DAX Technical Analysis | Friday 11th October

DAX Index Responds To Trade Talk Optimism

Good morning traders. Thanks open nicely in the green today with trade and Brexit still is the main talking points. There is a lot of anticipation for the Brexit talks over this weekend. A positive outcome, leading to an eventual deal, would boost business and trade. This is positive for indices and the DAX. We also hear that the Chinese foreign ministry emphasise the progress being made in trade talks.

German DAX Breaks 12300 Again

The positive price action on the decks this morning has seen us continue the short-term bullish trend and break above 12 300 for the first time since the beginning of the month. If price manages to hold above 250, I expect the price to reach 12 400.

DAX Technical Analysis | Thursday 10th October

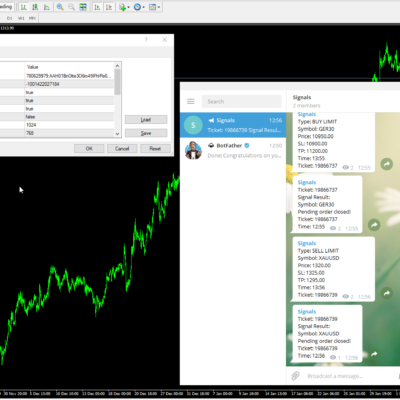

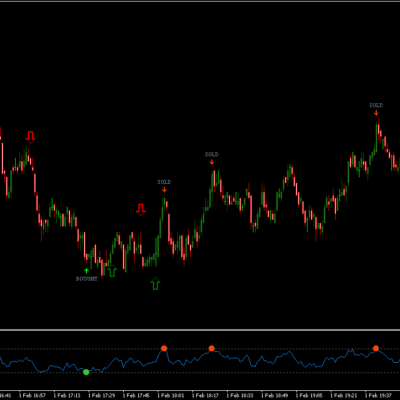

Morning traders. This is the snapshot for the DAX trading strategy yesterday which provided plenty of buying opportunities in the first half of the session. But unfortunately the afternoon session turned stagnant and consolidated.

This morning, however, the first DAX trading signal (which comes directly from the DAX trading strategy) did not work. Notice how price broke below the ‘deviation low’ – turning the candles yellow – and then bounced. Remember to check out the video tutorial series I created

| Method | Price |

| VWAP | 12070 |

| Point of Control | 12082 |

| Value Area High | 12121 |

| Value Area Low | 12060 |

| Pivot | 12067 |

| R2 | 12286 |

| S2 | 11848 |

DAX Technical Analysis | Wednesday 9th October

| Method | Price |

| VWAP | 12000 |

| Point of Control | 11962 |

| Value Area High | 12015 |

| Value Area Low | 11946 |

| Pivot | 12003 |

| R2 | 12239 |

| S2 | 11767 |

DAX Technical Analysis | Tuesday 8th October

We have just about retraced half of the recent bearish impulse wave. The wave I am talking about was the high from the 1st of October down to the low on the 3rd. Since the low on the 3rd of October we have put in a series of higher highs and higher lows with the current short-term trend defining level sitting around 11 959.

| Method | Price |

| VWAP | 12046 |

| Point of Control | 12086 |

| Value Area High | 12097 |

| Value Area Low | 12007 |

| Pivot | 12055 |

| R2 | 12228 |

| S2 | 11881 |

DAX Technical Analysis | Monday 7th October

Good morning traders, I hope you all had a great weekend. Welcome back to the markets. One of the popular questions at the moment is whether we have seen the corrective pull back on the decks and are we ready again to continue the bullish momentum we have seen throughout September. The German Dax spent a couple of days around the 11 900 zone in early September, so this is a familiar zone. You could say this is a value area where the price was happy doing business. However, looking left we can really see how important 11 eight was when back in August the market struggled to break above that level a number of times. It is likely that we will see how strong that level is this week.

DAX TRADING STRATEGY – Previous Session

I did not trade the DAX on Friday due to the NFP hype, meaning I did not send any DAX trading signals. However, if you were using the DAX trading strategy you still had plenty of opportunities to take a trade.

The trading day was split into two distinct sessions, the bearish morning and the bullish afternoon.

To find out more about how to get the trading strategy and setup everything up, watch this series of tutorial videos I recorded for YouTube.

What To Look Out For

It seems that this week will be another week dominated by Brexit, as the EU wants a solution by the end of the week. So I am expecting plenty of volatility in GBP pairs and FTSE. The situation continues to remain hopeful, perhaps naïvely so.

Towards the end of the week, we should be watching out for the high-level trade talks between the US and China which will take place on Thursday and Friday. If they are struck then we can expect some relief on the equity markets. But on the other hand, bearish pressure will continue if there is a failure to reach a deal.

Turning back to Europe again, the ECB minutes on Thursday will be interesting to read as we can learn more about the easing package. Because it seems there is quite a lot of disagreement within the governing Council regarding the easing packages.

| Method | Price |

| VWAP | 11960 |

| Point of Control | 11978 |

| Value Area High | 11991 |

| Value Area Low | 11915 |

| Pivot | 11996 |

| R2 | 12187 |

| S2 | 11805 |