Good morning traders and welcome back to the German DAX 30 Technical Analysis.

Well, there you have it! Nothing more to say other than, we’ve made an all time high on the Dax! My bullish bias was not incorrect and now we’ve finally closed some of the disparity between the US and other European indices and the Dax. The downside is, it now makes the index look incredibly overvalued and difficult to find spots to buy, so for a bull like me, it’s a waiting game. Which is really boring. Would I buy from here? Maybe, but unlikely.

It’s almost pointless analysing the data from Friday, because thanks to the ongoing and developing French election saga, the moves have already happened. I believe many short traders have had their pants pulled down here, not because of bad decisions or bad analysis (because technically it was beginning to look bearish), but because of the political shift. There are plenty of column inches devoted to the story, so you can research that yourself, but my prediction remains that Macron will win it. I think it would be a disaster for the EU project if Le Pen gets it.

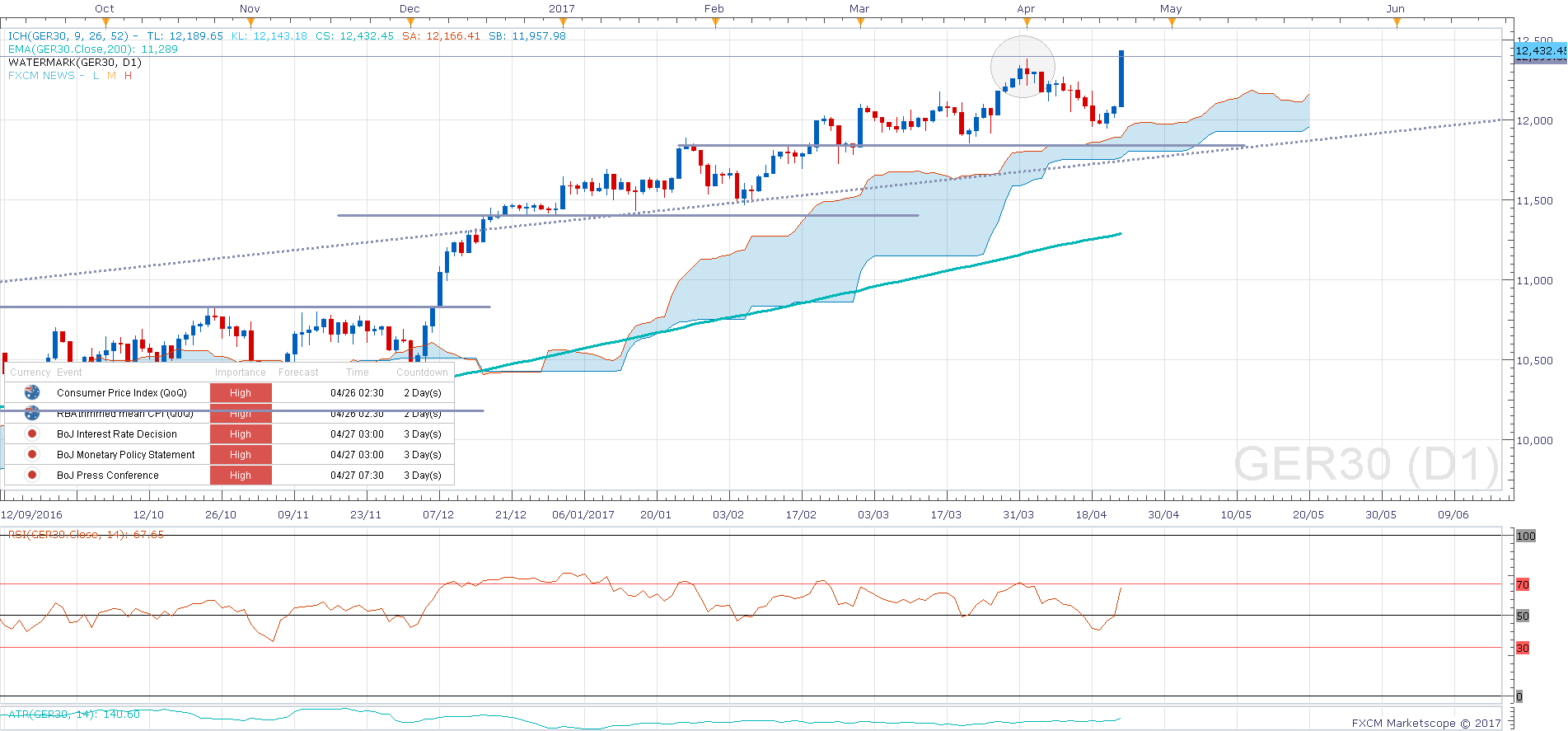

So right now, the Dax is at an all time high, it looks like it wants to reach 12500, but right now it’s already gained nearly 400 points on the day, 3-4 times the average daily range of the market, it’s above all major technical pivot levels, into uncharted territory, it’s really anyone’s guess as to what happens up here, but the sheer aggression of the move states that we may see some higher levels, squeezing the shorts out, before it pulls back.

If you are not already long, keep your powder dry for the moment, because the worst thing to do right now is say “but the market is moving, let’s ride it”, jump in, find out that the move is exhausted, then be caught on the wrong side of a trade and sit on drawdown for weeks of volatility during the election campaign. It’s a fools game to chase it. Wait for the market to move back to the buy zone and be patient, otherwise, you’re gambling and the majority of gamblers don’t last in this game.

Is there a chance to short? Possibly yes, but it’s clearly a counter trend move, therefore it’s easy to get stopped out as the bullish momentum continues, so it will probably take a few attempts. But in my opinion, patience will win. Thank you for reading the GERMAN DAX 30 TECHNICAL ANALYSIS.

GERMAN DAX 30 TECHNICAL ANALYSIS – Support & Resistance

| KEY LEVELS | |

| Open | 12043 |

| High | 12094 |

| Low | 12009 |

| Close | 12080 |

| Range | 85 |

| Change | 0.31% |

| 14 Day ATR | 140.6 |

| Daily R2 | 12142 |

| Daily R1 | 12109 |

| Daily Pivot | 12058 |

| Daily S1 | 12025 |

| Daily S2 | 11974 |

| 200 Day EMA | 11289 |

GERMAN DAX 30 TECHNICAL ANALYSIS – Charts

Develop Your Trading Business

TheDaxTrader.co.uk provides top quality DAX Analysis articles every day cover various topics of technical analysis from technical indicators to naked price action. We study market geometry and share our outlooks. If you want to learn more about how we trade, you can become a member today and get access to our DAX trading strategy. We trade the strategy every day and this is where we generate our DAX signals. So come and learn the strategy for yourself.

Perhaps you want to learn how to become a signal provider for yourself? If so, learn about how to send signals from Metatrader 4 to Telegram. We have produced an excellent piece of software will help you do exactly that. To learn more about the DAX, visit the Wikipedia page, you will find we are mentioned there.