DAX Outlook

This month has seen the price range between 11935 and 1233 (the range defining levels) and we need to break one or the other to begin a new trend.

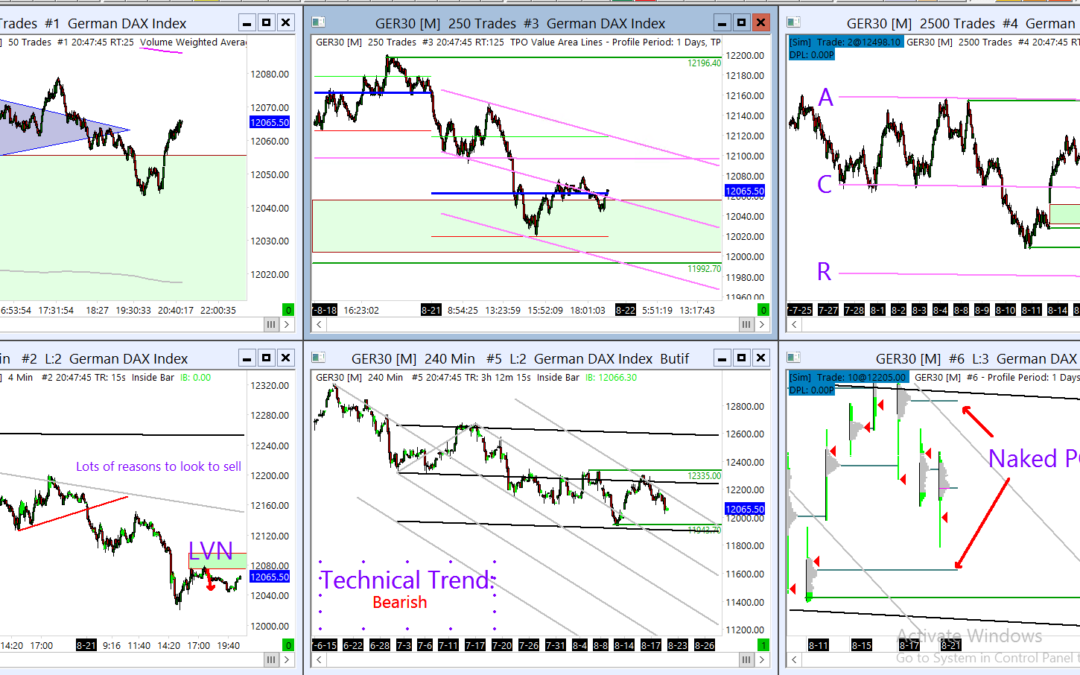

The last four days of price action have carved out a bearish trend channel. We are currently about to test the channel resistance (see the third chart) so this may act as a zone for sellers to get short.

The double distribution from yesterday and the gap this morning has left behind a low volume node which I would expect the price to fill that zone at some point over the next day or so.

I am expecting for the longer-term bearish trend to continue, but if the channel breaks I will wait to sell at higher prices.

News Summary

(Copied from the news wires)

Asian equities traded mostly higher in what was a particularly quiet session overnight. FX markets saw USD/JPY break back below 109.00. US President Trump announced that the US plans to continue sending troops to Afghanistan to fight the terror threat

Looking ahead, highlights include UK PSNB data, German ZEW and APIs

Asian equity markets were mostly higher although news flow was remarkably light amid a lack of central bank speakers and macroeconomic data. The focus was on a speech from US President Trump where he highlighted US plans to continue sending troops to Afghanistan to fight the terror threat emanating from the country. The Nikkei 225 rose 0.1% while the ASX 200 was up 0.3% after numerous earnings, including from BHP Billiton.

10y JGBs were lower despite a strong 20y JGB auction as participants move into the long-end following the well-received issuance, leading to curve flattening. The line was sold with the lowest tail of 2017 and highest cover since January 2014.

The JPY was the main mover in FX markets, weakening as USD/JPY broke back above 109.00 with reports suggesting strong demand in the pair from Tokyo names in early Asia-Pac trade. US President Trump’s speech on Afghanistan may also have not been as controversial or aggressive as some had been expecting. Meanwhile, China set the CNY at its strongest level against the USD in 11-months stemming from the recent USD weakness.

OPEC/Non-OPEC JTC reportedly sees July production deal compliance at 94%.

Kuwaiti oil minister said that OPEC will discuss ending or extending cuts at its November meeting. He also noted that OPEC is still working to push oil stocks below 5-year average.

DAX Support

| 12100 | Gap support from this morning |

| 12060 | Bottom of gap and POC from 10th |

| 11989 | Bottom of gap and naked POC from 11th |

| 11935 | Monthly low |

DAX Resistance

| 12235 | Naked POC from Friday |

| 12196 | Yesterday high |

| 12157 | Yesterday Value Area High |

| 12145 | Channel resistance |

DAX Charts

These charts can all be viewed in the Live Room when you join as a premium member. You can watch the charts being worked on and contribute in the chat room where we discuss setups and opportunities.

Crypto Portfolio

Current value = $123.88

Original value = $125