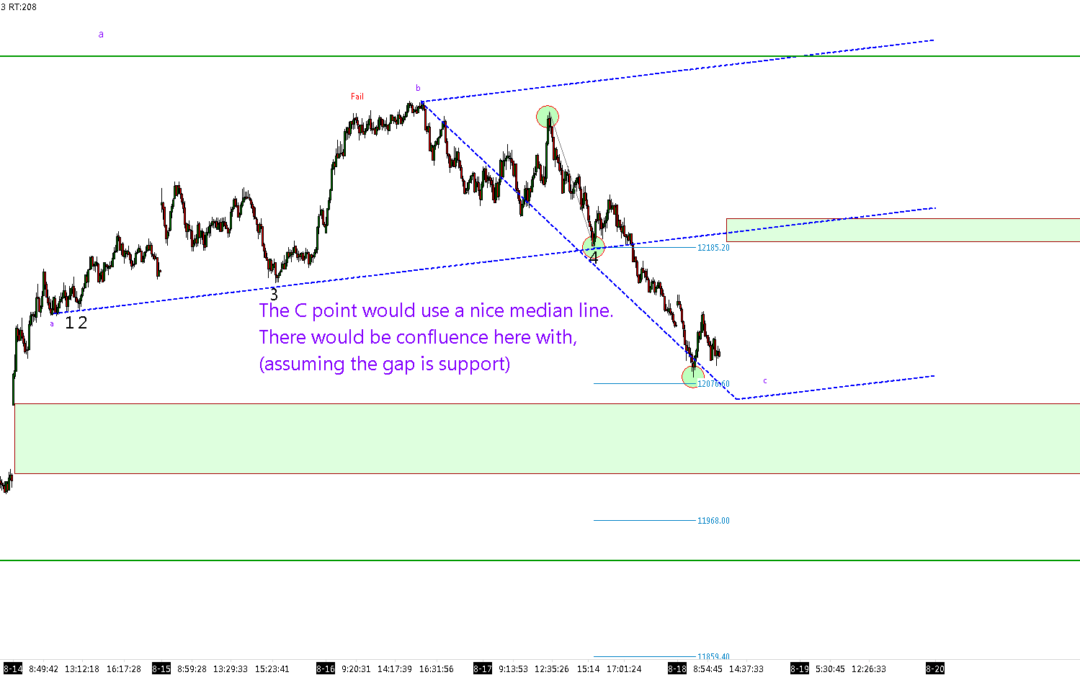

On the 250 tick chart below, I have drawn a median line from the 14th August morning lows, through 3/4 touches, including the 15th August low, and extended it through the current day. This median line will actually work as an A line for a fork:

A – 14th August low

B – 16th August high

C – speculative, based on curve fitting the median line

The disclaimer here is that I am ‘Fishing for C’ or curve fitting the median line. I am happy to do it here because the median line sees a number of touches. There is also a gap around this C level, so that can provide a confluence of levels, which helps strengthen the analysis.

Dax Buying Zone

If we assume that the gap from Monday holds, or doesn’t close, then there is an opportunity to buy from the C point of the fork, just above the gap.

Selling Zone

This is the most likely outcome at the moment, with the various political factors at play. A retracement to the median line of the fork would be an interesting spot to short: 190-210 on FXCM or 180-200 on futures.

DaxTrader LiveRoom

I have upgraded my charting platform to Sierra Charts to run on the server (where the live room is hosted). I am having a new server built with more CPU, Ram and HDD space to be able to run everything a little quicker. The next step is to get the audio feed in there, so we can run a couple of hours of audio a day too.

Indices

All the majors seem to be struggling currently

Crypto Portfolio

Well…. current value = $114 (down $14 from yesterday – RRT and IOTA the main culprit)

However I own LiteCoins too (in my Exodus wallet), and they have finally broken above 45.