Hello traders. Mario Draghi has ignited some action in the markets this morning with his press conference, stating that signs are pointing to strengthening and broadening in the Euro area. Deflationary forces have been replaced by reflationary ones. This may trigger a change in bias for a number of traders as it suggests a tightening of monetary policy.

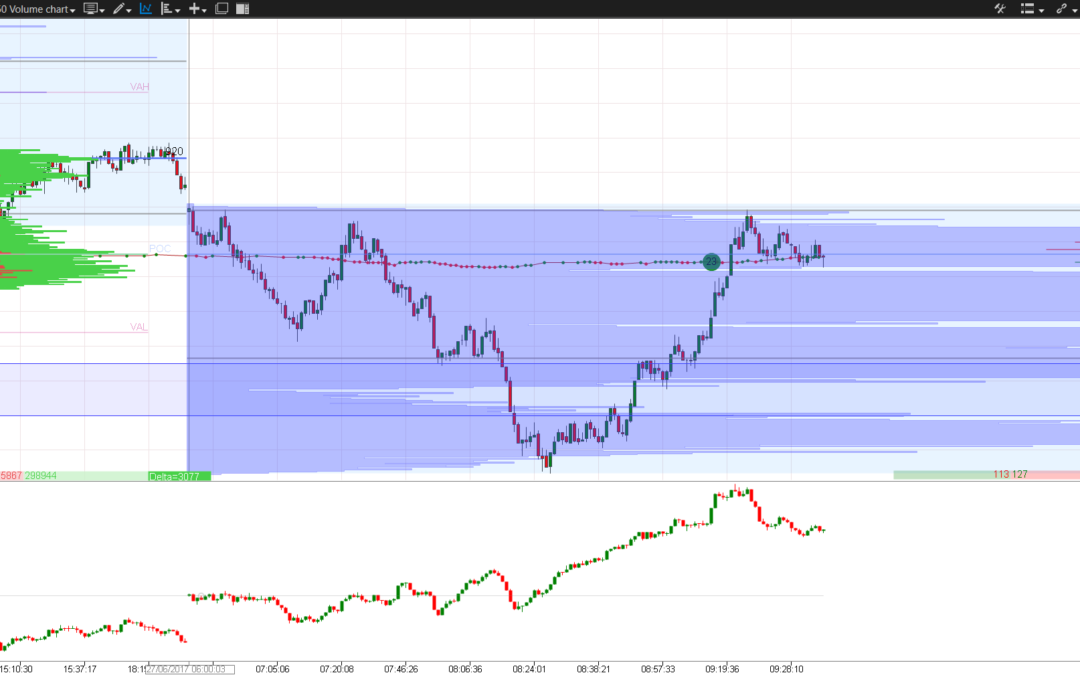

In the webinar this morning we discussed a low volume pocket opportunity that opened off the back of the sell off from the Draghi press conference. The low volume pocket turned out to be a great signal. Here is a summary of the webinar in a video here:

Dax Video

Dax Daily Chart

The ascending triangle is testing the range support and a break lower could open up a further decline, potentially a reversal. It may be too early to accept that this has happened.

Dax 2 hour chart

We tagged the bottom of the bull channel this morning after the press conference and a significant break below this could be an interesting setup. But for now, I remain a buyer at the lows.

Dax 5 minute chart

There was a large collection of bearish divergence signals on the chart yesterday, combine that with a wedge break to the downside and it’s a compelling signal. That was around the time that I shorted the market. I did not stay in the trade for very long, so could not capitalise on the full move, but congratulations to those who took it this one.

DAYTRADE SELL #GER30 @ 12819.65 | SL:12850.00 | TP:12745.00 | 2017.06.26 13:33 (BST) | ID 13599677

DaxTrader and ATAS

Download your demo of this software from here: http://orderflowtrading.net/soft/atasmed353