Good morning traders!

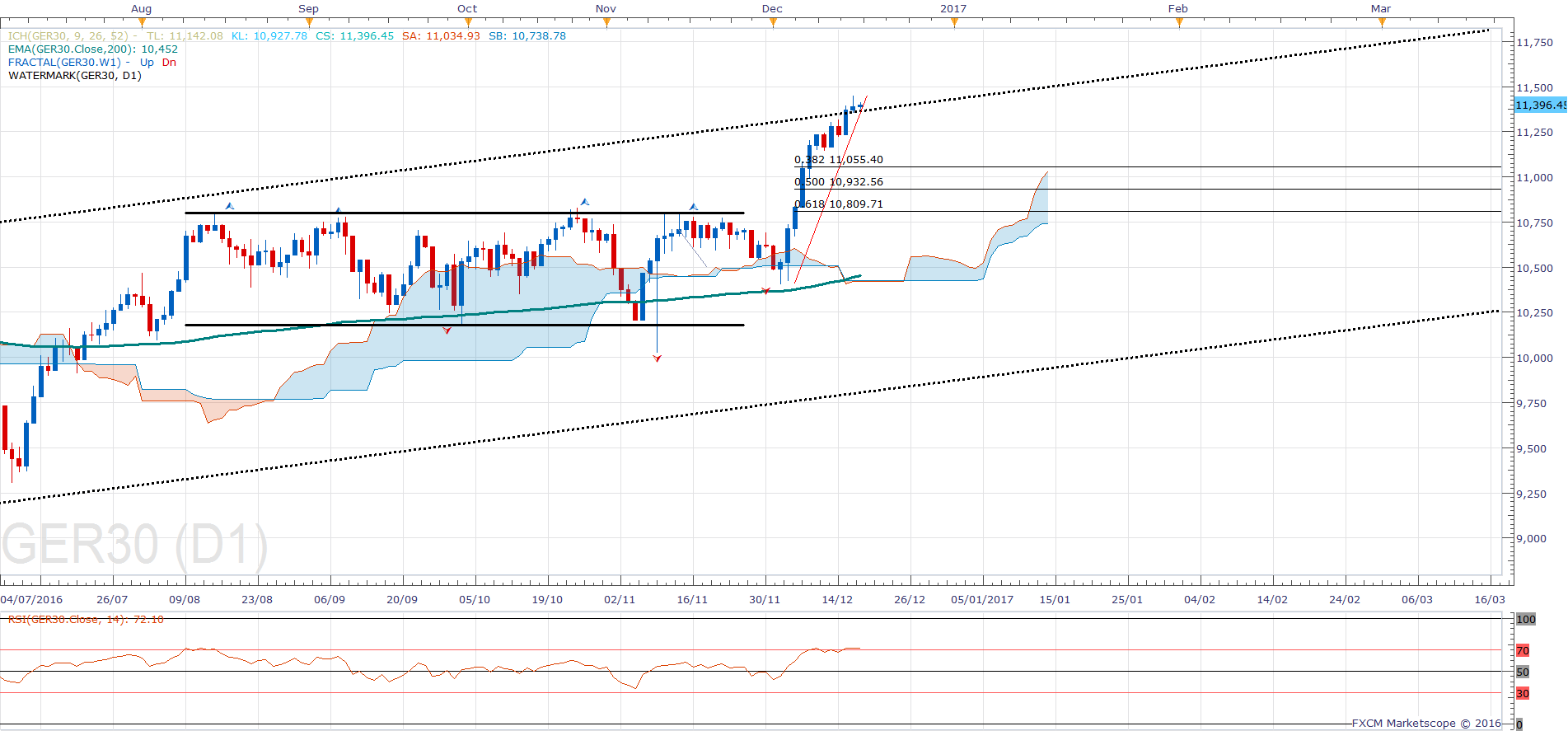

Yesterday we closed out at the highest level since Aug 10th 2015 and the Dax continues to defy gravity and progress higher, still battling through the various resistance levels. We have closed above the 11430 level, we have closed above the daily trend channel resistance and we have printed another high on the daily RSI oscillator, the highest level since March 2015. We are still comfortably trending higher but progress is slowing significantly which will encourage bears who are ready to pull the trigger. Are we ready to sell yet? Maybe not.

The waning Euro is continuing to help the Dax in its progress to complete a strong “year-end rally”. The horrendous attack on the Berlin Christmas market did little to affect the markets, so at the moment it is still remaining buoyant on the back of the ECB decision to continue QE.

Intra-day traders yesterday were treated to a few interesting spots, on the 5m chart, the first one was to go long from the daily pivot early on in the trading session, using a fairly tight stop loss, somewhere in the region of 1-2 times ATR (Average True Range), targeting 3:1 reward. Price rallied 50 points or so which would have hit target comfortably. The next opportunity was to go short from the daily R2 as price was rejected twice from that zone in quick succession. Once again, a 3:1 reward would have been achieved fairly comfortably using a 2x ATR multiple.

That would have been all that was needed: 30 points each from those trades, assuming we bought 1 standard contract @ €25 a point, that is a decent days work.

We are bullish above 11150 and short term bullish above 11350.

An interesting setup for bears is a short from current position, with a stop above 11475, targeting a move back towards 11425. I doubt I will take that. A pullback to that level, which was the R1 from yesterday (pivot point indicator) could interest me to go long. Bulls will also take encouragement from a break above 11475.

Dax Support & Resistance

| KEY LEVELS | |

| Daily R2 | 11516 |

| Daily R1 | 11485 |

| Daily Pivot | 11441 |

| Daily S1 | 11410 |

| Daily S2 | 11365 |

| 200 Day EMA | 10471 |

Dax Charts

No charts today